Create passive income through investing: learning how to create your first financial portfolio

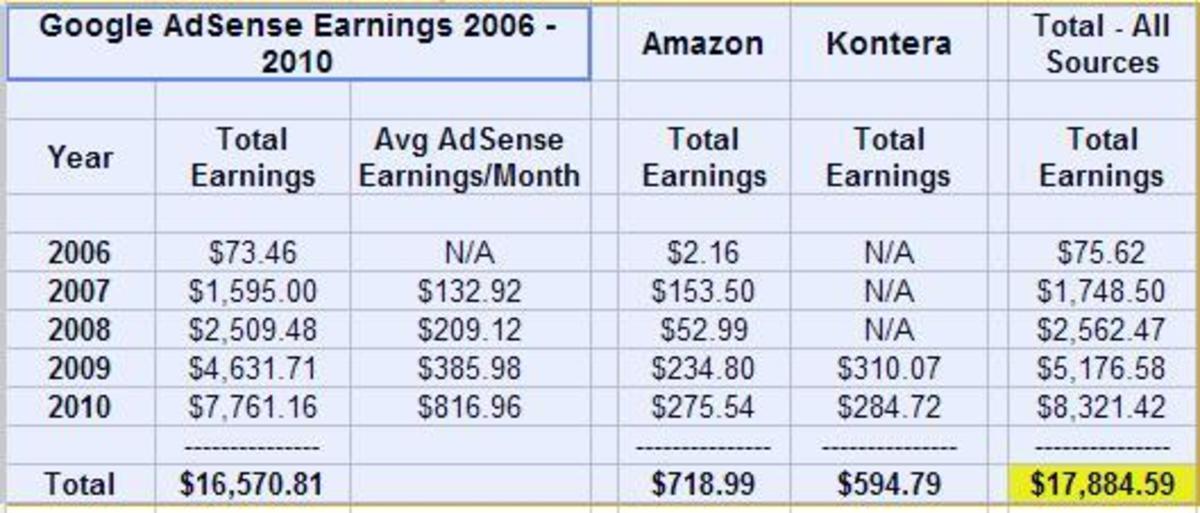

Make passive income by writing for hubpages

Learning to invest

The easiest way to create passive income is through investing. I am sure you all have read a book or online article about “making your money work for you”, well, this is exactly what you are doing when you invest. One of the biggest excuses I have heard about why people are not investing is that people don’t know what they are doing. Well, now is the time to learn. It’s not that scary, trust me. Also, give yourself some credit. All of us at one time or another have been faced with a challenge that they overcame, and looking back it probably seems silly that you were ever worried in the first place (riding a bike for example…).

So, how should you start learning to invest. Well, you have already taken a big step into learning how to passively build your income as you are reading this article. The key for me was constant reading of books, websites, and blogs about investing. The more you read, the more you can learn, and after a little while you will start to have your own perspective on how to invest. Maybe after a little reading you decide you like the idea of becoming the next Warren Buffett, and find it easy reading through financial documents to find under-valued companies. Then again, maybe value-investing is not your cup of tea. Maybe you like the relative security of bluechip stock where you make a nice little profit collecting a monthly dividend, and put together a dividend portfolio. Then again, maybe you love risk and the opportunity to make big money, so you start day-trading or study options and currency markets.

Well, I can tell you right now that all of the above scenarios take time, and while I do recommend that you do your homework and eventually take the time to create your own stock portfolio, there is a faster way to start investing for people with little experience to passively build your income by investing. The way to do this is by buying ETF (exchange traded funds) and mutual funds. These funds are somewhat safer than a specific stock (or, even a few individual stocks), because they diversify your risk. Exchange traded funds and mutual funds are safer because the money you put into them are spread out over multiple (100’s and 1000’s) of different stocks.

Learning to invest

How comfortable are you with investing?

Investing in mutual funds and ETFs

You can buy stocks and mutual funds that mirror the S&P, or a specific industry. The bottom line is that if you have the money to invest you should be socking some away in the stock market, and the best way to do so for someone without a whole lot of financial experience under their belt is to buy ten to twenty mutual funds and ETF’s from different categories. The idea here is to be risk averse, so you don’t want to buy only 10 high tech mutual funds and ETF’s, or only 10 automobile funds. Rather, spread yourself out over several industries so that all your eggs are in different baskets. That way, if one of your baskets (let’s say the healthcare industry) gets dropped, you have 9 or 19 other baskets which are still being held onto tightly. If you are just beginning to learn how to invest, it would also be a good idea to find a trustworthy financial advisor to help you build and maintain a risk averse portfolio through the diversification of mutual funds. There are many good financial advisors out there that will help you create a profitable and safe portfolio. I would recommend talking to friends with financial advisors, or searching the web. I would also recommend finding out how they get paid. Some make a flat rate, while others make a percentage off of every trade they make for you. I would definitely be sure to ask these and several other questions in order to make sure they are not going to be over-charging you. An honest financial advisor will have no trouble disclosing how he/she earns a living, so do not necessarily go with the first one you talk to just because they are being pushy to close you (sometimes the financial advisors that make the most money, know very little about the stock market, but are very good sales people).

All in all, it is very important to learn how to invest, and it a great way to passively build income. The longer you keep it in the market the longer it has to grow, and if you keep it in there long enough, you will find that the compound interest can grow to the point to pay your bills. So, hang in there, read everything and anything about investing that you can get your hands on, and build your wealth!

Small Time Finance

- Small Time Budget

I would like to start out by saying that if you don't currently have a budget, now is the perfect time to start one. The first step is realizing the absolute necessity of a budget. No matter how great your income, the need for a budget is there. - small time finance

Hubpages Experiment Day2: After a little over 48 hours I am the proud author of 6 hubs. I have also done several hours of reading to see how to improve my SOE and keywords as ways to improve the number of views. So far I have made a grand total of $

Other articles that will tickle your fancy (whatever that means...)

Click edit above to add content to this empty capsule.

Thank you for reading my article on passive income through investing. Now go out there and start making money like its your job. If you enjoyed it please feel free to drop a comment (below), or check out my other recent articles on similar subjects...

Make Money Like It's Your Job: A Beginners Guide To Passive Income

Financial analysis of two companies

Specialty Coffee Industry Analysis

Cost Structure of a New Cleaning Company