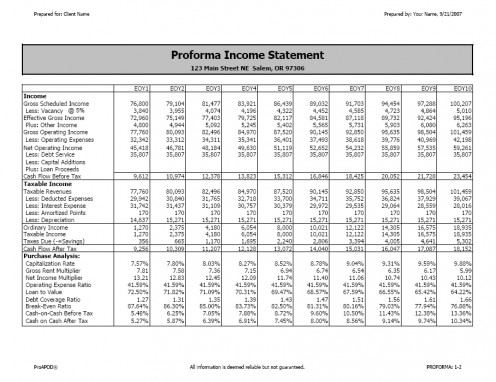

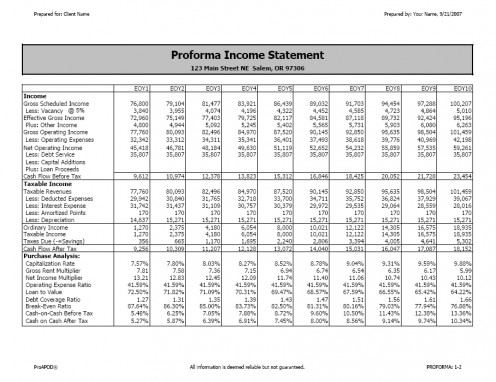

The Proforma Income Statement

Real estate investors like to evaluate the "future" performance of an investment property along with the first-year performance provided by reports such as the APOD.

This is where a Proforma Income Statement becomes useful.

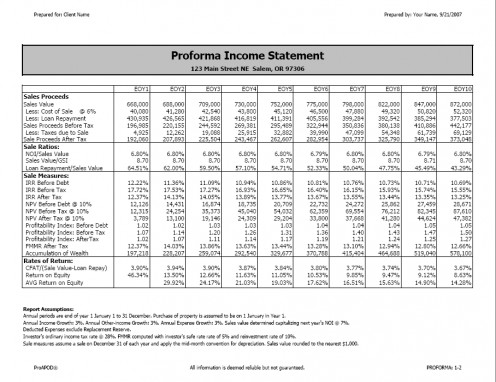

A Proforma Income Statement virtually projects an investment property's income and expenses typically out ten years and gives the investor an idea of such things as future cash flow, tax benefit (or loss), and sales proceeds in the event of a future sale.

A caveat, however, should be understood with the Proforma.

Since it is a "projection" with speculated numbers, real estate analysts should use it cautiously. It's always best to include numbers that are more conservative then overly aggressive, and the investor should never make a buying or selling decision on the results of a Proforma alone. Moreover, given that a Proforma Income Statement is speculative, you might want to opt for a ten-year proforma rather then a fifteen or twenty-year income statement.

You can generally find a Proforma in most real estate investment software or real estate investor software solutions. But solutions might vary slightly. In fact, some solutions might even omit some features like tax shelter, sales proceeds after tax, or specific rates of return. A software solution, naturally, is your most prudent option, just be sure to examine each program carefully.

You can also create your own Proforma Income Statement. It does take some effort, but it can be done on a spreadsheet program like MS Excel.

If you choose this option, just bear in mind what you want to accomplish.

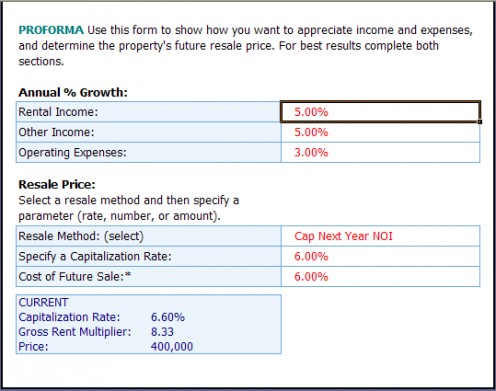

You want to analyze the cash flow and other performance measures resulting from changes to such variables as income, operating expenses, and property value over a future period. In other words, given the assumption that rents, expenses, and property value are going to increase over future years, you want to see the outcome to the property's financial performance.

To begin, you must create an income statement for the property.

In this case, include income, operating expenses, cash flow, and property value. Next, decide on the percent you want to annually increase the income, expenses, and property value and then make those calculations (i.e., inflate each value). If you are using a spreadsheet, place this calculated data in column one. Repeat the calculation (inflate each value in column one) and place it in column two, and so on, through column ten.

If you created your Proforma Income Statement correctly, it should be ready for you to evaluate the future cash flow performance of the rental property in question.

Sample (page 1)

Sample (page 2)

Sample (input form)

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes!

Other Articles

- The Annual Property Operating Data (APOD): Why Real Estate Investors Use It and How to Construct!

Learn about the APOD. Why it's a popular real estate investing report and how to construct one. - How To Buy Rental Property To Help Insure You Make a Profit

Four insightful real estate investing tips that will help insure that the next rental property you purchase will result in a profit. - Understanding Net Present Value: Knowing Whether The Next Income Property You Buy Will Achieve Your

Learn about net present value, its calculation, and how to use it in a real estate analysis. - The Present Value of a Future Cash Flow - Why Understanding Present Value is Crucial To Any Real Est

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate.