How You Can Fix A Blemish On Your Credit Report Score

Let's get started!

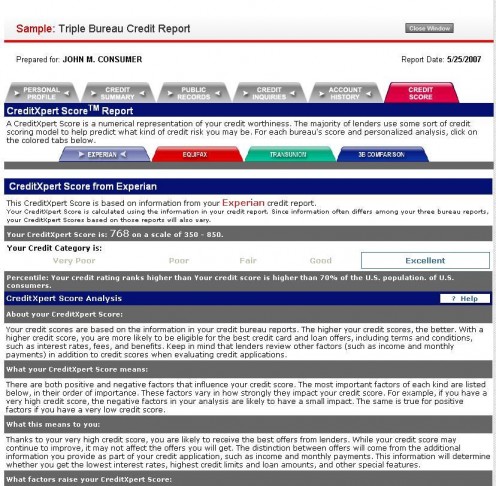

To understand how to repair your credit score, you first needto learn how it's calculated. Your credit score is compiled as an average ofthree scores that are maintained by three different companies: Experian,Equifax, and Transunion. By averaging the scores from these three companiestogether you get your true credit score, but how true is it?

Well … Not everything you do wrong with your credit getsreported to all three, so you might score high with one agency and low withanother. To make matters more confusing, they each weigh your credit a bitdifferently and not every lender looks at all three when considering you for aloan. As this is the case, your best bet is to raise your score with all three,and that's what I'll show you how to do.

What's my credit score

Your credit score is a number between 350 and 850. The higher the score, the better off your credit is. Generally, 700 or above is considered good credit and anything less is considered risky. Banks and loan companies will push the boundaries either way as they tighten or loosen their belts, but a 700 credit score from all three reporting companies is a goal to strive for. As such, we need to see how to achieve this – but to do that, we need to understand what lowered our score to begin with, as this will be key to raising it again.

How your credit score is compiled

This will take some time to explain, but the informationthat follows is the key to fixing your credit. As such, we need to understand what'shurting your score before you can fix it. Here's a breakdown of thepercentages:

35% of your credit score revolves around your paymenthistory. Above all, this is the one that is the most within your control. Asbanks and lenders know this, they place a lot of weight on this one in yourcredit score as it tells them if you are financially able to handle more debtand if you are one who is willing to pay such debts back. Even if you befell afinancial quagmire in the past, you can still take action and repair this partof your score.

Another 30% of your score is your debt to credit ratio. Itsounds like a big scary term, but it's really not. It's how much you owe onyour credit cards vs. how much your credit cards are worth. So, if you currentlyowe $1000 on your credit cards and your cards max out at $2000 (for all of yourcredit cards combined), then your debit to credit ration is 1000:2000 or 1:2.You then divide the number to the left by the number to the right to discover …your debt to credit ration is 50%. So, what this really amounts to is thepercentage of the credit on your credit cards that you currently owe. Not sodifficult, eh? Idealistically, you want to keep this one around 20%. Too high, and the bureaus think you are too risky - too low, and the bureaus think you are just collecting credit cards, which they (oddly enough) also see as risky behavior.

The next 15% of your score is something you can never fix,but you can most certainly damage - it'sthe length of your credit score. You see, from the moment someone first givesyou credit (whether it be a loan or a credit card), this percentage startsgoing up. This 15% works against those just starting out in life andrepresents the 'young and foolish' aspect of credit. Of course, as you age, it alsorepresents the 'older and wiser' aspect. So long as you continue to pay or oweon something this percentage slowly rises over the years, but should you decideto become a hermit this number will slowly dissolve.

Now, I'm sure someone laughed at what I just said. Afterall, how many of us decide to become a hermit? Actually, many of us who fallinto financial ruin do this when we move in with others and allow them to takecare of us. Those three years you move back in with mom and dad can do a lot ofdamage to this percentage, unless you are paying off debts during that time, asit shows an absence of credit history. So, if you decide to become a hermit, becertain to keep paying on those old debts to keep this percentage movingforward.

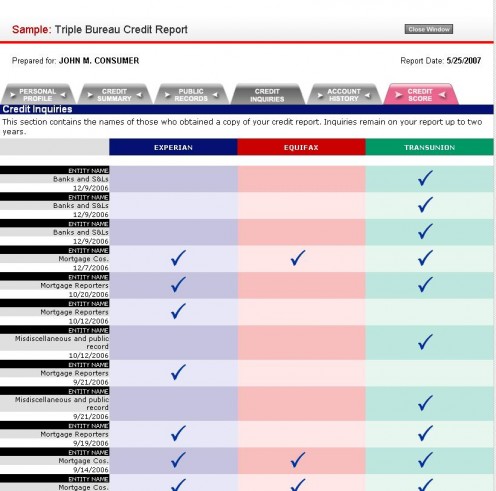

Which brings us to the next 10%. This is the time betweencredit checks, and few know that this is monitored. You see, banks and lendersare concerned when a person applies for a lot of credit or loans in a shortperiod of time – even if that person never accepts any of these offers. It'sseen as 'shopping' for a way out of an upcoming credit crunch and your creditreport will represent this act of desperation by lowering your creditscore.

Of course, sometimes a person is just shopping around for agood credit card or is looking to see just how good of a loan they can get. Forthese people, the penalty is highly unjustified (and highly contended), but allfor naught, as this percentage of the score won't be disappearing anytime soon.

The final 10% is dedicated to the type of credit that youuse, which should idealistically be a mixture of loans and credit cards. If youhave a lot more of one or the other, then this upsets this percentage.

Where can I get a free copy of my credit report?

Well … a certain commercial on TV comes to mind, but you need not take that route. Besides, you want to do this for yourself, right? Luckily, you can. For you see, all three reporting agencies are required by law to give you a free report once a year. All you need to do is request your report and I will tell you how.

Go to this website right here (but read below the link before doing so):

Even though this three bureau report is free, as you travel through the maze to receive it you will be bombarded by many offers. Accept none of them, as they will do nothing to repair your credit. Your entitled – by federal law – to a free yearly credit report, so they can't refuse your request.

When you finally receive your three credit reports (and yes, they make you work for them) be certain to print them out in their entirety. These pages will be your blueprint to recovery, so you will want to set aside a manilla envelope to store the printouts in for safe keeping.

Alright, let's get to fixing this mess!

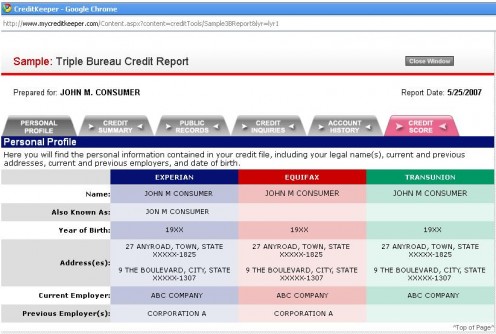

Not all reports look the same, but they all contain the same information. I'll comb through a sample report and point out the areas you can fix and how you will mend them. Let's look at the various sections and see how we can fix our credit report - shall we?

Your personal profile

This section reports who you are, where you live, who employs you, and any aliases you might have legally created for yourself throughout the years. If anyone steals your identity, this is often your first clue it has occurred, as the first thing an identify thief will often do is switch the address in your report to theirs.

Make certain the name and address are up-to-date. If not, then you need to go to the reporting bureau's website to get this information updated. Also, if the address is one where you have never lived, contact the bureau immediately! Someone might have hijacked your credit report and could be using it for their own personal gain!

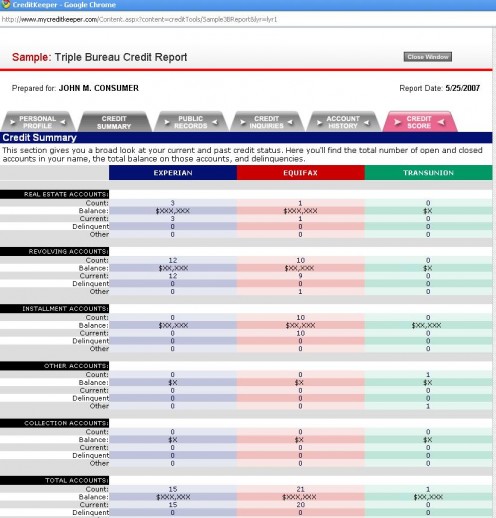

Your credit summary

This is your outstanding debt. Everything you owe (at least everything the reporting agencies are aware of) will be found on this part of your report. What you are looking for here is to see if any debts already paid off show up in this section of your report.

For instance, what if you paid off a car last year but it still shows as an open account with Transunion? That's a blemish on your credit record that needs to be reported to them and fixed – ASAP!

Also, if you see any accounts open that can't be yours – such as that $80,000 loan you never took out – then inquire immediately! It could mean your credit is being destroyed by some unscrupulous person or entity.

Remember, you are held solely responsible for keeping your credit report accurate. If you do nothing to resolve the blemishes on your credit report then they will remain there to haunt you.

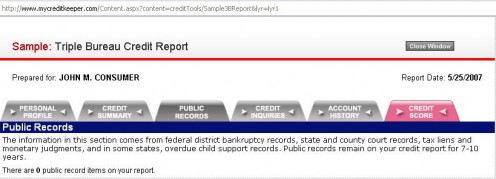

Your public records

This section deals with bankruptcies, tax liens, and financial judgments being held against you.

Above all, this section will hurt you the worst and is often the most difficult to resolve, as most of these items on this list will remain for 7-10 years and you can do nothing about them. All you can do is check it for accuracy and shake your head at any mistakes you have done in the past that recorded an incident in this section.

However, all is not lost, as the upcoming sections of your credit report will allow you to improve upon your score.

Your public inquiries

Remember how I said earlier that applying for credit too often can damage your credit score? Well, here's the section to prove it. If you are repairing your credit then it's best not to apply for any new line of credit until the repair process is completed.

Remember this golden rule … you should never pay off bad debt with more debt.

You already know what bad debt is, but what is good debt, you might ask? Good debt is several loans in excellent standing that you want to consolidate together to lower your monthly payments.

Please, if you are already sinking down the proverbial rabbit hole and are unable to meet your current financial obligations - don't borrow and dig yourself in deeper. Consolidate your loans if you can, but if you can't, realize you need to find yourself a legitimate credit counselor to lift you out of debt. (beware, as there are many organizations out there that pose as credit counselors, which are anything but. Research them heavily and speak to coworkers and friends who might be able to recommend a legitimate one.)

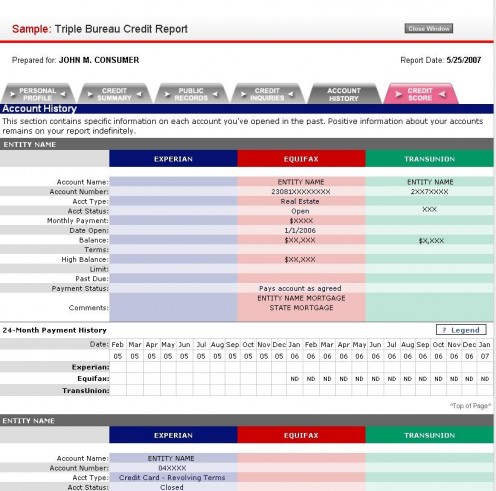

Your account history

Again, check for any mistakes and report them to the perspective bureaus. Also, look through to see if there are any debts here you can discharge of. For example, that $35 light bill you forgot to pay several years ago when you moved – pay it off and get it expunged from the record. The same goes for any other light debts, dispose of them as they need not remain on your record to hurt you.

And what of the rest?

Check your payment history on all loans and credit balances. For those which you have a sketchy payment history with, you will need to improve – or continue to suffer with bad credit.

Remember, I said above that your ability to pay debts on time constituted 35% of your credit score. You need to keep paying your bills, every month, always on time. Repeat that – then do it. It's the single-most important thing you can do to repair your credit score!

Your credit score

Again, check for any mistakes and report them to the perspective bureaus. Also, look through to see if there are any debts here you can discharge of. For example, that $35 light bill you forgot to pay several years ago when you moved – pay it off and get it expunged from the record. The same goes for any other light debts, dispose of them as they need not remain on your record to hurt you.

And what of the rest?

Check your payment history on all loans and credit balances. For those you have a sketchy payment history with, you will need to improve – or continue to suffer with bad credit. Remember, I said above that your ability to pay debts on time constituted 35% of your credit score. You need to keep paying your bills, every month, always on time. Repeat that – then do it. It's the single-most important thing you can do to repair your credit score!

My own financial crisis

Now that you have your credit score in-hand and understand it a bit better, it's time I formally introduce you to why I'm the right person to advise you on repairing your credit.

You see, I was once like you, looking to improve upon my credit score. I had made some financial mistakes in the past, but I was rounding the corner and amending for my past. Still, I couldn't seem to get my credit moving. No matter, I thought to myself, as I wasn't looking to purchase anything big, but my wakeup call was around the corner.

Big dreams

You see, I met a really nice girl and she had three kids. We had the American dream building up around us – minus the house – as we were renting the place we lived in. Now, as we all might or might not know, renting a house is actually paying someone else's mortgage. Being wise and intelligent people – we thought it better to pay our own, so we marched off to the bank with a $10,000 downpayment in-hand, certain we could secure a loan. After all, money is all you need to secure a loan, right?

Sadly, you need good credit too, and that's something we just didn't have. And while I would love to tell you how we fixed it all the next day and bought that dream house of ours, I don't see it fit – nor proper – to lie to you. We lost the house and found ourselves among those who have no choice but to remain someone else's mortgage payment. The Amircan dream turned to dust.

Back then the internet was in its infancy, and many ads on the internet promised to 'fix your credit instantly'. Of course, these were all scams, and I wasn't hungry enough yet to bite into them (nor, thankfully, did I ever reach that state). Instead, I researched how credit scores work and looked to see how one could legally pull the strings on their scores and how long it would take.

Are you still with me? There is a way out …

Mending the broken fence

To mend a fence, you only need replace what is broken. Simple, right?

In my case, I had little nagging debts I had forgotten – reminders of a previous marriage I had escaped. I started by paying those off and I was annoyed at the fact that most of these were less than $50. Still, a hole in the fence is a hole in the fence, and mending it is what makes it strong again.

Next, I looked at how I was paying my bills. I was always making my payments, but sometimes I would let a bill slide for a month here and there. I resolved to never do that again and created a bill structure by which I still pay my bills – paying them when they arrive, instead of waiting until they were due. I won't lie. It took some financial juggling to be able to do this, but once I fell into the groove I was easily able to keep this up.

From there, came an issue that took me some time to figure out. My credit history was too young. Heck, so was I, for that matter. How does one overcome such a hurdle? I did some research and discovered there was such a thing as a secured credit card.

Simply said, you put down $200 and they give you a card matching that amount. No risk occurs on either hand, as they have your $200 and you have theirs (in credit), but the reporting bureaus see things differently. To them, it's a real credit card and they see its usage the same as any other.

So, what do you do with this newly found credit (which you can't be turned down for, as it's secured against your own money). Well … you use it, but use it lightly. Charge up about $50 a month, then pay it off before the due date (so as not to accrue any interest charges – after all, we don't want more debt). Repeat this monthly and you show the credit bureaus that you can handle your credit wisely – all for $200. Pretty neat trick eh?

Of course, the proof is in the pudding. Did this plan work?

Our new home!

Indeed it did, or I would not be here advising you on how to fix your credit.

Nearly one year later we checked our credit score. It was about a 720 by this point, but we were still skittish. Everyone said no the first time, so we expected the same treatment the second time around.

To our surprise, we asked once and received a yes – from a credible bank, no less! And five years later we still have that same home – living out our American dream.

Can you do it too?

I'll be straight up and honest with you - some can and some can't.

It's altogether possible you don't possess the financial resources to pull yourself out of the hole you are in, and for those people I feel truly sorry as I believe they deserve all the help one can offer. However, for those who possess the funds to repay themselves out of debt but just don't possess the know-how, the above steps are guaranteed to improve their credit score.

You can do this!

And now, having read all this, I ask you … did you see the part where I asked you to sign up for my X step program to success or the part where I told you I could repair your credit for X amount of dollars a month?

No? That's because you don't need to pay someone to repair your bad credit. You can do this yourself, so long as you remember it will take time to fix what has been broken, and so long as you remember a family that had a dream of owning their own home – who realized a year later it could be done.

So, bookmark this page for future reference, as you might want to turn back to it or share it with others, and know that I have walked in those shoes … and I'm not willing to do so again. To that end, I check my credit report periodically and I work hard to keep my number above the 700 mark, as I now realize the value of having good credit.

May your success story be as great as mine …

A special thanks!

I would like to provide a special thanks to the people at mycreditkeeper.com for the samples images provided.

While I make it a point of telling everyone they can receive a free credit report online (which is absolutely true), I found these guys at a time before this was possible, and I will be forever thankful for all the information they have provided to help me fix my credit and keep it that way. For anyone looking to track their credit report on a monthly basis, I definitely recommend them.

I also want to thank my family for sticking behind me and believing I could make their dream of owning a home come true. It's not easy to ask four people to believe in you for a year, with the hope that their dream won't be shattered in the end. Without their endless love, faith, and devotion, there would be no success story to write about today.

I hope this helps many out there who suffer with bad credit as I once did!