why and how has - by what article does Congress have the right and Power To Coin Money And Regulate The Value Thereof

(Article l ,Section 8 , Part 5-------Constitution of the United States)

The Congress Shall Have The Power : To Coin Money,Regulate The Value There oF And oF FOREIGN COIN.

This authority is has within it the hope of the preservation of civilization itself.For without it civilization cannot continue to exist.

An honest money system is required for civilization to continuee to prosper over time.

Sudden gyrations in the money supply can cause an economy to collaspe and steal the value from everything we own.

Not only the value of money we earn and save over the years but also the value of the money used to pay back loans to lenders

It's simple math!

Today you may be able to buy an item like a candy bar or a soft drink for about one dollar.

Twenty years ago you could buy the very same candy bar or soft drink for about 50 cents and twenty years before that they both would cost only ten cents each.

Question : Has the value of money gone up over the years?

Answer : If,money has increased in value theoretically so we should be able to buy more with the same amount of money.Right? While this may be true for some small items for things like houses and cars it may or may not be true depending on the quality and quantity of those items are at any given time.Generally speaking all things being equal then no the value of our money has accually decreased.

Question : Has the value of what we buy with our money gone up down or stayed the same?

Answer : If,an items value has gone up then we should be able to sell it for more money over time assuming the value of our money has not gone down too.. If,the value of our money has gone down then we may get the same value or less for our money more likely get less for it if we wanted to sell it.The fact is we are taking about the very same items.Same materials and everything.It was made the same way,no change at all in how it was made and the materials within it..Otherwise we could make the arguement that the cost of producing that item increased or decreased based on the value and quantity of the materials within it.and that was part of the reason for the price difference.The only other difference would be an increase in labor and energy costs or colectable value.But for my purposes here we are talking simply about the value of the money supply involved relative to the value of the goods and services we buy with it after we account for inflation..

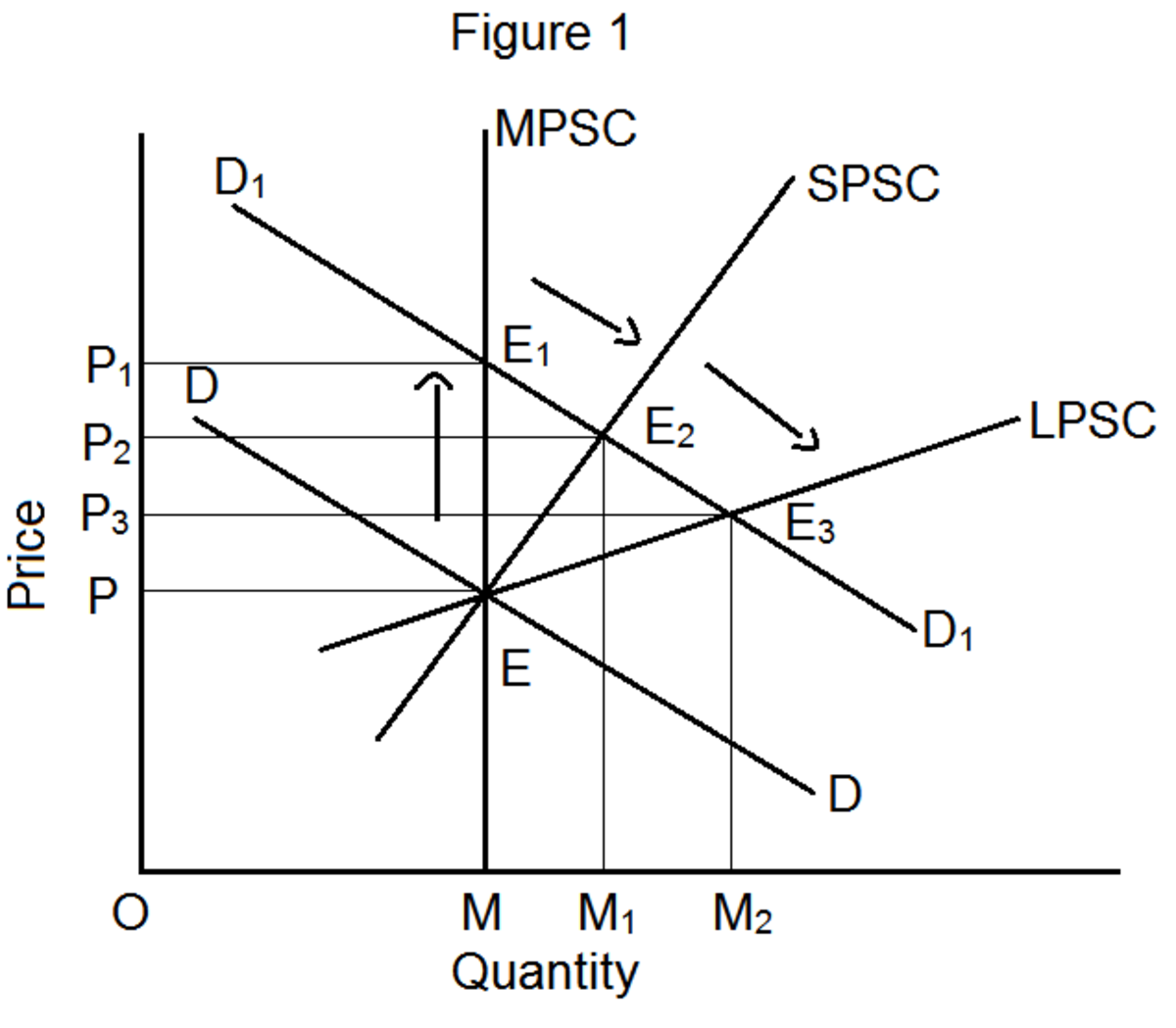

The law of Supply and demand .says that ,if there is a low supply of something and there is a demand that outstrips the supply than the price of the item will naturally go up .How much it goes up depends on who is willing to pay the most for it.If,however the supply can be increased or the demand decreased somehow the price for it will decline accordingly.This process is not instantanious ,so those who know that the supply of goods is going to increase or the price decrease because of a lack of demand will be willing to wait until the supply or demand changes in his favor and as a result he will get the most for his money.

Money itself is considered a commodity and the money supply is increased and decreased by the federal reserve banks at will for their own reasons.Supposedly to stablize the economy.

when the amount of money is increased unnecessarily we have Inflation and when decreased unnecessarily we have deflation.

When money is needed and not provided ,that is called Stagflation.Stagflation is when the economy is in decline due to a lack of money in cirrculation to carry on business.For example loans to businesses who depend on them in order to meet their shorterm expenses at a time when money is scarce because the banks are not lending money or the need for more money to accommidate an increased need for startup capital for expansion.

In Stagflation the cost of doing business has not gone down and some businesses may need to increase production in order to bring down the cost of manufacturing an item in order to sell more goods at a reduced price in order to make enough to cover their expenses and make a profit.in order to improve the business..Under other circumstances this increase in the money supply would be Inflationary.This is when too much money is in cirrculation compared to the goods and items being sold.

In some cases where we have Staglation a businesses overhead. has to be cut back while and at the same time make enough to stay in business.If,he has competition then he is in even more trouble.This is a case where competition for business puts those who can't compete out of business.Sometimes the bigger companies resort to selling their products at cost or less in order to rid itself of it's competition .After the competition is gone and they have a virtual monopoly they usually charge whatever the traffic can bear even if in doing so,they are effectively robbing their customers..as Immoral as that is.