The Savings and Loans Vs. The Subprime Mortgage Crisis

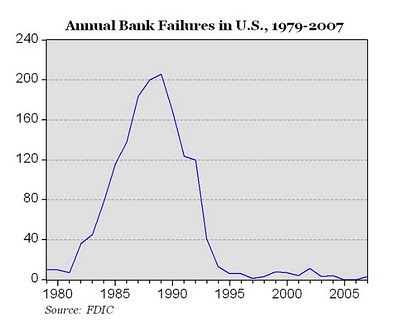

Does any one remember the savings and loans crisis? Before there was a U.S. subprime mortgage crisis, there was such a thing as the U.S. savings and loans crisis—aka the S&L crisis of the 1980s garnered similar media headlines and international attention. Nevertheless, prior to the 80s, most financial intermediaries had been functioning quit well—to say the least. In economics, for every small action, there’s an even bigger reaction; and what caused the S&L crisis to meet its inevitable demise could be attributed to this very same logic.

What’s a savings and loan?

A savings and loan association (or S&L), also known as a thrift, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans (Economics: Paul Courant). The original concept of the savings and loans—just like the mutual savings banks—was to provide a safe place for individuals to save thereby invest those savings into financial instruments like mortgages, loans, stocks, bonds and other securities. The general idea behind the savings and loan association was to provide a safe haven for savers to put away monies to invest in “The American Dream.”

What caused the S&L crisis?

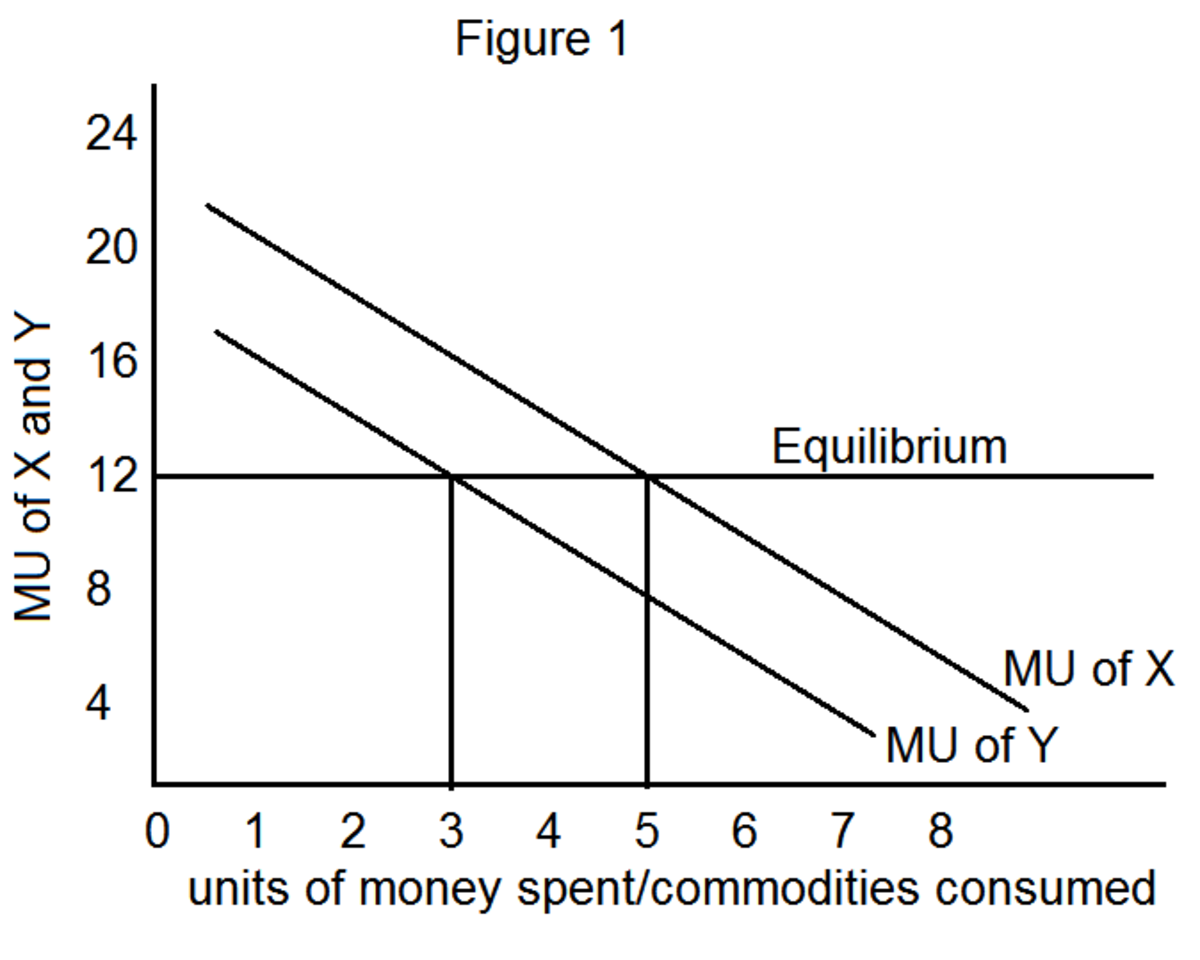

Most market economist theorized that the S&L crisis was created out of the same framework that caused the subprime mortgage crisis. Fact is, if you really delve into the roots of what really cause mass market distortions—i.e., S&L and subprime mortgage crisis—what you would find is these same maniacal tendencies guiding market participants towards this idea of self-suicide. You have to understand something about mass market distortions: no matter if there’s a market for widgets, high-priced goods or bank financial assets, if the market deviates too far from its comfort zone of price equilibrium, the science of market says, “there could be some type of collusive external force at work.” The collusion at work, during the S&L thrift crisis was large pockets of real estate development scandals out west.

The theories of what caused the crisis began and ended, again, with kamikaze economics. S&Ls made most of their loans in the form of long-term mortgages. The institutions’ deposit liabilities were, however, relatively short term. The general level of interest rates rose steadily throughout most of 1988; as a result, the interest costs paid by the S&Ls on deposits rose quite sharply, while their interest return on assets didn’t. This placed the S&Ls in a profit squeeze. These problems were intensified by the fact that real estate values had been falling in certain areas of the country—especially in the oil-producing states of the Southwest—and S&Ls that were holding mortgages for property concentrated in these areas suffered unusually poor collections and unusually high default rates(Courant).

The S&L crisis wasn’t a crisis as much as it was a scandal—if I’m big time Texas developer and I have a college buddy that runs a S&L, then, I have, at my disposal, the ability to borrow large sums of money for the development of real estate—i.e., “you scratch my back, I’ll scratch yours.” If the developer makes good on the investment, then the S&L made a conscience decision. But if the developer misallocates resources and the project ends up a failure, then the S&L’s got a lot of explaining to do.

Comparing S&L with Subprime

By historical comparison, the savings and loan crisis of the 80s cost the U.S. taxpayers $519 billion and measures about the same size as our current crisis. There’s no hiding the fact that in the 80s, under “Reagonomics,” the US economy grew from $4.5 trillion to $5.5 trillion. This means the S&L crisis involved assets of between 8 and 10 percent of GDP. Today, the United States has well over a $14 trillion economy, but the subprime crisis only represented about 3.5 percent of GDP; therefore, by comparison, the S&L crisis meant more damage to the U.S. economy at the time.