Accounting Principles

Basic accounting principles are the general decision rules which govern the development of accounting techniques. These principles, do not violate or conflict with the four basic assumptions discussed above, but refine the application thereof. The following are the basic accounting principles:

- Duality (Dual Aspect Principle)

- Revenue Recognition Principle

- Historical Cost Principle

- Matching Principle

- Full Disclosure Principle

- Objectivity

Duality

This principle states that every transaction has two aspects. It therefore, implies that minimum two accounts will be involved in recording a transaction. When an investment is made by the owner in the business, it results in increase in an asset and increase in owner's equity. Thus, this transaction is recorded considering these two aspects, i.e. asset and owner's equity. Every transaction will affect the accounting equation, whereby, there will be corresponding increase or decrease on both sides of the equation or increase and decrease on one side of the equation. The accounting equation is given below:

Assets = Liabilities + Owner's Equity

The enterprise can acquire an asset by sacrificing another asset, incurring the liability or receiving it from owner (resulting in increase in owners' equity). The use of accounting equation for processing of business transaction is discussed in the next chapter.

Recommended Articles

- Role of Accounting

Accounting is not an end in itself; it is a means to an end. It performs the service activity by providing quantitative financial information that helps the users in making better business decisions....

- Accounting Assumptions

Assumptions are traditions and customs, which have been developed over a period of time and well accepted by the profession. Basic accounting assumptions provide a foundation for recording the transactions... - Accounting as an Information System

Earlier, the accounting work was entirely manual and accounting department used to take excessively long time in processing the transactions and generating the accounting reports. The modern technology has... - Characteristics of Accounting Information System

The objective of accounting is to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to wide range of users in making economic... - Basic Terms in Accounting

There are two basic financial statements which are prepared by an enterprise: Profit & Loss Statement, and Balance Sheet. The three components of a balance sheet can be stated in the form of following...

Revenue Recognition Principle

Revenue recognition (Revenue realization) principle helps in ascertaining the amount and time of recognizing the revenues from the business activities. Revenues are the amount a business earns by selling its products or providing services to the customers. The revenue is deemed to have been earned in the period in which the sale has taken place or services have been performed to the satisfaction of the customer and the revenue has been received or becomes receivable. However, there may be situations where, within the accounting period, sale may not have concluded or services have not been fully rendered. This poses the problem of revenue recognition.

Normally, the revenue is recognized at the point of sale when title to the goods passes from the seller to the buyer. However, there are few exceptions to this rule of revenue recognition.

In a situation where the government has appointed an authority to acquire entire production, such as refine of gold, the revenue may be recognized on the completion of the refining irrespective of the fact of physical transfer of goods.

In case of work to be completed on contractual basis taking longer period of time such as road construction, bridge construction, the revenue may be recognized on the basis of cash received on partially completed and certified works. In such contracts, payment is made on the basis of the terms of contract, which specify partial payment in relation to the work certified and completed. On the completion of contract, the remaining amount is treated as sales.

In some cases, revenue may be realized at the time of receiving cash and not at the time of providing services.

For example, a lawyer may charge the fee from his client and treat it as revenue earned for the current period, whereas legal services may be provided in future.

The basic test, as discussed above, is used to ascertain the revenue. The revenue from permitting other entities to use the enterprise's asset is to be recognized as the time passes or as the asset is used. The rent from the premises let out or interest on money loaned will be recognized on the basis of passage of time. The royalty may be recognized on the basis of production/ sale of the products.

Historical Cost Principle

Historical cost principle requires that all transactions should be recorded at their acquisition cost. The cost of acquisition refers to the cost of purchasing the asset and expenses incurred in bringing the asset to the intended condition and location of use. In other words acquisition cost is equal to buying price plus all expenses incurred to put the asset to use. The cost is historical in nature and will not change year after year. This implies that no adjustment is made for any change in the market value of such assets.

The advantage of using historical cost for recording the transactions is that it is objective, verifiable and reliable. Thus, it imparts reliability to the financial statements.

Matching Principle

Matching principle requires that the expenses should be matched with the revenues generated in the relevant period. The simple rule that followed in this context is, ‘let expenses follow revenues'.

The Matching Principle by relating expenses to the associated revenues helps in measuring income (profit) for the given period. It is of great significance since the performance of an entity is usually measured in terms of income earned by the entity.

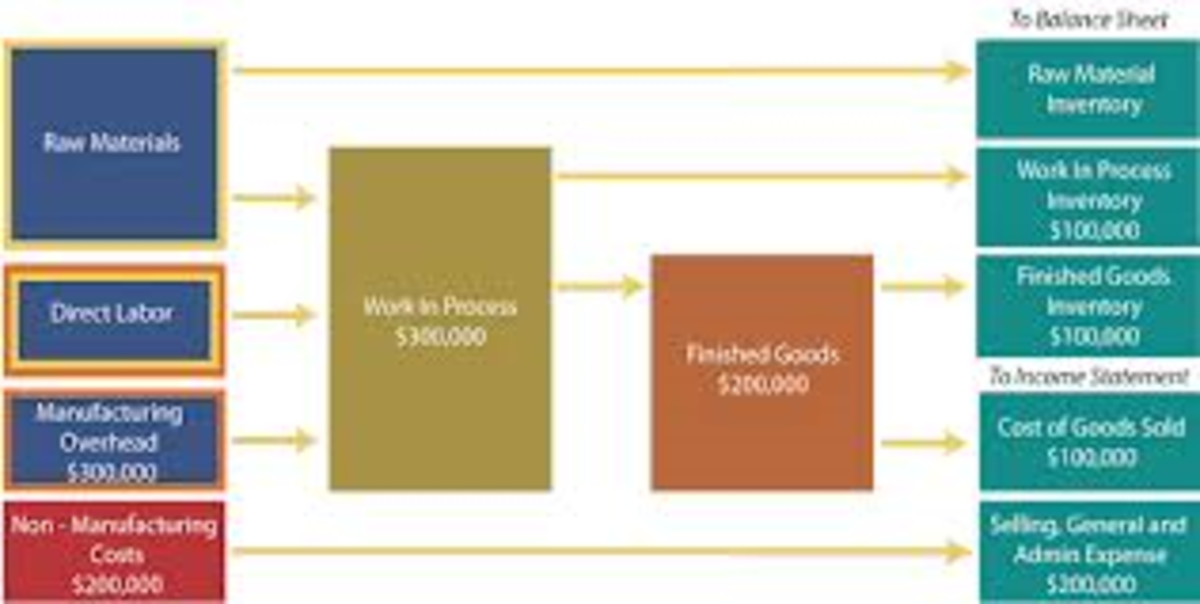

We do not recognize the expense when cash is paid or when a product is produced. It is recognized when the service or the product actually contributes to the revenue. Therefore, expenses are not related to the period of cash outflow but to the period in which the revenues are generated. The matching principle requires that part of the cost of fixed assets used in the operations of the business, known as depreciation, is treated as expense of the period. Likewise, in case revenues received in advance for which the services have not been rendered will be treated as 'unearned income', and hence, it will be carried forward to the following accounting period.

Full Disclosure Principle

Full disclosure principle requires that all those facts that are necessary for discharging the accountability and proper understanding of the financial statements must be revealed. All material information should be disclosed fully and completely, which is relevant for decisions to be taken by users. The information may be disclosed in the main body of the financial statements, schedules and annexure, and the footnotes appended thereto. Further, it requires that any significant event, which takes place after the balance sheet date and is likely to affects the financial status of the enterprise significantly, should also be reported in notes to financial statements. There might be some claims pending against the firm, which if not revealed in the financial statements will mislead the users. The regulatory bodies like SEBI mandates disclosures to be made by the companies to portray true and fair view of business operations to ensure discharge of accountability. Accountability is said to have been discharged if complete information is delivered with due diligence by the prepares (management and accountants) of that information, so that the economic interest of the users of the information is not adversely affected.

Objectivity Principle

The principle of objectivity implies that the accounting data should be verifiable and free from any bias. In fact, to generate the reliable accounting information, the basic requirements are neutrality (free from bias) and verifiability. The historical cost recorded in the books is on the basis of original documents, which contain the information, which is not affected by the personal bias. Therefore, the accounting entries are recorded on the objective basis and is verifiable from the source documents. Historical cost accounting, therefore, is preferred inspite of its shortcomings due to objectivity.

Also See:

- Trial Balance

A trial balance is a summary of balances of all accounts recorded in the ledger. The trial balance is prepared at the end of a chosen period which may either be monthly, quarterly, half-yearly or annually or... - Suspense Account

In spite of best efforts, locating errors is not an easy task and may take some time. Unless detected and located, errors cannot be corrected. To avoid delay in the preparation of financial statements, the...