THE FED'S SHELL GAME HAS REACHED ITS CLIMAX

THE FED’S SHELL GAME HAS REACHED ITS CLIMAX

“An imbalance between rich and poor is the oldest and most fatal ailment of all Republics.”

-Plutarch

While Wall Street continues to prepare for the possibility of a Fed interest rate hike later this year (yeah, right) and the rest of the world passes QE around like a hot potato, key economic indicators continue to flash red. A goosed up DOW may be a useful tool in maintaining investor confidence these days, but it is no match for economic reality. By themselves, the trends below are alarming. Collectively, they portend economic annihilation.

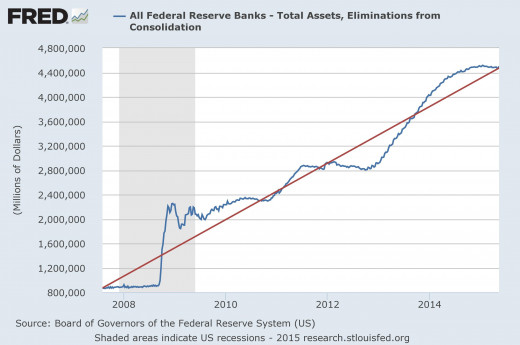

THE FED’S BALANCE SHEET HAS INCREASED BY 500% SINCE 2008

It’s amazing to me that the Fed could extend its ruse for as long as it has. How is such a balance sheet run up even possible in the real world? It took two world wars and almost one hundred years since the Fed’s creation to get our circulating currency to $800 billion dollars. The Fed more than quadrupled this number in less than 10 years! To me, the Fed is holding onto what would have been legitimate interest income for us all. Not only has it has magically redistributed what is rightfully our wealth back to the banks, but it has perverted the entire free market concept of what passes for money and what represents value. To make matters worse, $1.5 quadrillion worth of derivatives attached to the Fed’s larceny are at present, 20 times global GDP and unaccounted for in currencies, equities and bonds. Incredibly, Citigroup and JPM hold over $100 trillion in derivatives between them-pyramided on a reported $3 trillion in assets: 30:1 leverage. This is tinder waiting for a spark to ignite. Be forewarned.

The Fed has masterfully re-inflated stock, housing, and bond markets without the participation of ordinary investors and/or working people! It has somehow sidestepped business cycles altogether and seduced investors into believing that key asset inflation devoid of measurable GDP is the free market. Central bank cheap money is but fool’s gold, though, and no matter how many times these Banksters polish up a penny and try to convince us that it’s a quarter, it will ALWAYS be a penny. Those investors foolish enough to believe that they have a quarter will some day soon come face to face with ruin. The classic link between Wall Street and Main Street has been severed and this will have enormous consequences on all investment classes in the future as the inequality gap between the two widens. We can see trends, but the trends coincide with market fraud rather than actual economic activity. Prepare for market volatility and be nimble enough to get out of its way when the time comes. Remember, there’s no shame in holding some cash as a hedge, especially in the clearly manipulated, unstable global markets of today. Or, in the words of Roman philosopher Lucius Seneca, “The path to growth is gradual but the road to ruin is rapid.”

The Fed may profess to pursuing its dual mandate of full employment and low inflation but what it’s really trying to do is eliminate the correcting recession/depression from free market business cycles, expunge mal-investment from sovereign and banking balance sheets, and inflate away decades of fiat debt without destroying the dollar’s preeminent status as the world’s reserve currency. And given the Fed’s miserable track record on calling markets-or even recognizing the consequences of its own policies- I think it’s safe to say the Fed has no idea what it’s doing, and has no intention of abandoning its financialization of global markets. The Fed’s policies have:

- Ushered in the era of “TOO-BIG-TO-FAIL”.

- Re-inflated bubbles in stocks and real estate.

- Created the greatest bubble in history in U.S. Treasury bonds.

- Added tens of trillions of dollars of global debt which will never be repaid.

- Funded speculation in OTC derivatives to the tune of $1.5 quadrillion- 20x yearly global GDP.

- Broken the “price discovery” and “mark-to market” metrics germane to the free market.

- Exacerbated wealth inequalities between rich and poor around the world.

- Eliminated capital, competition, and labor from the free market.

- Ignited regional global economic instability.

- Devastated savers.

- Obliterated pensions.

- Killed the American middle class.

- Created bank runs.

- Bankrupted nations.

- Facilitated currency wars.

- Negatively impacted the long term viability of the U.S Dollar globally.

- RISKED ECONOMIC ANNIHILATION FOR EVERY SINGLE FIAT CURRENCY AROUND THE WORLD.

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.”-Lord Acton

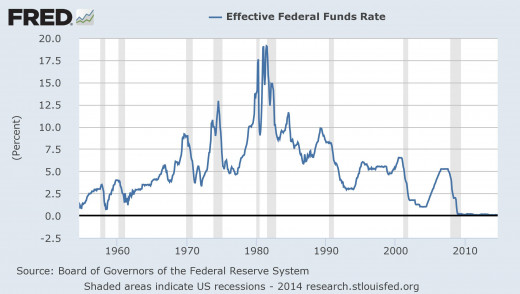

79 MONTHS OF ZIRP AND COUNTING

The St. Louis Fed chart above clearly shows the methodical decline in interest rates since the early 1980s. Is it any wonder then that event after event has rattled the markets in this time, with each recession helping to push the Fed’s funds rate to zero going on 8 years now! Money should never be free, and corrections can never be expunged from the free market. Interest rates reflect risk, regulate economic growth, buttress savings, and generally provide a sustainable platform of price stability for investment purposes and the myriad complexities of Capitalism. The Fed can manipulate markets (to an extent) but it cannot control every variable within the economic strata. Quantifiable economic activity should be evident beyond stock market indexes if that were the case. It’s not. What we see is a Fed desperately trying to ward off the spectre of deflation with the only thing it has in its tool box at this point: the bubble economy. Where is the demand-pull inflation its policies were supposed to stimulate? Exactly when are ordinary folks going to participate in this monetary free-for-all?

It is my belief that we'll continue to see the clash between irrational monetary policy and the free market's economic reality, a bear market in paper precious metals, a bull market in physical precious metals, and quixotic, dislocated housing, stock, and bond markets that can break apart at any time. Only Keynesian disciples who think that asset valuations can go up forever with no cost structure or capital behind them would support such a dangerous interest rate policy.

THE FED’S BALANCING ACT CANNOT GO ON FOREVER:

Even if Janet Yellen does raise the Fed’s funds rate 25 basis pts to .50, this is effectively still ZIRP. But the those 25 basis pts will add another 45 billion to our total deficit, kill US exports, keep oil cheap for China, kill the junk bond funded shale boom, and wreak havoc on currency exchange rates. Moreover, when you are involved in a currency war, the last thing the Fed wants is a strong dollar, which raising rates would create as investors would then pile into dollar denominated assets looking for yield. Well, this kills Janet's whole 2% inflation target mandate. And when you factor in 77% of all derivatives being interest rate swaps, the Fed can never move. We're at 0 and we'll stay at 0 until all confidence in CB policies is lost. Eventually, though, yields will move WITHOUT CB permission. We're already seeing it in the 10Y YIELD. The Fed clearly does not trust its own data. If it did, it would have already moved.

“The dragging US economy now presents a daunting problem for the Fed. It would not surprise me to see QE or something like it brought back. It’s wise to keep the big picture in mind. The big planetary picture is deflation and a deleveraging of the 70 years of inflation and financial engineering in the massive buildup of economies since World War II.” Richard Russell on KWN

Functionality of markets has been co-opted by central bankers and turned upside down to the detriment of investors worldwide. There is no economic nirvana to be found in Central Bank intervention, and there is no permanence in fiat currency for ordinary folks. The U.S. has a recovering economy with a disappearing middle class and a record DOW with no quantifiable economic activity! We now live in a digital fiat world where economic growth is totally dependent on currency destruction rather than on capital formation. Investors need to be cognizant of this fact and tread very, very carefully. Paul Craig Roberts was right when he said that the off-shoring of our jobs to China has transformed American wages into corporate profits. The West put the fate of its own Capitalist system into the hands of a Communist nation. Ruminate about that for a minute?!

2008 was not a one-off event. It was the first death pang of a dying monetary regime; the denouement of a bloated and corrupted empire living well beyond its means. The 2009 recession never ended. We're just bottom bouncing on Fed supplied monopoly money, hoping and praying for a recovery that never seems to materialize. Caveat Emptor.

AS OF Q12015,

THE FED IS LEVERAGED 77:1

$56.2 BILLION IN ASSETS

$ 4.4 TRILLION BALANCE SHEET

IN 2008, THE FED WAS LEVERAGED 22:1

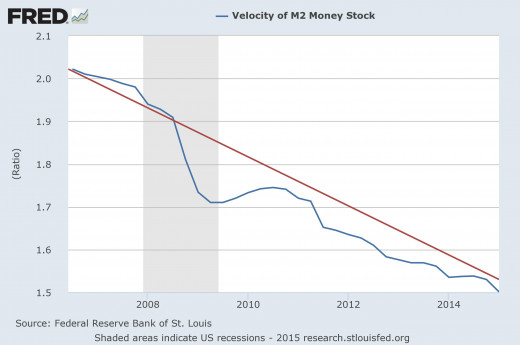

THE VELOCITY OF MONEY CONTINUES TO CRATER

AND IT’S TRENDING LOWER!

The term “Velocity of Money” is just a fancy description of how fast people are spending money. A higher rate indicates spending, a lower rate, saving. Globalization may have been a boon for corporations but it decimated the discretionary income of working class people in the process. The velocity of money collapse confirms it. If there is no money circulating in the real economy after almost 8 yrs of ZIRP, when can we expect economic activity to pick up again? At this point, an economic revival benefiting our middle class seems unlikely. Wages are stagnant, costs in healthcare and education are exploding, and retailers continue to shutter stores.

Roughly 70% of the U.S. economy is based on consumption, so any slow down in spending is significant and distills our basic problem to its core: The American consumer is still tapped out and/or unwilling to take on more debt. More than anything else, though, consumer spending is a reflection of confidence. What will be the ramifications for global stock markets going forward if this loss of confidence accelerates? Just as you don’t sober up a drunk by giving him another drink, you don’t fix a global debt problem by issuing more debt.

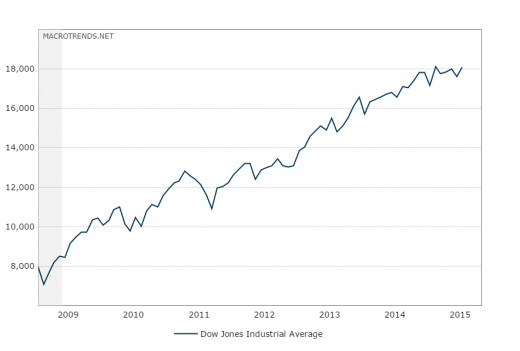

SINCE MARCH 9, 2009, THE DJIA IS UP BY 175%

Common sense should compel investors to thank the Fed for the 175% notional DOW moon shot since 2009, but has the time come for us to take the money and run for cover? Yes, I truly believe it has. The unmolested Fed inspired run up in the DOW is a great time to take some profit and examine the lay of the land.

The global economy is on fire and yet the DJIA seems impervious to the flames! Too many investors still believe the recovery narrative and maintain their total faith and dependence in the same system that destroyed their wealth the first time around and is on the verge of collapse yet again. Their only saving grace is this thing could go on for a few more years as all roads still lead back to the US Dollar. But the folly of financiers will ultimately end in capital destruction. The free market will eventually win the day and sit in judgment of the Fed’s criminality and eradicate the phantom wealth it conjured out of thin air. Take steps now to preserve your wealth and stay liquid, but above all, keep your money close because you never know when you’ll need it.

FOR THE FIRST TIME, U.S. CORPORATE CASH OVERSEAS NOW TOTALS $2 TRILLION, WITH EVERY $1 REPATRIATED GOING TO SHARE BUYBACKS-.80 AND STOCK DIVIDENDS-.15!

MERGERS AND ACQUISTIONS TOTALLED OVER $1.75 TRILLION IN 2014, CLOSE TO THE 2007 RECORD OF $2.28 TRILLION.

NONE OF THIS WOULD BE POSSIBLE WITHOUT THE FED’S LARGESSE!

HOW MANY BLACK SWANS ARE OUT THERE?

“More than $2 trillion worth of bonds are now trading at negative interest rates. That means the owners of that wealth are reconciled to making a loss. They are willing to buy a bond with a small negative yield, locking in a small loss, because they are afraid that any other investment they could make would generate an even larger loss.” Gordon T Long

Private equity (PE) firms are selling stocks at the fastest pace in history. According to Bloomberg, PE firms have sold $73 billion of their holdings to the public so far this year. That’s the most ever for a six-month period.

GLOBAL DEBT HAS ECLIPSED $200 TRILLION-with $57 TRILLION ADDED JUST SINCE 2007.

CORPORATE DEBT:

2007-$3.5 Trillion

2015-$7 Trillion

TOTAL REPORTED U.S. DEBT:

1970- $389 BILLION

2015-$18.3 TRILLION

STUDENT LOAN DEBT IS NOW OVER $1 TRILLION DOLLARS.

GREXIT/EU STABILITY

UKRAINE/GAZPROM

CYBER ATTACKS ON MARKETS AND/OR INFRASTRUCTURE

IMF cutting projected U.S. GDP growth from 3.1% to 2.5%.

World Bank cutting projected growth forecast for developing economies from 4.8% to 4.4% citing possible recessions in Brazil and Russia. It also lowered its GDP forecast for the rest of this year and next year in the United States.

ECB QE-60B euros/month until Sept ‘16

JAPAN QE HAS CRUSHED THE YEN’S EXCHANGE RATE

CHINA STOCK AND HOUSING BUBBLES

SHANGHAI STOCK MARKET DOWN 29% SINCE JUNE 12TH.

MARGIN DEBT (STOCKS BOUGHT WITH BORROWED MONEY) IS AT AN ALL-TIME HIGH

BALTIC DRY INDEX NOSEDIVE- DOWN 60% SINCE LAST NOVEMBER

11/3/14- 1,456

6/8/15-610

10Y @ 2.37% at a 7 month high

FED WORD CLOUDS

JADE HELM 15 EXERCISES

FALSE FLAG/ DOMESTIC TERROR ATTACK

FUKUSHIMA

GAZPROM/CHINA RMB oil deal.

OIL VOLATILITY

SYRIA

ISIS

ISRAEL/PALESTINE

NUCLEAR IRAN

GLOBAL PANDEMIC

HOW LONG UNTIL THE COLLAPSE STARTS?

A FINAL WORD ON THE RISE OF BITCOIN:

A healthy degree of skepticism about any nascent digital crypto currency is certainly not unwarranted; however, any alternative to the current war driven petrodollar fiat system can be a blessing for the common man- a potentially profitable investment opportunity which repudiates the Wall St. shills selling debt and the glib-tongued politicians propagating death. Risk is inherent in any investment and due diligence is always required. But risk alone should not be an obstacle in choosing to see the global economy in a different light. Choice should be viewed as a blessing rather than a curse. When choosing to invest, one must be prepared to incur loss from time to time. We already do it with stocks. Bitcoin, gold, and silver are no different. Don’t let some self-serving, clueless financial advisor tell you otherwise.