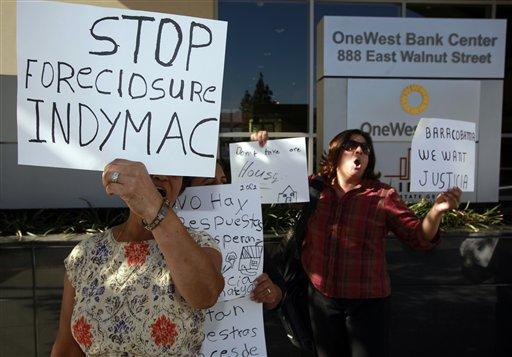

National Shame IndyMac/One West Bank Day on January 4, 2010

Mad as Hell and Not Going to Take it Anymore

IndyMac forecloses on Luis Benito's home

Let's Make January 4, 2010 National Shame on IndyMac/OneWest Bank Day

Like many people in this country I am one of thousands, if not millions of homeowners, suffering and struggling with a bad mortgage . I have written a couple of blogs about my misadventures into the strange and frustrating World of Loan Modification. ( http://hubpages.com/hub/My-Personal-Hell-Known-as-Loan-Modification-Part-2)

Based on news articles, Internet searches and talk radio, I knew I was not alone in my misery or frustration in attempting to get my lender to do the right thing and modify my loan, but what I did not know was the magnitude of people facing the exact same situation as I.

If there is anything "good" to come from this bad experience, it is the comfort of know we still live in a world with people willing to share their stories and empathize with you. This situation has caused me to make acquaintances I probably never would have but for this dire economy and mortgage crises.

For example, my new email buddy, Mike. He is an elderly man living in New York recovering from a heart attack. His wife is also ill and suffers from extremely high blood pressure. Medical bills and a decline in income contributed to his falling behind in his mortgage. Mike wanted to do the right thing. So he called IndyMac/One West immediately when it became apparent he would not be able to make his mortgage payment.

Mike ( like most of us ) have listened to so-called financial "experts" with their advice to homeowners that priority number 1 in saving your home should be: Call your lender immediately upon knowing you will not be able to make your mortgage payment.

Why is this always recommended? I think this is outdated advice. This advice may have applied when my mortgage was held by my local bank branch. When I could go into the bank and meet face-to-face with the Manager and explain my situation. These days I call my lender to let them know I am having trouble and my call is outsourced to India or some other 3rd World location where my "Customer Service Representative" can relate to me as much as I to them. These pseudo employees of my lender have no concept or understanding of American life nor do they care about our economic problems. And, can you blame them? Our banks set up these Call Centers in countries where they can get away with explotation of workers in sweat shops. My bank's "Customer Service" department is trying to make a living on pennies a day and I probably come off sounding like some spoiled rich American trying to get away with not paying the mortgage.

In any event, Mike listened to the "experts" and their outdated advice and called his lender. Unfortunately for Mike, his lender is the infamous IndyMac. He told IndyMac's "Customer Service Representative" about his heart attack, his wife's high blood pressure, his decrease in income; and all the valid reasons why he was having trouble paying his monthly mortgage.

Did he receive any assistance from IndyMac's "Customer Service"? Well.......if you consider their advising Mike to "eat less and go with heating his home" as a means of coming up with money to pay his mortgage, then I guess they were helpful! Bottom line, IndyMac's response to Mike's request of receiving a loan Modification was "NO" as it is for 99.9% of IndyMac's customers.

Mike forwarded this interesting though somewhat maddening, article to me written by Patrick Pulatie the CEO of a Forensic/Predatory Lending Audit company in Antioch California. Patrick's article masterfully articulates the devious and fraudulent practices of IndyMac/OneWest http://iamfacingforeclosure.com/blog/2009/12/01/anatomy-of-a-government-abetteded-fraud-why-indymaconewest-always-foreclosesOur government is condoning this blatant rip off by IndyMac/OneWest and Obama's Administration gives nothing more than lip service to consumers about "modifying loans" "helping homeowners and families stuck with toxic loans". Where is our help Mr. President?

There are thousands of people nationwide with their stories of their own personal hell known as loan modification. I have listed a few of them here. Seriously, I am dumfounded by the glut of IndyMac/OneWest complaints, although, I know I shouldn't be having my own firsthand frustrations with them.

From the complaintsboard.com:

tasR44 writes:

"I begin working with Indymac back in February 2009 on a modification for my rental property, they had me send in all of these documents month after month, everytime I called in i was told it's under review until finaly 09/23/2009 i was told they don't do workouts of any kind on rental properties and I need to pay $14, 363.93 to bring my loan current or go to forclosure sale in October. I told them I have a ederly tenant, the supervisor then said have her move into a senior home!"

Ceecii writes:

"IndyMac Mortgage purchased my loan from another company. After about a year into my "3 year -fixed" adjustable rate loan, my rate adjusted. 3 months later, it adjusted again. As I put the house on the market, I was told I had to pay $300 just to find out if they would accept a short sale and then it could take weeks to find out. My buyer was eager to purchase a home and refused to deal with IndyMac and their crazy terms therefore, I lost the sale and ultimately the home. Before walking away, I again received another notice from them saying my rate was to adjust again. To this day, I still cannot figure out how a 3 year fixed rate on an ARM can adjust 3 times in 1 year. Put me in for any law suits that come up...they are getting what they deserve from the Feds. Also, my home has now been vandalized as they have yet to secure it since the foreclosure. It's been 7 months already. Glad to see them loose in the end."

Pullman writes:

"After facing foreclosure, I contacted the bank and applied for the President's Home Modification Program. They put the foreclosure on hold while they were working on the program. I called them frequently for updates and was always told they were still working on it and everything was still on hold, not to worry. Yesterday (7-28), I received a Notice to Vacate and that my house was sold at auction by the bank. I find this highly unethical, if not illegal, and would like some help in rescinding this sale."

And more from the war:

MMnKL writes:

"The same exact thing happened to me. I called them constantly for updates. Numerous times they told me "your loan mod is in review, and the foreclosure is on hold." On 7/28 a realtor came knocking on the door asking my wife "how many bathrooms does this house have?" The realtor then informed us the house went back to the bank on 7/22. I checked with Onewest and verified it foreclosed . I am a homeowner for 22 years and bought this house in 2005 for a little more room for my family of five.

It's a long story, but it is now 9/23/09 and we are still in the house. I have an attorney and we are suing them for wrongful foreclosure. They had incorrect default amounts, violated California civil code 2923.5.(a)(1)and (2), and assembly bill ABX2 7, and led us to believe they were trying to help us. We have an eligible loan for the HAMP program, I have the income to qualify for it, and all they did was jerk me around for 8 months, then steamrollered the foreclosure. I NEVER ONCE got a call back from them. I documented EVERY one of my calls to them to check on the status and who said what. The always told me "your loan mod is in review, and the foreclosure is on hold".

Don't let these guys bully you around, PLEASE take a stand, hire a good attorney, do your homework and get your home back!

HighsaDitty writes:

"I've been in the loan modification program for 13 months now with IndyMac/One West Bank and have been lied to about the application process and have my application delayed to the point where now I'm in foreclosure because of their unwillingness to give me a straight answer, yet they continually tell me my account is being reviewed. It appears they are trying to force me into forclosure to receive some type of kickback from the FDIC. They have not been working with us nor anyone I know that has a loan held by them. I send them the needed documentation they tell me it could take 90 days they stall and request to same documentation 90 days later. All the while I receive a letter on September 11, 2009 stating my goes to foreclosure on September 29, 2009. Eighteen 18 days after receiving the letter. They have been unwilling to work with their customers although the house is worth $150, 000 less than what I purchased it in January 2007. They are lying through their teeth and trying to FORCE their customers into foreclosure. Follow this link to see the deal they struck with the FDIC. Whom I also filed a complaint with."

VanJohnson writes:

"At the end of last Year I called Indymac for help. I could no longer afford my payments on my house. They told me to fill out the loan mod packet and send it with a payment of almost $3000. The deadline they gave me was 12/31/2008. I sent the loan mod packet with a payment on 12/27/08 and it was received in their office on 12/28/08. I even have the registered mail receipt and the person who signed for it in their office. On 12/28/08 they filed a NOD (Notice of Default). Since then I have been calling and following up with them and they are sending me in circles. They denied my loan mod, and won't give me a reason why. They also breached their contract with me, which was to send in a payment with the loan mod packet and everything would be OK. I am currently living in the house and don't know what to do. Indy Mac is full of fraud. Their promise to help consumers is fraudulent and deceiving. The lady I talked to on the phone today at Indy Mac was very rude. I told her I would go to my local congress rep with this breach of contract. Her response was "there are hundreds like you"."

And, I could go on and on.

Oh President Obama, where are you? Your "Making Home Affordable" is not working and IndyMac/OneWest Bank has found ways to legally avoid having to follow the guidelines. Mr. President your administration's Michael Barr stated the other day " most of the banks were not doing enough to modify loans and should be embarrassed and we should shame them". Public humiliation? Scorn? Is that the answer Mr. Obama?

Come to think of it, public flogging of IndyMac/OneWest's investors would be an excellent idea, but since that is not legal, I am calling for a "Shame IndyMac/OneWest Bank Day" nationwide on January 4, 2010. Go to your local IndyMac/OneWest Bank and just hold a sign saying "Shame on you IndyMac/OneWest for foreclosing on us".

If you live anywhere within driving distance of Pasadena, California please join your fellow foreclosure victims outside the Corporate Offices of IndyMac/OneWest, 151 N. Lake Ave., Pasadena, California around noon time on January 4 2010 to shame these bloodsucking, greedy bank executives.

Exercise your right to shame IndyMac/OneWest into doing the right thing!

.