- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Is the Earned Income Credit (EIC) Fair?

There is a lot of talk in the United States that the very rich among us do not pay their fair share of taxes. Though it's virtually impossible to find exact numbers, there are so many tax shelters and loopholes that people who pay big money for top-notch accountants can get off with paying very little actual income tax.

While debate over the one percenters tax payments rages, a whole other class of people at the other end of the spectrum are being scrutinized. Not only do some people draw big checks in tax rebates every year, many are claiming and receiving money that they have never even paid into the federal government. Some say that tax credit for poorer families are just as unfair as the rich being under-taxed, especially when some of those poverty stricken families receive huge payouts in the form of tax refunds.

Some people contend that these large checks and one tax deduction in particular, called the Earned Income Credit, are not only causing many people to not pay taxes at all, but they are encouraging some folks to live below the poverty line in anticipation of that huge check every tax season.

What is the Earned Income Credit, commonly referred to as the EIC, and how does it benefit or harm the federal government?

What is a Tax Refund?

In 2011, the average amount for a tax refund was $2913. This is about $100 less than the average payout in 2010, but it is a number that a lot of people are very concerned about.

The short definition of a tax redund in the United States is the amount of money a taxpayer has paid in less the amount that the numbers crunchers in finance say that is a fair price to pay for taxes. Through regular paycheck deductions, American taxpayers give the federal government a certain portion of their earned income.

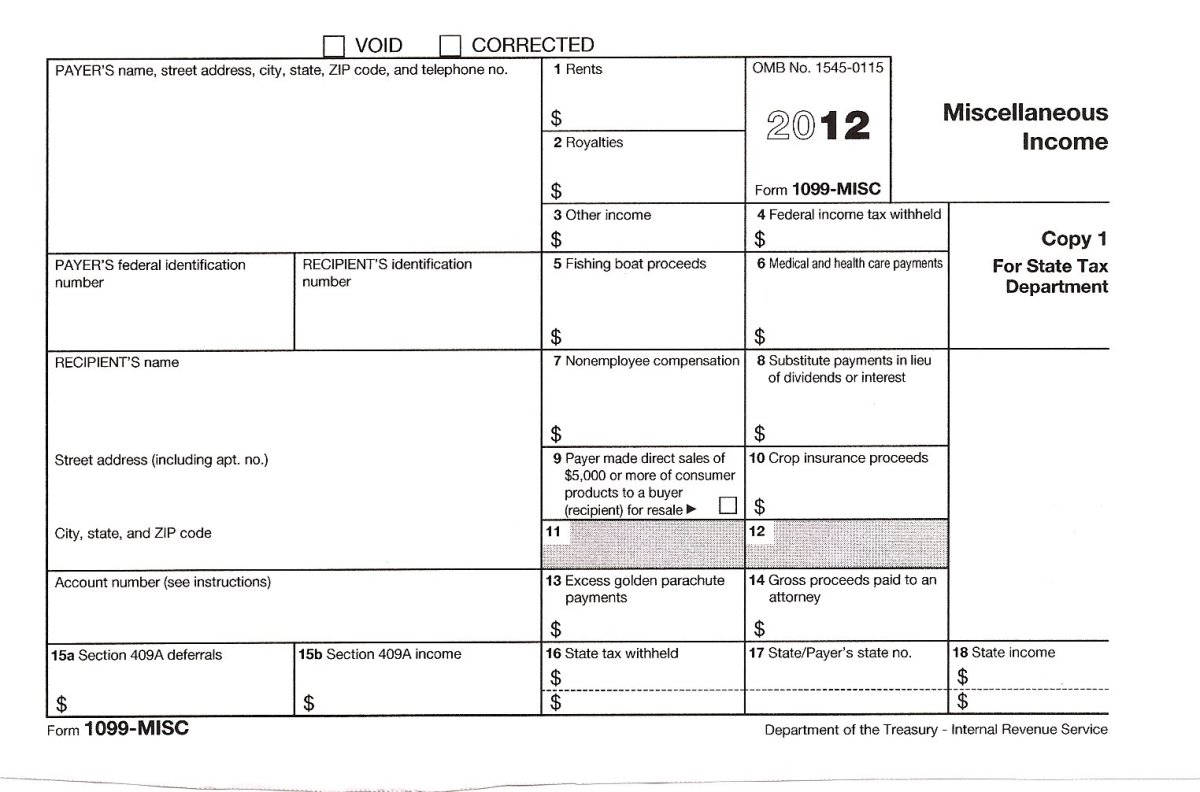

At the end of the year, all people who have earned any money in the US are required to fill out a tax form. Some are complicated when certain deductions are concerned, but many folks fill out a simple 1040 or 1040EZ form. If the amount of money that they have paid in for federal taxes is greater than their estimated amount of tax liability, then the IRS will issue the taxpayer a refund.

What is the Earned Income Credit (EIC)?

Essentially, the Eared Income Credit is a tax deduction. It allows for families with low income and folks with kids to get bigger tax refund checks.

For the most part, the EIC was designed to help stabilize the incomes of the lower class.

It is a large credit and claimed by many people. In 2004, the estimated payouts for the EIC alone was over $36 billion and, due to the crashing economy, those numbers have likely only gone up since. How much money are we really talking?

The maximum amount of the EIC available to single people with no qualifying children in 2011 was $464. For families with three or more qualifying children, the maximum amount was $5,751. Note: this is not the actual refund amount for these families, necessarily. It is the amount by which the EIC augments their original refund. Not all people who qualify for the EIC also qualify for the maximum amount.

The rules and guidelines are often difficult for the average person to navigate to even see if they qualify for the EIC. Some people falsely assume that the EIC is only available to people who live in extreme poverty or have multiple children. This is incorrect. A single person with no children can qualify for the credit, but they must meet specific income requirements (as do all who qualify). The IRS has provided a handy tool that should help you to see if the Earned Income Credit is available to you.

In order to claim the EIC, a Schedule EIC must also be filed with your regular, yearly tax forms.

What do you think about the EIC?

Case for the Earned Income Credit

Proponents of the Earned Income Credit have quite a few reasons why they believe that this tax credit is a good idea.

- Some believe that the EIC is a good tool for the redistribution of wealth. By putting more money into the hands of low to moderate income workers, they are increasing their quality of life.

- The EIC can be an incentive to work. Though many minimum wage jobs don't offer any more financial reward than some welfare programs, the EIC tips the balance in favor of working.

- The Earned Income Credit can be good for the local economies. Some studies show that spending increases more during tax refund time than during the Christmas shopping season and this is good for local retailers.

- The EIC enables some families to get out of debt by paying off past due bills and even setting money aside for emergencies that they would not have access to without the rebate.

Without a doubt, these checks that can reach into the thousands for low-income families with multiple children, the money is needed and appreciated.

Case Against the Earned Income Credit

There are a lot of US taxpayers who don't believe that they should be paying for low-income families to get these huge tax refunds. After all, it isn't their fault that these people are not able to find well paying work. No one is suggesting that anyone chooses to live in poverty, especially if there are children involved, but how responsible should we be for our fellow man?

There is also the argument that the EIC success rate is somewhat misleading. Though the bonus paid out to some low-income families does raise their yearly income above the poverty line, it does not raise the family itself out of poverty. It is only alleviating their poverty for a few months at most, until the money runs out.

There are a few other beefs that folks have with the EIC:

- These huge checks may not encourage people to climb out of poverty. Some feel that those who take advantage of the EIC may not find better paying jobs or make sound financial decisions that may decrease the amount they expect to receive from their tax refunds.

- Some feel that the EIC is just another handout, much like public assistance (ie: food stamps). Some have even argued that people who are receiving any kind of public assistance should not qualify for the EIC, as they are already receiving aid, or the amount they receive in assistance should be counted as income which would reduce the EIC amount available to them.

- Some other folks contend that the EIC is not well spent in many cases. A large tax credit for folks with children should be spent enriching their lives, but many buy expensive electronics like televisions, computers and video game consoles. I may say that they have every right to buy what they want, but think about it. Your tax dollars are paying for someone else's entertainment.

- The EIC could encourage people to not pay their bills for a month or more before tax refunds are due. In this case, their entire checks may go to paying back bills. Again, this is a matter of choice, but some believe that these kinds of checks breed irresponsibility.

- The most frequent argument I've heard is that people should not expect to be entitled to anything they do not work to earn, which rings especially true with relation to folks who do not pay in anything for income tax. They are receiving huge checks yet they are contributing nothing to the financial well-being of the nation.

One of the biggest problems with the EIC is that some people fraudulently claim it. Even in this day and age, these things still slip by the fact-checkers at the IRS and, it is estimated that these fraudulent claims cost the US government and taxpayers up to $10 billion dollars per year. Yes, that's billion with a "B." There is a penalty if folks get caught claiming the EIC - anyone who has claimed it "fraudulently or recklessly" will not be able to claim the EIC again for ten years. This, of course, does not stop people from trying.

In all fairness, this does happen by accident on occasion, especially considering how convoluted the tax laws and deductions are. Unfortunately, the IRS has no way of knowing if someone has fraudulently claimed the EIC on purpose or by accident.

Detailed Video Detailing the Earned Income Credit (EIC)

© 2013 Georgie Lowery