Debt Financing vs Equity Financing

For those, who are new to stocks, I'd request you to please check the basic introduction here.

Now, what are the demands and needs related to stocks? Have you ever wondered why a company needs to publish or issue stocks and shares to general public?

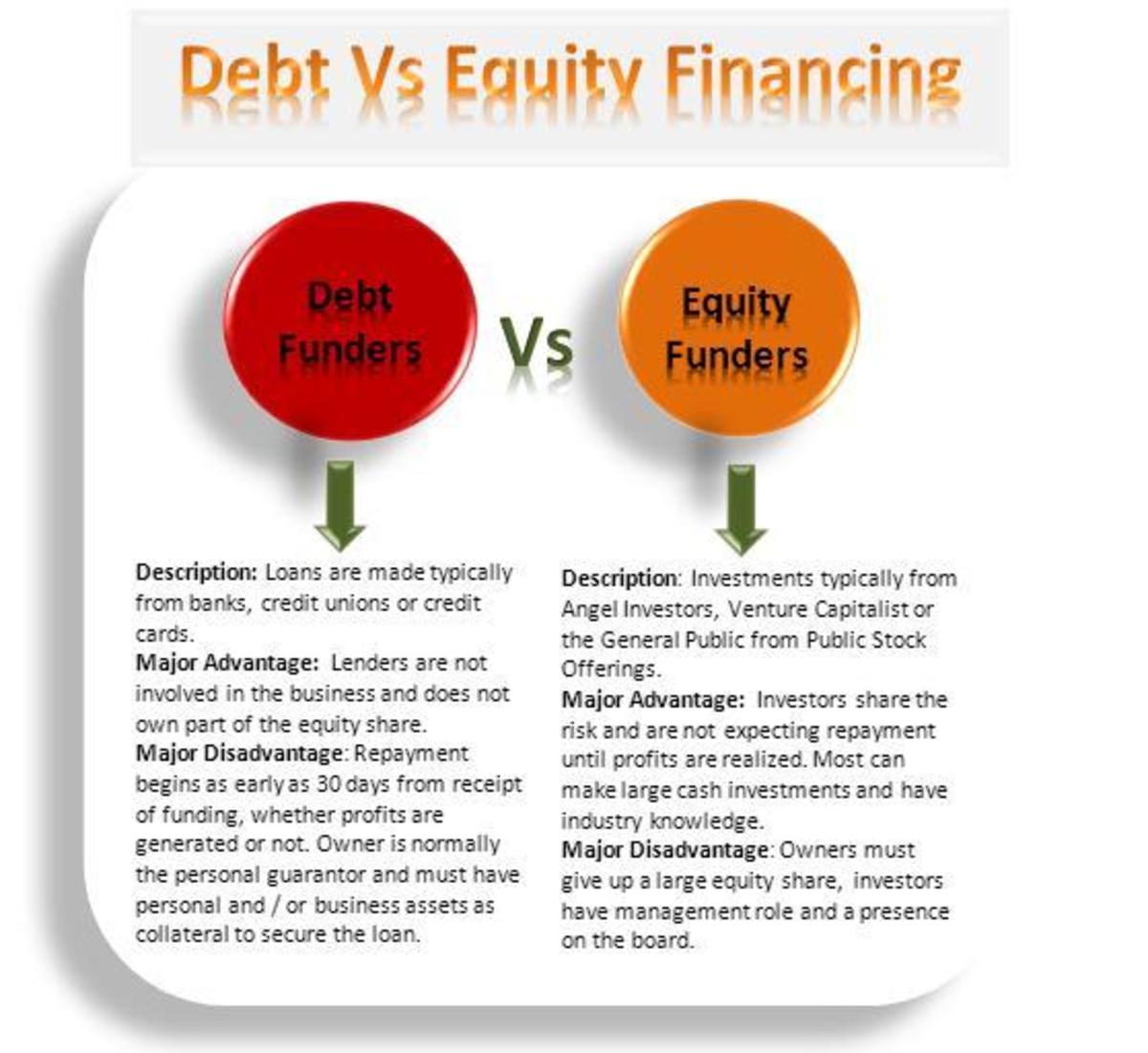

Why would the founders of the company want to distribute the gains with thousands of people, when they could easily save the profits to themselves? Well, the main reason behind such strategies is that, at some point of time, every company wants to raise money. In order to attain this, companies can either take loan from some institution or raise it by merchandising a part of the company, which is called issuing stock. A company can either take a loan from a bank or issue bonds. Both methodologies come under the field of “debt financing”.

On the other side, issuing stocks is called “equity financing”. Issuing stocks has its benefits for the company because, it makes the company free from the burden of paying back the money or even make any interest payment, as it proceeds. Shareholders, who pay money to buy stocks, get in return, a chance and future hope to attain better selling rates when the stock prices rise someday from the current value. The initial sale of a stock, which is published by the private company itself, is called the Initial Public Offering (IPO).

Debt Financing vs Equity Financing

It is really crucial that you understand the difference between the debt financing and equity financing companies. When you invest on debt instrument such as a bond, you stay assured that your principal amount invested will come back to you along with the pre-calculated interest rate. The case is a bit different with equity investments. When you invest on equity instrument such as stocks, your stakes are at risk, in case the company is not successful – just as a small business owner can not be ascertained to get any returns, same is the case with shareholders too. Your claims on company’s assets and income as an owner are certainly lesser than that of the creditors. This means that you, as a shareholder will get your money, in case of company’s bankruptcy and liquidation only, when the banks and bond holders have been paid the debt amount; this is called absolute priority. The earning potential of shareholders is huge, if the company is successful, but there is always a risk to lose the whole investment if the company falls down.

For normal shareholders, it doesn’t make much difference if they are not able to manage the company. After all, our basic motive is, to not have to work, in order to make money, correct? The benefit of being a shareholder is that you are qualified to a part of the company’s gains and have a title or claim to its assets. The company sometimes pays out its profits in the form of dividends. So, if you own greater amounts of shares, you will get larger amount of profits too. If the company goes bankrupt, you own a right to claim on its assets. In case, there is liquidation, you will get what is left, after the payments to all the creditors have been done. This statement is worth repeating: the prominence of stock ownership is your title or claim on company’s assets and income. Without this, the stock has no value at all.

Apart from this, another important characteristic of stock is its confined or pre-determined indebtedness, which means that if you own a stock, you are not personally indebted, if the company is not able to get over its debts. In other companies, such partnerships are pre-defined so that if the partnership gets bankrupted, the creditors have full rights to follow the partners or shareholders personally, and get their houses, furniture, car, etc sold in order to get the payment. Getting ownership of a stock means that, irrespective of anything, the upper limit of the amount you can lose, is the limit to which you have invested. Even if a company goes bankrupt, for which you are a shareholder, you can never suffer any loss in your personal assets.

Risks

It must be made absolutely clear and certain that there is no assurance for the investment, in case of individual stocks. Certain companies pay out dividends, but a lot others don’t. And the company is not obliged to pay dividends even if they have given out some in their past. An investor can still generate revenues on a stock without dividends, through the stock’s appreciation in the open market. Going to the negative aspect, any stock has a risk to go bankrupt and in that case your investment is all gone in the drain. Even though, this risk looks quite scary and negative, the better and positive aspects also exist. If you go with higher risks, the possibilities to get better return on your investment are more. This is the basic reason behind the conventional success of stocks over other investments like bonds or saving accounts. In the long run, an investment in stocks has traditionally had an average return of around 10-12%.

(Disclaimer: This article does NOT give any insights about the trading market, or any complicated financial terms or jargons. You can refer to the relevant places for stock market information of various stock exchanges. The article is a very basic tutorial or introduction to people who simply find it difficult to understand the whole stock trading process, because of the overloaded or complex information available over the internet and books.)