Online Writing, HubPages and Taxes

Writing online in the various publishing venues, like HubPages, with the intent of making a profit is a taxable event. Most money made from online writing is earning in one of two ways:

- Affiliate marketing. Affiliate income is earned by ads placed near your article (Google AdSense and similar advertising models) or commissions from items sold from ad placement (Amazon.com Associates affiliate program).

- Direct sales. People following this model make money by selling products or services from their own company.

From the moment you start your company to the day you close or sell your business, you are allowed certain deductions. Income is always recorded. Online writing has a lifecycle. Each step of the way the tax issues are different. The beginner has expenses with little income; the mature online writing business has modest expenses compared to income. In either case, the tax code can lighten your pocketbook unless you arm yourself with tax saving knowledge.

In this article I will discuss the opportunities at each stage of the lifecycle. The opportunities for tax savings are large.

Finally, I will highlight audit issues. Any tax strategy is worthless if it causes an audit or fails to stand up in an audit. We will not shy away from a deduction for fear of an audit; we will not encourage an audit either.

The Team

In the Beginning…

Starting a business is a big step. The moment you add affiliates to your blog, website, or hubs, you are in business. The money does not roll in right away, but expenses do. You can deduct your cost of research, possibly an office in the home, travel expenses, internet service, computer, office expenses, and more. Any costs related to the business are either, deductible, depreciable, or capitalized. Below I will review each main point of this paragraph.

The Office

Deductions

Cost of Research: Gauging by the questions and comments I see on HubPages and around the internet, there is significant confusion on what counts as a deductible cost of research. The most important point to consider is the likelihood of profit from the research. You cannot deduct the entire cost of a car because you wrote a review on it. The same applies to smaller items. You can only deduct the amount attributed to business use. Therefore, if you buy a BBQ smoker to review in a HubPages article, you can only deduct the portion used for research. Future personal use is not a deduction. A few examples are in order:

Example #1: I buy a BBQ smoker for $300 and write an article on the smoker. I’ve never made a penny writing online before and it is unlikely I will ever earn $300 or more from AdSense or Amazon on this review. I will need to keep a log book on the business AND personal use of this smoker. The percentage business use of the smoker is deductible. A BBQ smoker is a 5 year property according to the IRS, so, only 20% of the $300 applies to the first year, or $60. If you used the smoker 10 times in the first year, 9 for personal and once to write the review, you can deduct $6. The same applies for cars, etc. You would need to keep a log of all miles driven and only the pro-rata business portion is deductible. The amount will be small. You can not claim all miles as part of the review. In an audit the IRS would gut you.

Example #2: I buy a $300 BBQ smoker and review it 15 times over several years. I have a history of making money writing online reviews. Every time I fire up the smoker I write a beautiful article, pictures and all, promoting the smoker. The AdSense and Amazon revenue pours in. I would say you can depreciate or expense the entire BBQ smoker. Personal use is incidental to the business use. The smoked food is not deductible. In taxes, the facts and circumstances are so important. I would still keep a log book.

Office in the Home

The rules for an office in the home are strict. The IRS requires a home office be “regular and exclusive.” Another issue to consider is the tax-free Section 121 exclusion of gain from the sale of a principle residence.

Home Office: For a home office to be “regular and exclusive,” it must be used for the business purpose only and on a regular basis. The kitchen table does not count, a spare bedroom might. If you have an area used for writing articles you publish online only and you write on a regular basis, you can deduct some of your home expenses as a home office. The leading items you can deduct for a home office are: property tax, mortgage interest, utilities, repairs and maintenance, and insurance.

Depreciating the Home: Depreciating part of your home for an office is usually a bad idea. The “allowed or allowable” rule in depreciation does not apply to the home office. To determine the percent of your home that is business, you divide the office space by the total area of the home. You can depreciate this portion of your home over 39 years. However, when you go to sell your home, the percentage used as business is now subject to tax. For the majority of taxpayers, it is best to leave the depreciation of the home alone. Take the other business expenses: the utilities, and so forth and leave the depreciation behind.

Not for Sale

Travel Expenses

Traveling for research or training is a deductible expense. The miles you drive to pick up office supplies and other business purposes are also deductible. An important point you need to follow when deducting travel, auto expenses, computers, and internet fees, is the IRS rule called substantiation. Most deductions are supported by a simple receipt. Certain expenses, like travel, entertainment, and computer expenses require a log book to substantiate the expense. For these items, your log book must list for each occurrence, the date, place traveled to, who you saw, and the reason. Your log book for computer and internet usage needs to indicate personal and business use to determine the amount allowed as a deduction. Same applies to a cell phone.

Deductible, Depreciable, or Capitalized

These three terms confuse more taxpayers than any other. Here is an explanation of each:

Deductible: Deductible expenses are those that arise in the normal course of business and are expected to last less than a year. Office supplies, utilities, payroll, advertising, and other recurring expenses fall into this category.

Depreciable: You depreciate any item that cost over $100 and is expected to last more than a year. Your desk, chair, computer, printer, and office building fall into this category.

Capitalized: I can’t think of any situation that would require you to capitalize an item in an online writing business. Capitalizing is where you add the cost into the finished product. Example: You capitalize all costs of building an office and depreciate from this amount. You can not deduct utility bills, etcetra, separately, and so forth, as it is part of the cost of building the office.

Not a Deduction

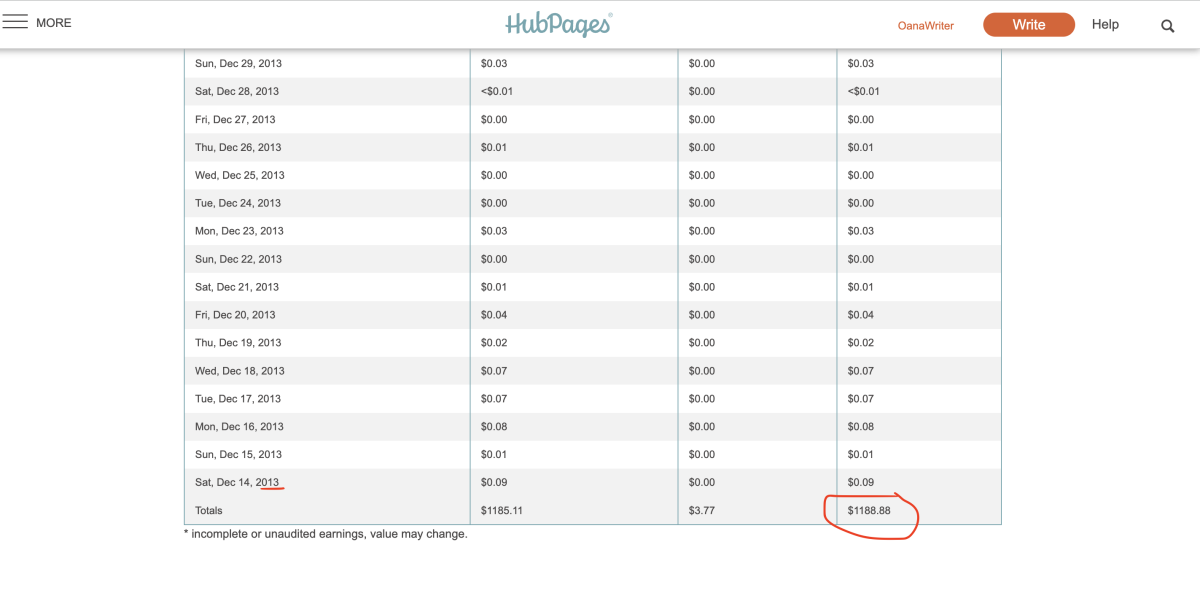

Success at Last

Once you get your business going with several articles producing revenue, profit is in your eyes. All the deductions above still apply, but your income is now passing your expenses. As a result, you have a tax bill.

The temptation is to get too creative when your business develops a tax liability. Writing a check to the IRS is never fun. There are ways to reduce your taxes without risking an audit.

At the profit point in your business, I assume you have recorded all your deductions listed above. Now you are ready to organize as a single-member LLC for tax purposes. I say tax purposes because you may want or need an LLC for legal purposes prior to this.

A single-member LLC has one big advantage over a sole proprietorship: the office in the home rules. Since an LLC is an entity separate from you, you can rent your office to the LLC. The business still pays all the utilities, property tax, etc. on the pro-rata portion of the home used. This reduces the income subject to self-employment tax. The rent you receive is also free of self-employment taxes. The rent must be reasonable. The strict rules of the home office are no longer valid. Renting area not used exclusively is allowed. The same applies to anything you rent out.

Example: Betty organizes as a single-member LLC. Betty’s business before the LLC has a profit of $20,000. Assume income tax bracket of 15% (we will not consider itemizing or personal exemptions for Betty; assume other income put Betty into the 15% bracket on all additional income), plus 15% for self-employment.

As a sole proprietor, Betty paid $3,000 income tax and $3,000 self-employment tax. As an LLC, Betty rents her office space to the LLC for $500 per month, a fair market rent for her area. $6,000 of Betty’s income goes on Schedule E for rent income. The LLC deducts the rent from Schedule C. Rent is not subject to self-employment tax.

As an LLC, Betty still pays $3,000 in income tax. She just moved the income from one form to another. Only Schedule C income pays self-employment tax. Schedule C has $20,000 - $6,000 rent = $14,000 profit. Self-employment tax is $2,100, saving Betty $900 in tax.

The Money Machine

Now things really start cooking. Your online profits are $50,000 or more. That LLC you started a while back now needs to elect to be treated as an S Corporation for tax purposes. You keep the same LLC. As an S Corporation, you are now an employee. You pay yourself a reasonable wage. The remaining profit flows to your personal tax return as income only; no self-employment tax.

Example: Betty’s turning an $80,000 profit in her business. Assume the 15% tax bracket for easy figuring. Betty pays $12,000 in income tax and another $12,000 in self-employment tax.

Betty elects to treat her LLC as an S Corporation and pays herself a reasonable salary of $40,000 per year.

Betty’s income tax remains the same. The salary shows up on a W-2 and the remaining $40,000 in profit flows to her personal tax return as ordinary income. Betty pays no self-employment tax. She pays FICA tax (the equivalent of the self-employment tax) on her salary only. There is no self-employment or FICA tax on the $40,000 flowing to her personal return from the LLC/S Corporation. Betty saves $6,000 in tax.

All Good Things…

And then it ends. Betty builds a profitable business and passes away. Her heirs want to keep receiving those monthly checks from Google. The estate attorney handles all the transfers and all is good.

Except, one heir needs cash now. So the decision is made to sell the business. The attorney fills out the necessary paperwork to transfer the business to the buyer for $500,000. Very nice. It is unlikely there is any basis in the business. The entire $500,000 is taxed as along-term capital gain. Capital gains are taxed at a lower rate than ordinary income.

Audit Risks

You should claim all income and deductions you are allowed. Fear of an audit is a poor reason to prepare an inaccurate tax return. In some cases it is illegal to NOT take a deduction you are allowed. I am thinking of people getting the Earned Income Credit here.

A Schedule C business has a higher risk of audit by just existing. An office in the home is also an audit area. S Corporations get audited at about one-sixth the rate of Schedule C filers. Getting to that level fast is a good idea if only for the audit protection provided.

Take all the tax breaks, but don’t create expenses just for a deduction. Don’t take a $20,000 trip through Africa and write a 2,000 word article and expect to deduct the trip. Not happening. If you review a book, deduct the purchase price of the book. After reading the book once for business purposes, a personal reading is unlikely; hence, the book is deductible.

In taxes, form trumps substance. Here is what I mean: Document everything. The IRS disallows deductions when documentation is inadequate or lacking. Good records will sustain questionable deductions further than poor records will on known expenses. Keep records. Plan. Build your business, make money, apply tax strategies, and enjoy life.

I have nothing more to say.