- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Form 1127: An Extension of Time to Pay Tax

Ask a hundred accountants, “Can I file an extension to pay my income taxes?” And you will get 99 “no” answers. Ninety nine would be wrong. You can file an extension to pay your taxes, not just an extension to file.

An extension to pay your taxes is not automatic like an extension to file is. By following a few simple rules, you can get your extension granted.

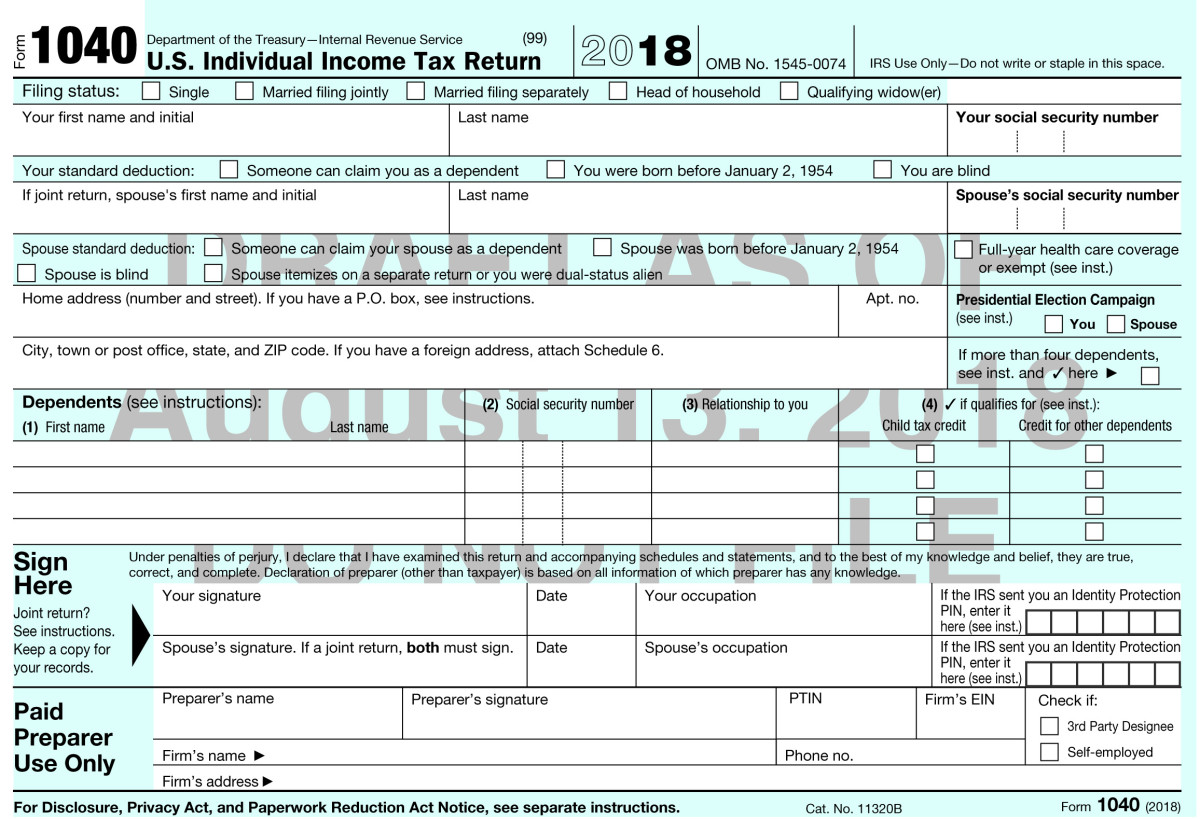

Form 1127 is available for tax liabilities on an original tax return or from an assessment due to an audit.

An extension to pay is commonly used for income tax, self-employment tax, and gift taxes. You can review the instructions to Form 1127 for additional taxes covered under Section 6161 of the code.

Who Should File

You should file for an extension to pay as soon as you become aware of a tax liability you cannot pay without “undue hardship.” Undue hardship is more than an inconvenience. You must show that selling assets to pay the tax when due would result in substantial loss.

Form 1127 must be filed by the due date of the tax return without consideration for extensions. If the tax liability is the result of an audit, the extension to pay request must be received by the IRS on or before the due date listed on the Notice of Deficiency.

How Much Time Do I Get

Unlike an extension to file, you get to choose how much time you need… kind of. Most requests for more than 6 months are denied. If you are out of the country, a longer extension request has a better chance at success.

A tax liability due to an audit or Notice of Deficiency is limited to 18 months, with an additional 12 months possible.

Final Notes

An extension of time to pay is easy to file; Form 1127 is a one page form. You are required to provide documentation that includes your assets and liabilities at the end of the previous month AND 3 months of income and expenses. Failure to include the required documentation is an automatic denial of request.

Form 1127 is an opportunity to pay your taxes later without penalty (interest still accrues). The effort required to get an extension to pay is more than an extension to file, but the savings can be significant. Don’t make a bad financial situation worse, file an extension to pay.

Be sure to file Form 4868 if you are not able to file the tax return by the due date. Form 1127 is due on the due date of the return without extensions, so don’t delay.