How To Maximize Your Money – Horror Stories and Hail Marys

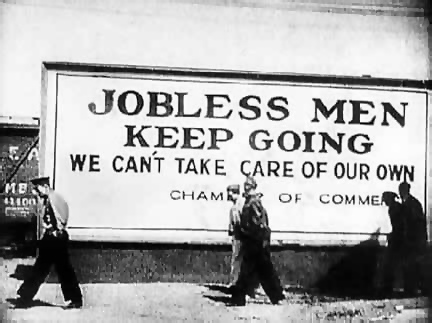

The Great Depression, 1929

Healthy Money Management

This presentation will address two items:

1) Having no money and

2) Saving money in ineffective ways.

Before you can maximize your buying power and investment return, you must obtain an amount of money. Unfortunately, although some people work, they never see a penny of their wages. While some of us complain that we are unable to purchase the largest wall mounted flat screen TV at our local electronics store, these victims are unable to purchase food. In a recession, any of us might fall into the latter category.

Incredible? It is.

The following examples are from real life and illustrate scenarios that you might never have thought possible.

Working Teens

Many teenagers work for spending money, to pay for car insurance, or to save for college. However, some teens are forced to work by parents, who confiscate their full paychecks and use the money for their own purposes. Until the youth is age 18 in my state, this is a legal action for guardians to take. I can provide three recent examples of this.

The first involves a 16-year-old female high school junior that was put to work over 20 hours per week by her upper middle class parents. Her paychecks made the family car payment and she was permitted to have none of the money. Her parents picked up her checks from the department store that employed her, but she was permitted to take her driver's license test with the auto and drive it to school on special occasions, such as her band concerts. She had planned to do a mission trip to Spain after high school and thought her parents were saving money from her checks to send her. Shocked that she had no money after high school except for that year's income tax refund, she attended an inexpensive and local 2-year Bible college, working her way through. Then she married a rich young man, wedded in Hawaii, and moved away from home. Similarly, her younger sister married just out of high school. Her younger brother became an alcoholic and wandered from bar job to bar job. None of these youth learned to manage money, because they were not given the opportunity to do so.

The second example is another female high school junior, whose parents both worked and also received some $30 a day each for 5 foster children (approximately an additional $4500/month). The young woman was forced to care for the elementary school aged foster children in the mornings, after school and on weekends without payment or an allowance. She dropped out of school in her senior year, left home and moved in with a friend, and was hired full-time in a delicatessen, where she worked and saved all the money that she could. She earned a GED certificate and went away to college. Her one blood sibling, a brother, became a bully and an abuser before he was 10 years old.

Slave Labor

The third example is one that is present in a small percentage of yearly after-school programs and summer work schemes for at-risk youth. it is not the norm, but it exists and harms youth, families, and our nation's overall economy.

The youth affected are devastated by the result and are often unable to hold a job later. Stipends and wages are paid to these disadvantaged youth for attending high quality work-and-learn programs, work readiness training, real job skills training, and paid internships, able to receive high school credits, and cash bonuses for good attendance and grades, winning writing contests, etc. Some programs award a full laptop or desktop computer system and other excellent and useful prizes.

However, a few gaurdians show up at school on payday each month and take the stipend/wages checks for themselves. Since the wages in certain programs are also termed stipends, these are not taxable. Though the money is meant to purchase food, clothing, supplies, and other needs of the youth and family, the money is spent by these few gaurdians for pleasure. Some programs have circumvented this problem by placing some of these funds in a dividends- or interest-earning trust payable only to the youth at age 18.

One situation I witnessed was that of a woman in a high paying job, with the addition of $30 daily for fostering three teen boys in addition to raising her own teen daughter. Mom drove a new orange Corvette to the programming office monthly and collected the checks. The kids benefited from a free school breakfast and lunch program, but rarely had dinner. One of the boys was expelled and placed in the local detention center. The other three youth were not able to work, because they could not learn interview skills. The daughter was irregularly groomed and during interview instruction, either burst into hysterics or repeated only one phrase: “I want to be on “ telebizion.”

The Financial Literacy training provided to this family by a local bank had no opportunity to be applied in their lives at that time.

In the Adult World

Adults need to have benefited from financial literacy training through their parents, in high school, on the job, or in a community program. However, they can still obtain that education – free of charge. Hospitals, banks, community centers, and schools offer free classes in Financial Literacy in many towns and cities in America (see the next Hub in this series, link at the bottom of this page). In addition, an officer of one's local bank will gladly spend time with customers for this purpose in an ongoing relationship Thus, adults can seek training or visit their local bank for help.

However, not all adults have control of their own money. Some spouses or partners in controlling relationships know nothing about the family financial situation and have no access to money or credit cards. This is sometimes true of senior citizens at advanced ages as well, living with family members or even in nursing homes and retirement centers. Just a couple of examples include:

Out of Town Accounts

Be careful of placing your name on another person's – friend, partner, spouse - bank accounts, even if you do not intend to deposit or withdraw funds from them. Be especially reticent in doing so if that person threatens you about it and especially careful of out of town banking accounts. If the other person is able to overdraw the account, followed by leaving town, you will be asked for the money. Further, on the back of any check issued to you can be written “For Deposit Only to Account # ________” and your money can go into that account with your name on it without your knowledge. Be informed and careful about sharing banking and financial accounts with others.

Hiding Money at Home

During a recession, people often hide money around their houses and properties, having lost trust in the banking and investment systems. Individuals that had grandparents who survived The Great Depression may also hide money in any economic era. Some controlling partners/spouses simply hide everything from their families.

It is reasonable to keep some emergency cash at home, but well concealed and in not such a manner as to be forgotten when you need it. Hiding money should also not be used to control another person.

There are a number of scams and other controlling tactics that can be applied to individuals that know little about money and finances. Financial Literacy training in primary and secondary schools can be a first step toward thwarting these things later in life.

Post-War Paranoia

Avoiding Financial Abuse

O Henry Would be Horrified

Here is a case history in a 20th century setting that is a good example of the combination of money, fear, and madness.

An elderly man believed that he had saved money for the greater good.

In order to survive even before the Great Depression, he worked in the family business before school and in a factory after school and weekends. He was able to save enough to attend college and was hired by a good company even during the Depression.

The gentleman's first marriage ended after many years, without children, in divorce. His ex-wife was awarded the house that he had built, along with another that they had owned.

Starting over, the aging fellow later purchased a 600-square-foot frame house (smaller than a one-bedroom apartment today) and hid his finances from his second wife, who had no understanding of mathematics and finance, and little of reading.

For over 35 years, since the divorce from his first wife, the gentleman purchased and sold properties, made profits, invested in lucrative retirement plans, made other good investments, and saved 50% of every paycheck that he earned. He spent little on clothing or food and cut out all entertainment early on. Saving became an obsession.

He did not invest in health insurance for himself, his second wife, or his children; and he never saw a doctor or dentist himself. The family was punished for becoming ill and doubly so for seeing a doctor. He kept four moderately priced automobiles plus two bicycles in order to assure himself of transportation, but would not allow his family use them.

This all resulted in unnecessary expenses in the long-term (health care, transportation, etc.) and to make up for it, he took fictional deductions on income tax returns (and was audited). After many years of what he thought was good saving, he died with over $800,000 in an era when minimum wage was only about $3.00. He had not made anly plans for his burial or for healthcare or income for his widow -- His children had disappeared long ago. The amount of his estate would have been more than enough for his widow, if invested wisely. It was not.

Over half of his money lay in hiding places in his house, unbeknownst to his wife. His wealthy sister came in and took it.

The gentleman's widow, hainvgmoney for the first time in her life, gambled and lost the rest of the estate within two years, was too young to collect widow's benefits, and ended in a legal guardianship and institutionalized in a state facility, because of uncontrollable severe mental disorders (SMDs).

Saving to the detriment of one's own health and the family's wellbeing is not effective money management. Obsessive hording, especially without a plan, is also unwise.

In the case of a sole breadwinner, such oversaving also damages the members of one's family psychologically as well as physically. Overcontrol of money is only one face of abuse that often occurs as an adjunct to verbal and physical abuse, often sexual abuse.

We see in the example above that after nearly 4 decades of inordinate saving, close to a million dollars was wasted in short order. Several people were left severely ill, some missing and likely destitute, an dall of this could have been avoided.

Reasonable Cutbacks and Money Maximization

Read about these tips and suggestions that you may not have considered at: