80s Abject Greed: A Major Impetus For Engine Problems

Remember the epic 80’s film Wall Street? What about the iconic character of Gordon Gecko? Well, if you don’t then you haven’t been living on this planet in the past 20 years. This was a really great film but this fictional movie represents everything that went wrong with our economy in the decade of the 1980s. Serving as a point of reference, the 1980s, economically speaking, was a period of rather low inflation: the then Federal Reserve Chairman Paul Volcker was widely credited with ending the stagflation crisis of the 1970s by using monetary policy to raise single digit interest rates well into the double digit category.

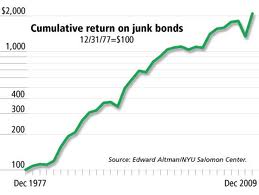

Inflation, which peaked at 13.5% in 1981, was successfully lowered to 3.2% by 1983. The federal funds rate, which had averaged 11.2% in 1979, was raised by Volcker to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well. What these astronomical rates pave the way for was a kind of zestful investor greed—that is to say, through high yield instruments, most notably, in the high yield junk bond markets, investors starting sweating at the prospect of instant millionairism. In fact, this very same phenomenon could be, solely, attributed to this time period.

Nevertheless, whenever you mention junk bonds of the 1980s, one name usually comes to mind: Micheal Robert Milken, “The Junk Bond King;” and who by most people’s account paved the way for many swindlers after him. To say the least, Milken was no simple Wall Street con artist: he was indicted on 98 counts of racketeering and securities fraud in 1989-and as a result was sentenced to ten years in prison thus permanently barred from the securities industry by the Securities and Exchange Commission (SEC). Michael Milken, an interesting character to say the least, used the stock market as his own personal circus act. Pulling high yield bonds out of a magic hat like a magician does a jack rabbit: this guy set bad precedent to the point of causing major financial influxes and blunders to the macro-economy in the following years.

Greed Might Be Good, But Abject Greed Sure As Heck Ain’t

Michael Milken, a cult hero at the time, inspired the now infamous fictional character of Gorden Gecko in the movie Wall Street. Wall Street, the movie, was all about abject greed. And what people fail to realize is that an economic engine can’t run off of abject greed. If you really watch the movie closely, as I have, you’ll immediately notice the similarities: “fictitious Gecko,” just like “non-fictitious Milken,” was both blinded by the concept of abject greed. Greed wasn’t a word to these guys, greed became larger than life—and almost like a hallucinogenic drug, “the need for greed” made both of them do really stupid things. If you see a guy on crack walking with a stolen television, in broad day light, and in front of a bunch of cops, he’s as good as caught. The same could be said of Milken and Gecko, the money wasn’t “the means to an end” for these guys, they wanted that feeling of supplying an imbalance in the mind: they were like “bad economic” emissaries carrying out a mission to set bad precedent for tomorrow’s swindlers.

Both Milken and Gecko manifested their true geniuses in areas comfortable enough to warrant doing harm to the system. And just like true magicians they had to have an act, a stage and a credulous audience. A magician can’t play magic on himself, the beauty of the game of magic is the illusion and how far you can play tricks with the minds of the audience.

Junk Bonds: High Risk, High Rewards….

As the name implies, Milken sold “junk” to the many naïve investors who got sold on the mantra of “high risk, high returns.” Let’s not forget that when you buy bonds you’re considered a debtor—in essence, you loan money to the bond issuer. Whether or not you loan money to the government or a corporation, a bond holder is still owed some form of monies in return for his/her risk. This said, from the lowest returns in treasury notes (low risk), to the highest in corporate bonds (high risk), risk is the common denominator in a very important equation of high yield returns. The default risk of bonds is graded by bond rating agencies such as Moody’s and Standard & Poor’s Corp, what this means is the bonds with the highest grades are those considered least likely to default. Unlike stocks, which are based on speculation, bonds are a complete game of risk. The riskier the bond, the higher its yield; therefore, it’s important to note that bonds issued by the U.S. Treasury are free of default because they’re back by the almighty federal government. On the other side of the spectrum of risk exists bonds issued by corporations or “corporate bonds.” The corporate bonds with the lowest-quality rating—and inversely the highest risk/highest returns are called high yield bonds—colloquially known as junk bonds.

Michael Milken pioneered an implicit financial collusive frame of mind that paved the way for a generation of “would-be” fraudsters to emulate. Fact is, Milken created paragon in the world of Wall Street swindling: his brand of swindling became somewhat of a springboard ideology which has launched the careers of many Wall Street fraudsters that followed him. Just like Milken, the guys that would succeed him, were not motivated by “greed,” but instead, were motivated by “the need for greed;” two totally different things. In theory, anyone can be greedy: sometimes we eat more ice cream than we should, sometimes we crave more sex than should, but “the need for greed” is an economic sickness.

Again greed, in on itself, is innocuous but “the need for greed” is as inherently dangerous to the free market enterprise system as an air born disease is to a weak immune system. Furthermore, in a free market system under such credo, you begin to see the self-interest shifts to being selfish, arrogance and power hungry. The system no longer rewards merit and hard work but gives kudos to the corrupted and cronied. Just like when a bad meal causes a person to think whether or he/she was poisoned, hardworking, law abiding, rule respecting citizens of the market place began to think that the system has been poisoned, thus begin to grow weary and apprehensive. In the free market enterprise system, wariness is a precursor to massive and widespread panic.

In conclusion, Michael Milken paid his debt to society and went on to lead a highly constructive life—by most people’s standards then, ironically enough, went on to legitimately become a billionaire. Michael Milken, I do believe was a genius, but he used his genius to take a ride on the dark-side of economics: his God given financial market abilities, albeit to say, was used to feed a perverse appetite of individual greed at the highest level. Economics, more than anything else, is the study of human behavior and although most citizens do decide “to play by the rules,” you have to always be cognizant that there are a few people that aren’t.