Best Value Places To Donate Money

About Microfinance

More Microfinance Videos

The best place to donate money is somewhere that money will do something good - not just once, but over and over again.

Philanthropy with leverage is what we're after!

I have been an active donator all my life - I even donated blood until I had cancer, after which they wouldn't take my blood any more.

One thing which always haunted me was the sense that welfare hand-outs can create a cycle of dependence, rather than boosting individuals out of their difficult situations.

I tried to get around this by choosing charities like the Surf Lifesavers, Guide Dogs For The Blind, the Police Citizens' Youth Clubs (for their drug education and life skills programs), Greenpeace, and Amnesty International. I could see, in each case, that my donation would have a chance at saving a life, or in some other way making a lasting improvement to the world.

A few years ago, though, I discovered a whole new concept in charity - a concept which allows my one donation to be recycled over and over and over, helping hundreds and hundreds of people. What's more, it helps people in the classic "teach a man to fish" way, rather than just giving hand-outs. More accurately, actually, it helps people in the "enable a man to buy a fishing rod" way.

I was so impressed that when I won selection to co-author a book for charity in 2008, I selected this form of charity to benefit from the project.

A New Concept To Combat Poverty

I am talking, of course, about microfinance, also known as microlending or microloans.

The way it works - your initial donation is loaned to an entrepreneur who is living in poverty.

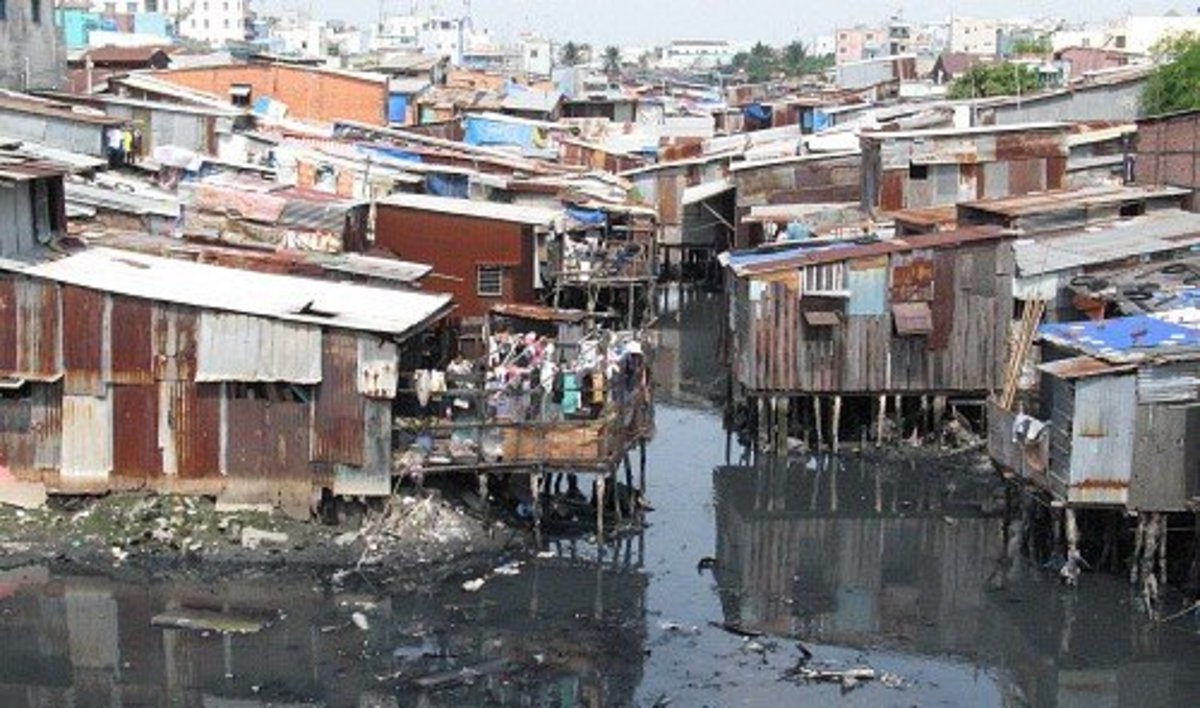

Many of the world's poor are "working poor" - that is, they work up to 18 hours a day, but earn less than they need to provide the most basic food and shelter for their families.

A very small amount of money can enable these people to start their own businesses, or expand their existing businesses, and thereby increase their incomes.

The loans can also be used for educating children, or even adding rooms to a house to provide rental income.

But the real leverage from microloans comes from the fact that the increased income is also used to pay the loan back.

The same funds can then be loaned out to someone else, while the first loan recipient is still enjoying the benefits of their expanded income.

Since microloans have a repayment rate of over 95%, a single donation can permanently lift the incomes of 20 or more households.

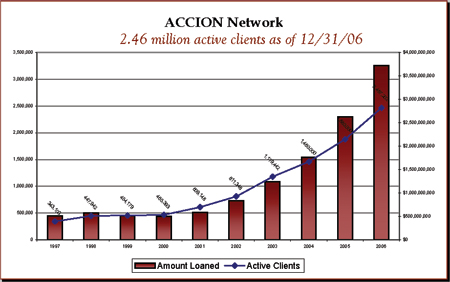

Fast Company Names ACCION, A Microfinance Charity, One of Nation’s Top Social Entrepreneurs

Selected for the fifth consecutive year for its pioneering approaches to poverty alleviation, ACCION was awarded the 2008 Social Capitalist Award by Fast Company magazine and the Monitor Group, and was named one of the top 45 organizations "using business excellence to engineer social change."

Why Make So Many Loans To Women?

The majority of microfinance borrowers are women. For example, women receive 85% of the loans from Opportunity International, the UK's largest microfinance charity. The charity's website expains their reasoning.

Lending primarily to poor women ensures that their business profits are spent on education, health, housing, and nutrition, maximising transformational impact on families and communities. Financial independence earns the women respect in their communities as neighbours approach them for advice and assistance, generating a positive cycle of self-esteem. Access to financial services empowers and equips women to make their own choices and find a secure route out of poverty and social exclusion in a sustained and self-determined way.

Microfinance Success Stories

Vivian Adamh, in Ghana, was an experienced teacher, but had no way to start a school for the children in her native village. A seed loan of just 27 UK pounds was enough to enable her to start teaching her first six students.

By repreatedly repaying each loan and then taking out a new loan of greater value, Vivian has built from those humble beginnings to running a school of 360 students, catering for all ages from toddlers to teenagers.

The school building is still only partially completed, with plans for a second storey, but Vivian's energy and determination, and support from microfinance lender Opportunity International, will continue to develop this vital resource for future generations.

Judith Ngoma, of Malawi, used microfinance to enable her to sell fish and tomatoes. She can now afford to eat breakfast, and to pay for her youngest child to go to school.

Judith's microlender, Micro Loan Foundation, provided business training along with the loan. Judith now has a business plan.

"I want to continue working with MLF so that I can increase production in my business. I would like to be able to sell clothes as well as fish and tomatoes since they generate higher profit margins," she says.

Carmen Ore Torres was selling fish on the streets before she received her first microloan. "Nobody would lend money to me," she says, "Not even my sister."

Carmen lived with her husband and two children in a plastic shack with a sugar cane fibre roof. All four of them shared bedding on the stone floor, because the only furniture they owned was a single wooden bench. Their total income was US$80 per month.

Three years later, Carmen has a stall in a busy part of town, selling fruit, linen and clothes. The family now lives in a three-bedroom house with concrete walls and floor, and everyone sleeps in their own beds. They have chairs and a sofa, and even electricity!

Carmen is now making US$600 per month, and the old wooden bench lives in the back yard with the chickens.

Internet Microfinance

Internet commerce giant eBay acquired microfinance charity MicroPlace in June, 2006, for a small, undisclosed, sum when it was little more than Tracey Pettengill Turner and her business plan. PayPal, eBay's online payment service, will process the loans free of charge. "There are a billion people in the world who are self-employed, hard-working, and poor, and we are hoping to scale the industry to at least a billion," Turner says.

Microlending - Healing Wounds In Rwanda

Faustin Zihiga is Vice President of Marketing and Rural Operations for URWEGO Opportunity Microfinance Bank in Rwanda. He sees microfinance as the key to the reconstruction of his troubled homeland.

"I love the work that I do, and the people I work with," he says. "With microfinance, people begin to depend on their own abilities, rather than expecting other people and relief agencies to provide the solution to their problems."

He sees additional benefit for Rwanda in the common microfinance practice of forming groups of borrowers, who support one another in keeping to their repayment schedules.

"In our group-lending programme, survivors of the genocide mix in the same groups as suspects of the genocide. They begin to associate themselves by their group, not by their ethnic background ... the social change is even more visible than the economic change that microfinance brings about."

Microlending in the USA

Microfinance is not just for the third world. Microlender ACCION supports entrepreneurs in the USA as well as in less-developed nations.

Melvin Gibson earns his living performing hands-on science experiments for elementary school children. When he needed $2,500 to buy a new computer, the banks turned him down, and he turned to a microlender.

At 66 years old, Ninfa Cárdenas of San Antonio, Texas is going strong.

Over 10 years ago, Ninfa's husband of 40 years left her. Since everything had been in his name, Ninfa had no credit history of her own. She had a business running festival stalls, but organisers were starting to ask for payment in advance, and microfinance was her answer.

Callie and Gary Ford, of Santa Fe, New Mexico, renovated an old trailer and started Callie's Cajun Smokehouse - only to discover that the cost of electricity was consuming most of their profits. They used a microloan to buy a portable generator, and managed to stay in business.

Rene Rosas used a $5,000 loan to buy stock for his Peruvian import store in Boston, Mass.

The average loan size for a microloan in the US is just over $5,000, as opposed to an average loan of $700 or $800 in a developing nation, but the increases in income are equally large. For example, Oscar Delorier of Miami, Florida, was clearing about $100 per month from his landscaping business when he first applied for a microloan. Now he employs six people, owns hundreds of thousands of dollars' worth of machinery, and makes $15,000 per month.

Sometimes, a small amount of capital at the right time can perform miracles.

The Warm-Blooded Alternative To Microfinance

A similar ripple effect of empowerment is delivered by Heifer International, but in a rather more cute and furry manner.

The charity buys a heifer (a female calf) for a family in poverty. The heifer grows up and produces calves and milk for the family. The charity asks that the first-born female calf is given back to Heifer International, to start another family on the road back from poverty. This means that each donation to Heifer International provides a heifer for a family living in poverty - not just once, but each and every year for all time.

Criticisms of Microfinance

Microfinance has been criticised for several reasons. Some have suggested that because the loan amounts are small, and they are directed to individuals, microfinance will never deliver infrastructure improvements, such as wells, roads, and hospitals.

Others have pointed out that since the recipients are in such a state of poverty, they may direct their loan funds into food for the family, rather than investing them in a business, making the loan little different from charity - in fact, worse, because mainstream charities don't expect to be repaid.

Some have criticised microfinance organisations for setting interest rates to cover their costs, which can sometimes result in higher interest rates than those in the Western world, who borrow funds from banks and provide real estate as security, are used to seeing.

Microfinance Charities

- Opportunity International

The UK's largest microfinance charity. - Microplace

eBay's microfinance charity - Microloan Foundation

An African microfinance charity - ACCION

Message On The Launch Of The International Year Of Microfinance - 2005

Microfinance has proved its value, in many countries, as a weapon against poverty and hunger. It really can change peoples' lives for the better -- especially the lives of those who need it most.

A small loan, a savings account, an affordable way to send a pay-cheque home, can make all the difference to a poor or low-income family. With access to microfinance, they can earn more, build up assets, and better protect themselves against unexpected set-backs and losses. They can move beyond day-to-day survival towards planning for the future. They can invest in better nutrition, housing, health, and education for their children. In short, they can break the vicious circle of poverty.

If we are to reach the Millennium Development Goals, that is exactly the kind of progress we need to make.

Let us be clear: microfinance is not charity. It is a way to extend the same rights and services to low-income households that are available to everyone else. It is recognition that poor people are the solution, not the problem. It is a way to build on their ideas, energy, and vision. It is a way to grow productive enterprises, and so allow communities to prosper.

Where businesses cannot develop, countries cannot flourish. Let us use this International Year of Microcredit to put millions of families on the path to prosperity.

Kofi Annan

United Nations Secretary General