Chasing Mispriced Stocks: How Inferior Goods Companies McDonalds & Family Dollar Store Won

Small investors who watch the market daily often beat themselves up as they read about some darling of Wall Street that has doubled or tripled in value over the past year. “Why didn’t I spot that one sooner?” Worse, if one of these stars did cross their radar early on, but they decided to wait for a clearer signal. The problem is assessing and deciding what level of risk one is comfortable with. Sometimes, by the time you feel it’s safe to put some skin in the game, the rest of the market has spotted the opportunity and the mispricing is gone or swung to being overpriced. It’s a common lament, “why didn’t I buy Microsoft when it was only … “

When looking for those mispriced stocks, there’s one principle of consumer behavior that often goes overlooked. When the economy goes south, ridership on city buses picks up. People opt for more home-cooked meals. When they do dine out, they watch the bill diligently. It’s little more than a footnote in early economics textbooks, but economists tag these downgraded choices “Inferior goods”. Unlike “Normal goods”, which consumers buy more of as their income increases, demand for inferior goods is inversely correlated to income. That is, the more money one has, the less the demand for cheap foods, cheap beer, and cheap cars. If one can afford better, one buys better. But in tough times, consumers downgrade their tastes. In a recession, that is where the opportunity lies.

Consider the recent history of two stocks involved in these inferior goods: the blue chip king of fast food, Mc Donalds (MCD) and the discount retailer, The Family Dollar Stores (FDO). City buses, sadly, do not issue stock. In December of 2007, the official beginning of the recession, Mc Donalds was trading at around $59, the Family Dollar Store around $19. Like most recessions, the beginnings and ends are usually not confirmed until months later. The housing bubble had burst, but unemployment was still under 5% and consumer behavior was not in full recession mode. The Family Dollar Store had been declining from a high of $34 in June of 2007. The Golden Arches had steadily risen more or less in sync with the S&P 500 for the previous few years. Then, the economy got worse.

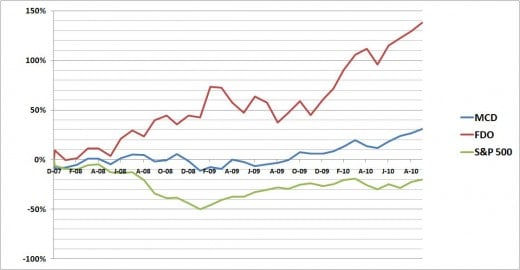

McDonalds, Family Dollar Store and the S&P500

In 2008 the S&P 500 started the year at 1,447 and ended it at 903, almost a 40% drop. It was a very bad year for nearly all stocks. Inferior goods, however, weren’t doing too badly. MCD was up 5.6% and increased their dividends by 33%; FDO shares increased 35.6%. By March 9th of 2009, the market had found its nadir; the S&P closed at 676. A month later, FDO nearly matched their previous high over $34. Nearly all stocks bought in March of 2009 were bargains, but when staring at the abyss, plunking down thousands in stock market speculation required not only tremendous intestinal fortitude, it required cash, and cashing out other equities meant huge losses.

The 2008 overall retail environment was bad, consumer confidence was low, but inferior goods were one of the safest investments. MCD competitor Yum! Brands (KFC, Taco Bell and Pizza Hut) also prospered. Walmart had double-digit growth in the first year of the recession, and food manufacturers Kraft and General Mills either gained slightly or treaded water while the larger markets tanked.

Technically, the recession ended in June of 2009, but unemployment is still near 10%, and the S&P remains more than 20% lower than its December 2007 level. Mc Donalds is up more than 20% (it nearly hit $80 in November 2010). At the end of September, The Family Dollar Store was trading at $44.16 – over twice its trading level at the start of the recession. If one had a crystal ball and cashed out of the market before the walls came tumbling down and jumped back in March of last year, their returns could have been better, but that’s witchcraft. In late 2008, there was no doubt things were bad. Nationally, bus ridership hit an all-time high in October of that year. Investors who watched this type of consumer behavior still had time to profit; both stocks added nearly $20 a share as the two experienced strong growth throughout the recession.

As the economy slowly crawls, there is likely to be more growth in inferior goods. If consumer spending continues to increase, the next big opportunity in mispriced stocks may be normal goods. I plan to keep checking bus ridership before making any moves.