Liens and Judgements - How Can You Stop Them?

What is a Lien?

A lien is a legal claim on an asset that allows the lien holder to take possession of the asset if certain conditions aren’t met. Property, cars, boats are all common examples of property that have liens.

A more common term might is "Collateral." You keep using the property until it's paid off, then you own it and the lien is released.

In the context we are speaking of here, If your don't pay the debt the lien holder can sell the property to satisfy payment for your debt. In the case of real estate this is called Foreclosure. In the case of cars or other collateral this is called Repossession.

Common Types of Liens

Besides the common liens mentioned above, lets look at a few others that commonly occur:

Tax Liens - failing to pay property taxes will eventually lead to a tax lien. This can happen for failure to pay state, federal or property taxes. Tax liens are reported to the major credit bureaus: Equifax, Experian, and TransUnion. They will go against your credit report and negatively impact your credit rating. If you have a Federal tax lien, the IRS can place a claim on all your assets until the debt has been repaid.

Mechanic’s liens - this lien is placed on your home by a contractor, subcontractor, or supplier that hasn’t been paid. As like most liens if the debt goes unpaid your home could be foreclosed. Most state’s require the contractor or supplier to provide advance notice if they plan to proceed with this type of action.

Judgment lien - a lawsuit which resulted in a ruling against you is called a judgment lien.Before a judgment lien is placed on your property, the creditor typically has tried (unsuccessfully) to get you to pay your debt. A judgment lien will be reported on your credit report.

Now we need to clarify just exactly what a judgment is.

What is a Judgment?

A judgment is a decision by a court that describes the rights and obligations of both parties in a lawsuit. You might also know a judgment as a "decree or court order," they all mean the same thing - you've got troubles.

You can have judgments from small claim court all the way up to multi-million dollar claims.

Judgments are generally legal disputes that don't involve property or collateral. If you don't take care of the judgment handed down by the court, this could turn into a lien or or wage garnishment.

SOL

You might think this means S____ out of luck, but it really means Statute of limitations.

This gets a bit complicated because each state has a different statue for different types of situations. For instance, credit card debt has a different SOL compared to oral agreements.

Filing a judgment can have a much longer time frame if the person does a renewal.

The best thing to do is check with the state where the debt or judgment is being processed. Chances are, if your situation is at this stage, a lawyer who specializes in this field will be of great help.

Is there a solution to this problem? Lets find out.

- Debt Hub

Look at options before bankruptcy. Debt relief can be just what you're looking for.

Lien and Judgment - Options

Heading off liens and judgments is you best option. The obvious solution is an agreement that satisfies both parties. If this is not possible, then consider bankruptcy.

Will bankruptcy eliminate the debt?

The question is, is the judgment or lien secured or protected from discharge in bankruptcy?

For example crimes, torts, and fraud cannot be wiped away in bankruptcy courts. Many liens brought by federal and state agencies are difficult to wipe out in bankruptcy. Child alimony payments are exempt from bankruptcy, but most common legal actions that take place by collectors will be subject to an Automatic Stay.

An automatic stay ceases all actions taken by collectors. This is why you have to preempt any activity you think will result in a judgment against you. This doesn't mean you cannot stop it after it has been ordered, but it's easier and less costly if you do it upfront.

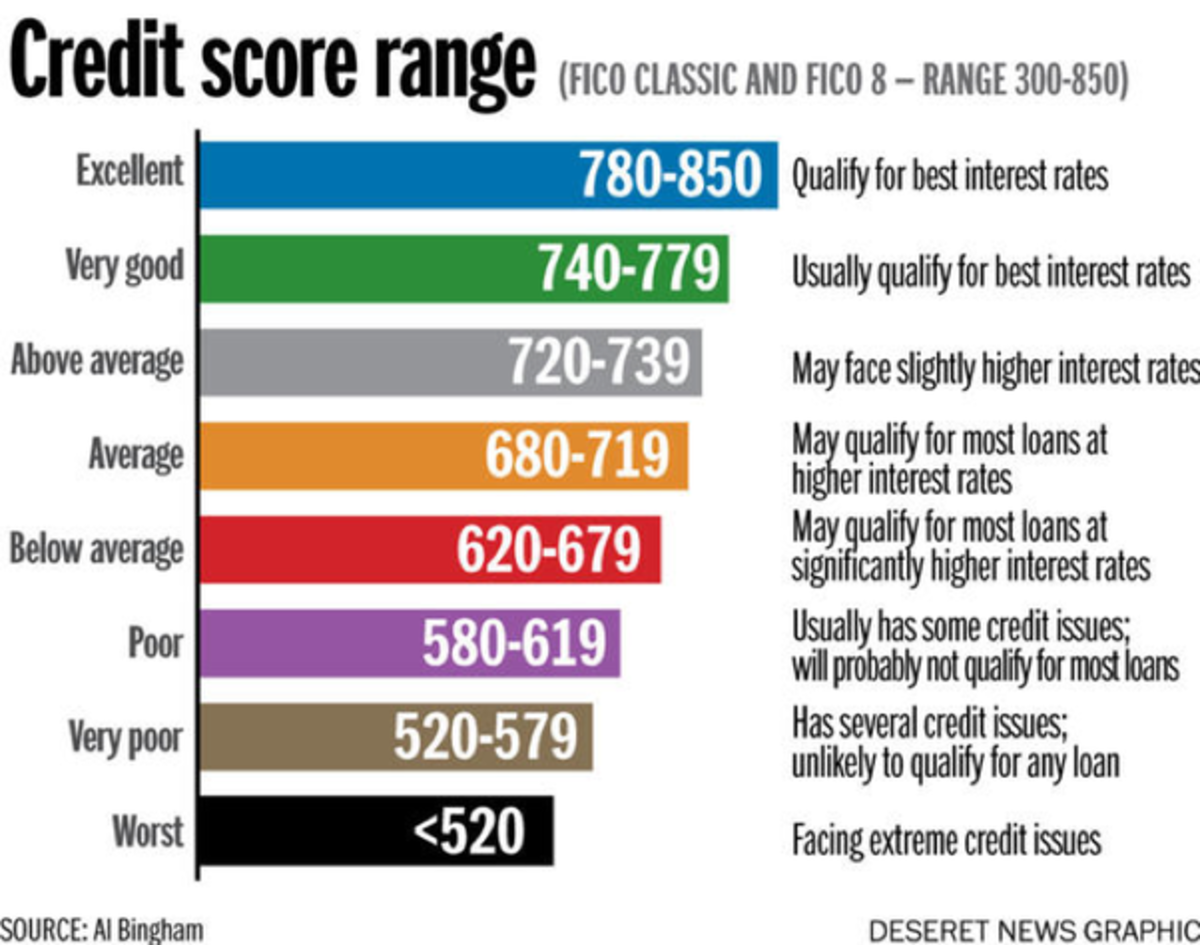

Credit Scores

Liens, judgments and bankruptcy adversely affect your credit score. Compared to what can happen if you take no action, your credit score is not the priority at this point.

Aggressive Creditors

There is a practice called “process supplementary”.

After getting a judgment in their favor, determined creditors can utilize a supplementary process to the lawsuit to find out what and where any assets may be. The court will look into any major transfers of property, especially to family members. Such transfers almost certainly will be deemed fraudulent, and that property might be confiscated by the sheriff. Even worse, a lien might be placed on your home in the event of fraud. If recorded as a lien, a judgment may be enforceable for up to twenty years in many states.

Conclusion

Most people don't try to be sneaky or commit fraud, they just got into financial trouble.

Knowing what could happen doesn't mean it will, but creditors have the legal right to use all means to collect a debt.

It can be costly and many times there is really nothing to recover. This is why you do not see many creditors going after the average person, it's not cost effective.

In most cases the borrowers biggest asset is their job. In these cases a creditor would try for a wage garnishment.

Bankruptcy is one option to legally stop garnishments, liens, or judgements. Bankruptcy is usually the last option for relief if the case cannot be settled outside of the court.