Save Money on Online Purchases with Upromise

I recently received $32.50 from Upromise! All I did to get it was make an online purchase of an HDTV from BestBuy.com for $649.99. The $32.50 represented a savings of 5%. People don't often send me enough money to pay for dinner simply for doing what I would have done anyway. Am I thrilled with Upromise? Yes. But that’s not always the case.

What is Upromise?

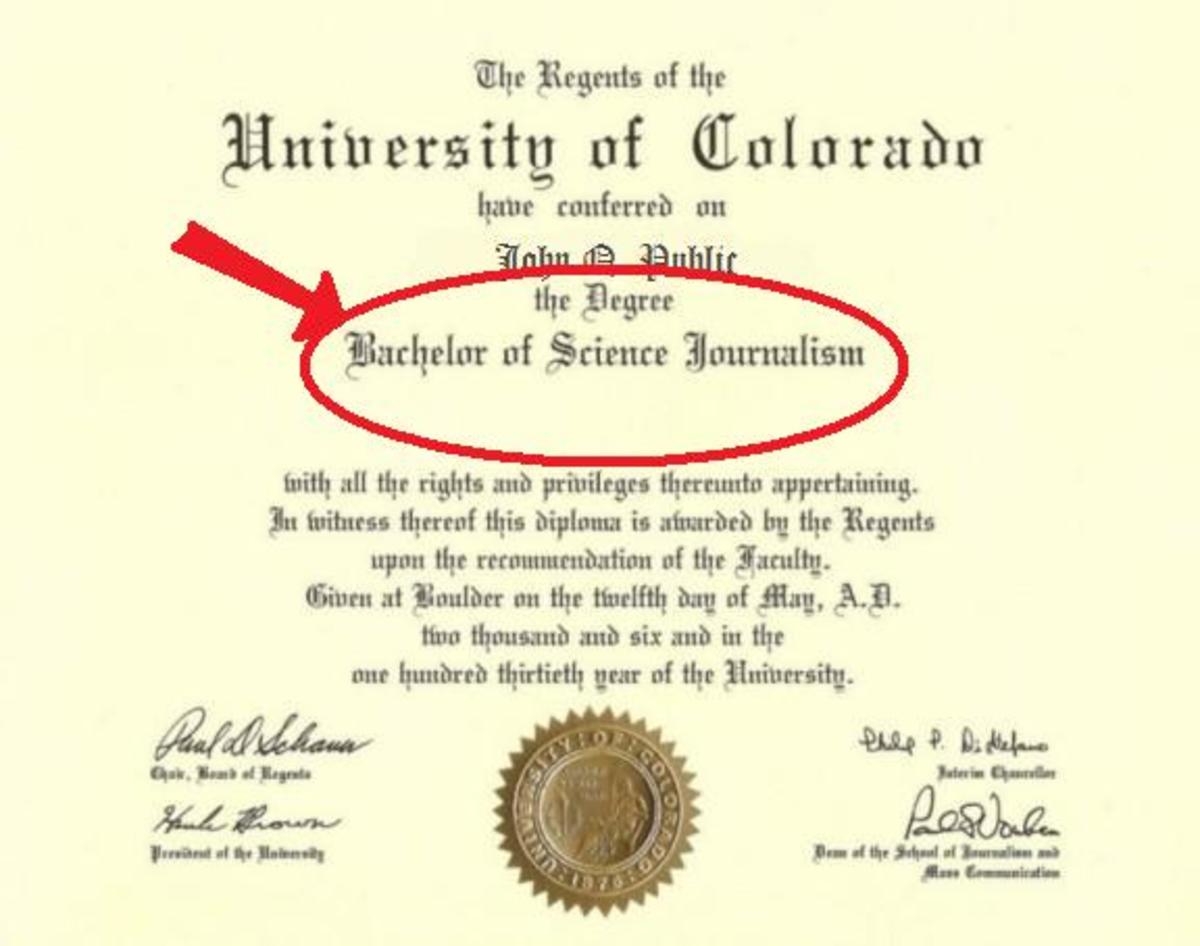

Upromise is a program run by Sallie Mae that gives its members cash back for everyday purchases. The amount of cash back is calculated as a percentage of the purchase amount. 5% cash back is common, although the percentage can range between 1% and 25% depending on the merchant. Members choose from a variety of options to receive their reward, including having the money deposited into a 529 tax-advantaged college savings plan, a Sallie Mae savings account, or applied to a Sallie Mae student loan. For simplicity, members can also choose to transfer their rewards to a bank account, where they are free to spend the money however they wish. I’ve chosen the latter option, since I like to keep things simple.

Joining Upromise is easy and free, as clearly explained on the Upromise website at www.upromise.com. After joining Upromise, there are a number of ways to earn cash back. This article focuses on earning cash back on online purchases. To earn such rewards, you can shop online through the Upromise site and earn commissions of 1% – 25% on eligible purchases at more than 800 online stores. Or, you can download a software tool called TurboSaver that alerts you whenever you shop at a participating online merchant and gives you the opportunity to click a button to activate your reward. For simplicity, I’ve chosen to download the TurboSaver tool, which makes my Upromise participation virtually effortless.

How Upromise Works When It Works Well

My purchase from BestBuy.com was an excellent example of how Upromise works when it’s working well. After much online and in-store research into the best product to purchase, I decided to make the purchase through BestBuy.com because they had the lowest price and I’ve been satisfied with my past experiences with BestBuy. When I entered the BestBuy.com website, the TurboSaver tool alerted me that BestBuy.com participates in the Upromise program with this message at the top of my browser: “Your 5% cash back rewards are now activated.” (In this case, I didn’t need to take any other action to activate the rewards, although with other merchants I need to click a button.) I completed my purchase in exactly the same way I would have even if BestBuy.com did not participate in the Upromise program. Then, a few weeks later, I received an email from Upromise saying I received a reward of $32.50 due to my purchase at BestBuy.com. When I checked my online Upromise account, I saw that I had indeed received this contribution. So, other than initially signing up with Upromise and downloading the TurboSaver tool, I didn’t need to take any steps whatsoever to receive the $32.50 cash back reward. I simply received this reward for buying the exact product that I wished to buy from the merchant that I wished to buy it from. What’s not to like? Well … from my past experiences, there are a few things.

How Upromise “Works” When It Doesn’t Work Well: Coupon Codes

During the last holiday season, I purchased a number of books and videos from BarnesandNoble.com as gifts. For many of the purchases, I used a Barnes & Noble coupon code which provided a discount of 20% off the price of a single item. As I made the purchases online, Upromise’s TurboSaver tool alerted me that Barnes & Noble participates in the Upromise program as follows: “Don’t Miss 5% cash back from this Upromise partner! Click the button below to activate this cash back opportunity.” After I clicked on an orange button stating “ACTIVATE CASH BACK”, the TurboSaver tool confirmed I was now eligible for cash back with this message: “Your 5% cash back rewards are now activated”. As I made my purchases, I believed I would receive 5% cash back. Indeed, I received a series of emails from Upromise entitled “Confirmation of your Upromise online purchases”. Each email gave a summary of my savings. These savings were re-confirmed when I checked my online Upromise account, which showed this activity: savings of $0.29 for my purchase on 12/06/11; savings of $0.84 for my purchase on 12/10/11; savings of $1.29 for my purchase on 12/10/11; savings of $0.26 for my purchase on 12/19/11; etc.

Unfortunately, when I checked my online Upromise account again during March, 2012, I found a series of very unwelcome messages: savings of -$0.29 for my purchase on 12/06/11; savings of -$0.84 for my purchase of 12/10/11; savings of -$1.29 for my purchase on 12/10/11; savings of -$0.26 for my purchase on 12/19/11; etc. In other words, three months after my purchases, Upromise systematically voided all of my cash back rewards by subtracting the rewards from my account! In my years of experience as a consumer, I recall no other situation where the terms of my purchase were altered months afterwards.

Naturally, I assumed these subtractions from my account were erroneous, so I contacted Upromise’s customer service to ask about them. The response was: “You will have negative college savings in your Upromise account due to one of the following reasons: … – If you have paid for the purchase with coupons … or with a promotion code not found on the Upromise website.” Upon receiving this email, I looked for the fine print on the Upromise website. Eventually, I found the following language buried in the Program Details: “some partners will not give contributions on purchases made through the Upromise website if you have also taken advantage of a promotional offer not listed on the Upromise site when you made the purchase. Please see each individual partner's terms and conditions.” Evidently I was expected to have studied the long list of “Program Details” on the Upromise website, and to have then found the specific “terms and conditions” for Barnes & Noble (which I still have not found).

With my professional background as a lawyer, I could easily blame myself for not researching this issue sufficiently to discover that I would, in fact, not qualify for cash back whenever I use a coupon code at the BarnesandNoble.com website. On the other hand, I think it is misleading (at best) and fraudulent (at worst) for the Upromise TurboSaver tool to have informed me that “Your 5% cash back rewards are now activated” before I made my purchases, and for Upromise to send me emails summarizing my “savings” after my purchases, and for Upromise’s website to list my “savings”, only to have my “savings” voided three months later. If the TurboSaver tool is designed to alert me that Barnes & Noble participates in the Upromise program, and tells me that I will receive 5% cash back on my purchases, then it seems like a simple enough matter for the tool to also inform me that I would be ineligible if I use a coupon code.

Upon discovering this restriction, it makes me seriously wonder if participating in the Upromise program is worthwhile. I use coupon codes for many online purchases. In fact, the ability to use coupon codes is one of the best ways to save while online shopping. If using coupon codes voids the cash back reward on these purchases, then the value of the Upromise program is significantly reduced. It simply does not seem fair to induce me to make an online purchase through the promise of cash back, only to then void the cash back transaction several months after the purchase—when it’s too late to return the product. If Upromise is going to keep this restriction on cash back, they should not hide it in their fine print.

How Upromise “Works” When It Doesn’t Work Well: Missing Transactions

During the last few years, I have made online purchases of prepaid cell phone minutes from TracFone. To minimize my cost per minute, I purchase large numbers of minutes for $199.99. To further minimize my cost per minute, I make sure to activate Upromise’s cash back feature since Upromise’s TurboSaver tool has promised cash back of 12% for these purchases. This should be a $24 reward per purchase.

Unfortunately, for whatever reason, I have not been receiving these $24 cash back rewards. The first time it happened, I contacted Upromise’s customer service to inquire about the missing $24. Luckily, the representative found an error and my account was credited with $24 in savings. However, the second time it happened, I again contacted Upromise’s customer service to inquire about the missing $24. This time, Upromise responded with an email saying: “In order to research for college savings regarding the transaction that you have made with ‘Tracfone’ dated ‘01.25.2012’, please fax the receipt which reflects transaction in question to the attention of Contribution research at: 617-559-2425, including your name and Upromise account number (418-672-4235).” I sent in the receipt shortly after, but have not yet received the $24 in cash back (or any other response!) even though three months have passed. At this point, it seems too tiresome to further pursue the missing $24 cash back reward.

What seems very odd about these missing transactions is that I made these transactions online with the TurboSaver tool active. As such, it seems difficult to believe these transactions went missing, especially since they were for high-dollar amounts. I’m also concerned about the relatively high barrier posed by Upromise’s procedure for following up on missing cash back rewards, since I don’t have a fax machine. This is especially true since, even when I did follow their procedure, I have not received any response. It seems that transactions should not go missing when you use the TurboSaver tool to make a purchase. And, if they do go missing, you should be able to send in any missing receipts by email rather than fax.

It’s also a concern that it can be very difficult to keep track of which cash back rewards I am entitled to receive. For example, if I order a book for $15 and I’m entitled to 5% cash back, will I really remember to inquire about a missing 75 cents weeks or months after my purchase? I would guess that very few Upromise customers are organized enough to be on the look for missing cash back rewards like this.

Conclusion

Upromise is a great way to save money. Participation is free, and Upromise pays me for purchases I would have made anyway. That said, there are aspects of the program that are frustrating, such as the restriction voiding cash back rewards months after the purchase is made if you used a coupon code, and the difficulty of tracking down missing cash. For peace of mind, I treat this program as one where I’m happy to get cash back, but I don’t count on it happening.