Mergers & Acquisitions II: Economics of The Hostile Takeover

On one side of the macroeconomic spectrum of rationality, there could be a place for (M&A)....there are such things as good mergers. Lee Iacocca, in his book, Talking Straight, talks about this when he says, “the moral is that because of all the bad mergers, good mergers are becoming impossible.”

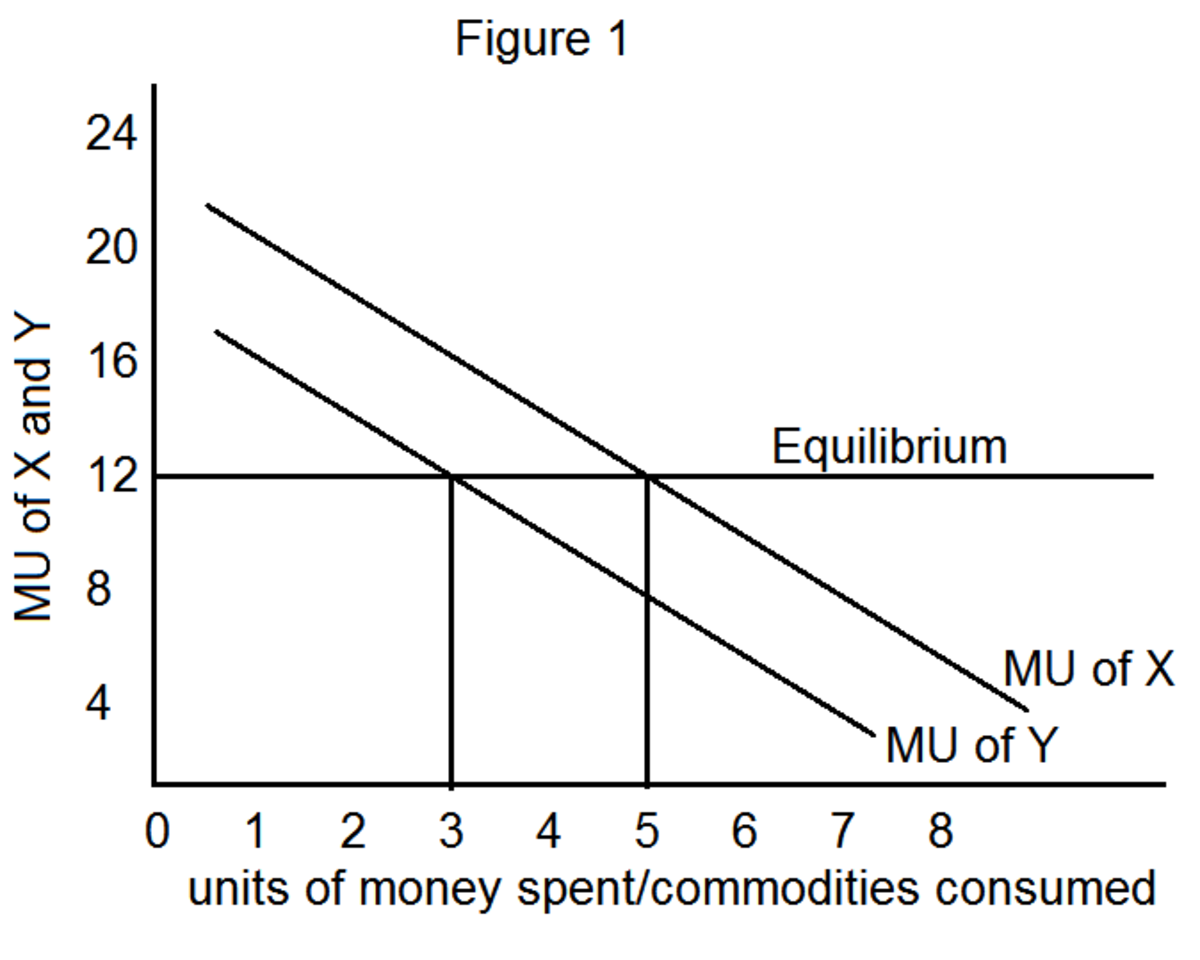

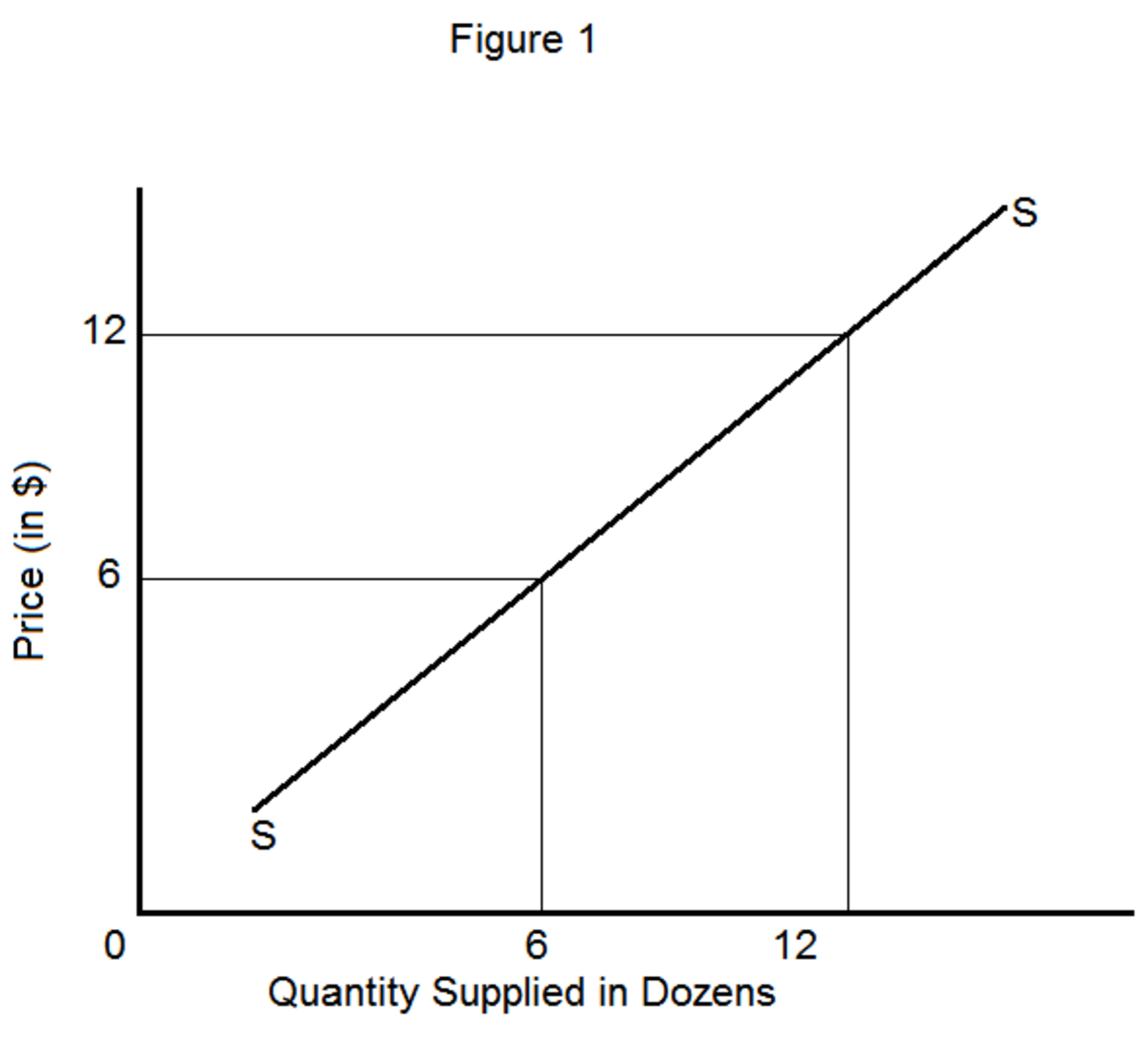

Conversely, bad mergers are apart of “bad business” and “bad business” is apart of “bad economics,” it trickles down to the essence of what it means to be a kamikaze economy doing battle in the business of war. In brief historical review, it appears most merged companies during the decade of the 90s were in business to do away with sound economic business decorum. As illustrated by the classic supply & demand model, when the demand for a good falls, prices was suppose go down—but during this period they didn’t? In a (M&A) cadaver company—to avoid this natural decline in prices—these companies found it profitable to collude and manipulate supply to counter any changes in demand for the good. What’s meant by “manipulating supply,” is the explicit use of in-house tactics to prop up the illusion of a company being in good health, when in reality it was a cadaver—i.e, Enron, WorldCom and Global Crossing.

Fact is, these (M&A) cadaver companies all plotted to some type of “in-house” accounting scheme. The leaders of these companies—lets call them the board of morticians—felt that they could do whatever the heck they wanted as long as they kept this illusion afloat. It didn’t matter whether or not the employees came to work, did their jobs and bought into the company’s mantra, the end result of a company with hidden kamikaze economic agenda is a company with an almost certain shipped wreck faith. What this mean to an economic engine, at large, is tenfold: now you had a hand full of people getting extremely rich at the expense of millions.

The 90s Hostile Takeover

Truth be told, the decade of the 80s and 90s ushered in a sinister period of hostile takeovers and corporate raiding; this alone should have sent a red flag to the American people that something wasn’t quite right with the system. The general idea of what a corporation meant to an advanced economy began to vanish like a puff of smoke. Through the hands of these boards of morticians, U.S. Corporations now became paranoid of the thought of facing an inevitable death.A corporate hostile takeover was about as vitriol as it gets in reference to corporate in-fighting. Normally, the chief executive suite serves as a kind of army barracks campaign tent, complete with hurrying advisers, councils‑of-war and swift-changing tactics. For leaders who favor the military style, this is as close as it gets to being a five star general—the plan, the attack, the surrendering and of course the grand prize. How could our once great corporate society evolve into such a microeconomic state belligerence?

A very hostile state of affairs, in deed: you had in these (M&A) an explicit reminder of what it meant to stand clear of the twisted minds of the “board of morticians;” as they mandated military style tactics to do away with the true essence of the free market enterprise system. Let’s not forget the powers these (M&A) gave to the CEO; who now had every reason to practice his own version of this “need for greed.” Because the best interest of the company takes a back seat to the best interest of the CEO’s needs and desires, a recipe for disaster awaited our economic engine and we saw only part of this disaster in the economic breakdown of 2008.

In addition, the decade of the early 90s kicked off a period where the CEO became analogous to a financial rock star. It was almost like something out of an economic comic book: the CEO’s job began to transcend its true meaning thereby shifting into a kind of economic underworld. Fact is, CEOs of a big (M&A) conglomerates became demagogues—bombastic effigies that showed up to work not for the betterment of their companies, but for the pure joy of calling shots; it was an economic power trip unlike anything else. In the mind of the CEO, the more money he was worth, the more power he had; nevertheless, traditional wealth accumulation took a back seat to “get filthy rich or go to jail trying” type mentality and most CEOs of major (M&A) corporations were willing to take that risk.

In conclusion, what people must realize is that market economics isn’t a science of fraud and unethical behavior. Market economics is a science of “markets.” If something unethical is going on, markets can’t police themselves. Fact is, this should be the job of the government: this is where the government has to step in and demand reformation. What our future economic engine needs to do is stir clear of (M&A); we need government to allow the natural competition of markets to continue by regulating the corrupt (M&A)—e.g., the Japanese government heavily regulates against both mergers and acquisitions. Although the term kamikaze was coined in Japan, the Japanese economy never wanted anything to do with it.