Post Secondary Education and Student Loans

If You Get a Student Loan, You'd Better Make It For the Best Career Choice Possible

Suppose for a moment that everything that has happened in the last two decades continues as it has for the indefinite future. Where does that leave everyone that is considering a post graduate education, but lacks the funds to peruse it? Given the current economic and political climate, it leaves the choice of opting out all together or to apply for a student loan in order to pursue education goals. Not all courses are equal in being able to attract potential employers and thus help to pay down the loan after graduation.

Coping with failure in life generally will come when that student loan taken out for post secondary education will likely never be paid off. Higher interest rates mean that a $20,000 student loan will balloon to about half a million over an extended period, more than 95% of it will be compounded interest over decades (1). Failure to meet payments will worsen the problem as interest will continue to accrue even if no payments are not made. Declaring bankruptcy will ruin chances of securing many opportunities later on. This is another way business is now mixed with education. Banks may not be able to foreclose on a degree, but they can arrange to have it rescinded and nullified. But you'd still be responsible for the loan even though the amount of the principle and then some may have been paid before default, meaning that the balance that they call the unpaid principle plus interest part is still a liability. In short, it is a collusion between the education business and banksters that sap your very lifeblood for something you may not be able to use to help you pay down the loan.

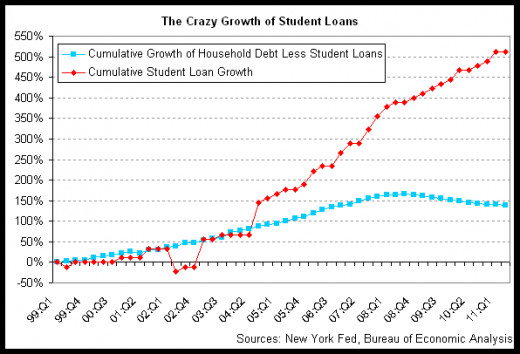

Given the foregoing and the additional fact that many jobs still require specialized training and/or on the job training, it may well be advisable to consider a current trade and/or education specifically tailored to that trade sought for in the work place. We can assume for the current course of the immediate future, that the system that is in place, will continue in its present state and direction. That is to say that loan defaults are unlikely to be forgiven. The economic bubbles will keep inflating and bursting. In fact, as of this writing, the interest bearing loans that cover the full extent of all business in the developed and developing world are the norm and entire countries teeter on the brink of default and collapse. The US and UK are already there and the strategy is to raise debt ceilings in a bid to as so often put in cliche, “kick the can down the road”. Clearly this cannot go on and debts including ballooning interest exceed the GDP of many countries. In the Canada alone, there are now nearly $16 billion in floating student loans (2). In the US, that figure tops $1.2 trillion (3). Consider that that the entire debt for the US is acknowledged as nearly $18 trillion (far more if you factor in debt swaps and derivative speculation). Outstanding student loans make up between 6% to 7% of the total. This amounts to a huge gamble on the future provided that these graduates can find employment and if they do, that it is something other than a $7 to $8 per hour minimum wage, part time jobs. The mathematics simply does not work individually or collectively. These loans will never be paid off as interest accumulates faster than wages that come in. At best, many will find they they will be paying the interest for the most part to stave off the inevitable.

In India, farmers have committed suicide in the hundreds of thousands because there was no way that their income could even match the loan interest payments let alone the whole loan. Contemporary and future graduates face similar prospects. In both cases, problems have been exacerbated because any other choices have long since been eliminated by privatizing the economy. This means that the only way to get ahead, if that were even possible, is to finance the present by taking a loan and hence a lien on the future. This is gambling on potential prospects and not anything solid other that speculation. What then must a person do to secure the best chance from an education in order to pay down an accrued debt before the interest swallows your life whole?

One of the options has already been mentioned and that is a trade. Active trades today appear to be in the electronics innovation sector such as for robotics and other automated machines and this market is booming, especially related to the military. Another active trade during boom speculation periods is the building sector. There will always be a demand for auto repair, so a trade like this can be lucrative, especially if one secures a career in speciality autos, such as racing, high end cars, antique rebuilding and hot-rods. Medicine is another booming business and anything to do with doctoring, nursing or pharmaceutics will be in constant demand. Even with medical insurance privatizing under the Obamacare scheme, there will be a demand in the private sector for all of these specialities. In a more controversial area, there is a demand for qualified prison management personnel and specialists. There will as a consequence, never be a shortage of positions for qualified police officers, investigators and detectives as well. A legal career is a definite goal with great prospects. An education in any field related to crime investigation would be an asset and a leg up on a future career. Most other education specialities will not pan out and they are either too competitive or there is too little demand. There are few jobs for philosophers unless one happens to win a professorship in some post secondary post. Similarly, there are few jobs for artists unless that artistry is incorporated in some industrial application and in demand. The area related to science outside of technology is touch and go and one would have to be exceptional in order to secure a career as a professional scientist in any field. The key in all of this is to secure a job or career that actually has the potential to pay down a student debt in short order. It would serve well to investigate just what is in demand before choosing a post secondary education direction. Some choices are good for the long term and some short term and this also needs attention. There are some post secondary colleges that actually guarantee job placement for their graduates and this is another prospect to investigate.

If you are already on a post secondary course that does not look too bright in a post graduate career potential, you might consider a mid course adjustment in your studies to ready yourself for something concrete at the end of your studies. The lesson of yesterday appears to tell us that we cannot gamble with speculative education ventures that place the graduate on the street and unable to pay off a student loan. The world has changed radically over the last few decades and an enlightened approach is needed as far as post secondary study is concerned and what ones goal should be for higher learning. This is not to negate studies like philosophy, art, maths and history, but this should now be a secondary consideration to something that will actually provide a post graduate living.

The foregoing is stated in the context of economics and politics as they exist today, but in all things economic and political, there is the possibility of change and sometimes the unexpected. Should that happen, everything detailed above is also subject to rapid and unexpected change and this is something to be aware of and concerned about. There is a certainty that is true since late 2010 and that is that people are starting to rise up and make it known that they want positive change and not business as usual. They are fed up with business as usual, the lies and corruption in all areas of life. A building movement is afoot and is already having some effect on governments, but there is clearly much more that needs to be done. Within this context, surprise is to be expected and one has to be ready for even that.

References: