e-Commerce vs. Brick-and-Mortar: Credit Card Payments Explained

Whatever Your Business Type, You'll Want to Get Paid

Perhaps you've owned a brick-and-mortar retail business for years, and you're considering taking your business online to attract customers around the world. Or, if you're the type who does things backwards (like I did), maybe you started by building a successful e-commerce business, and now you want to make your products available on Main Street in your hometown. Either way, you're going to need to accept credit cards. I'll use this hub to explain the differences and similarities between processing credit cards face-to-face versus online.

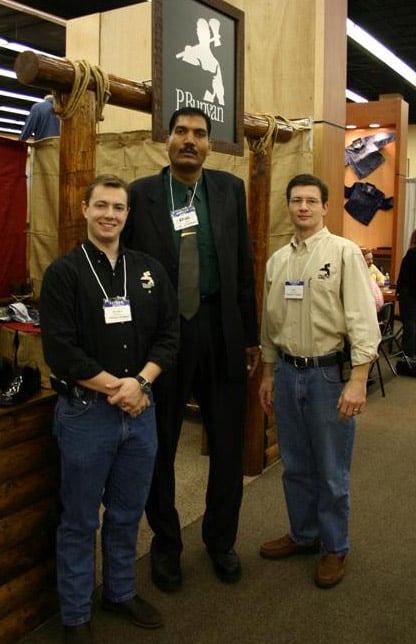

Who I Am and What I've Done

For this hub, I'll focus on the equipment and/or software you'll need. I'll also mention the different rates and fees you're likely to pay for each scenario. I won't get into how the credit card processing industry works. That subject is too broad, and will be covered later in another hub. So that you'll know I'm credible, let me tell you about myself. From 1999 to early-2007, I was a founding partner in 2BigFeet.com, an Internet-based shoe store for men with extremely large feet (up to size 24.) In 2001, we branched out and opened a retail location in Albany, GA. Over the years, we sold tens of thousands of pairs of shoes to customers around the world. In late 2006, I started my current business, Creek Financial Services, representing credit card processors. There are manythings I know nothing about. But I do understand e-commerce, retail, and credit card processing.

Retail Customers Are Face-to-Face, With Cards In-Hand.

Since retail credit card transactions are far simpler than e-commerce, let's look at those first. What separates retail transactions from other methods is that customers are normally present, face-to-face, with credit cards in hand. Without going into detail about rates, you should know that retail transactions cost less than transactions where the card is not physically present. The presence of the card gives you the opportunity to check your customer's ID, reducing the risk of a chargeback (or a denial of responsibility by the cardholder.) It is difficult for a customer to deny that he made a purchase when his card's magnetic stripe was read and recorded by your credit card terminal.

Retail Step #1: Get Merchant Account

Very little is required to accept credit cards in a retail store. Assuming you already have an established checking account at a bank, you just need to apply for a merchant account. Merchant accounts are only used for credit card transactions, and your money typically stays there for only 24 hours. Although merchant accounts are available at most local banks, you will almost always save money by dealing directly with a reputable credit card processor. Few banks can process credit cards in-house. Instead, most banks contract a third-party to do the work and then tack on an additional profit margin. If you decide to work directly with a credit card processor, that company will open a merchant account under your business name at an "acquiring bank" represented by the processor.

Retail Step #2: Get a Terminal and Start Swiping!

With the merchant account opened, you will need to purchase a credit card terminal and have it programmed by your credit card processor. Then, you'll simply connect the terminal to a phone line or Internet connection, and you're all set. As you ring up sales, you'll swipe the credit cards through the magnetic card reader which records the cardholder's name, address, and account number. The terminal transmits that data and the amount of the sales to the processor and then to the card issuing banks for approval. If a card is good, the card issuing bank responds with an authorization number. At the end of the day when you're ready to deposit your sales, you will "settle the batch." At that time, your processor will submit the batch of authorizations to the acquiring bank. The acquiring bank immediately credits the total amount of the deposit into your merchant account, and then begins the process of recouping the money from the card issuing banks.

It may sound complicated, but authorizations occur in the blink of an eye. Usually by the second business day, your deposit will have been moved from the merchant account into your local bank account by ACH transfer.

e-Commerce Transactions Get More Complicated

E-commerce transactions are more complicated because the card is never physically present for your inspection. There are also security issues which must be addressed. To accept credit cards online, you will need a website, a shopping cart, a secure payment gateway, an SSL certificate, and a merchant account. I will acknowledge that it's possible to sell online without some of these features, although I do not recommend it. PayPal is one option that allows businesses (usually very small eBay-type businesses) to accept credit cards without any of the normal infrastructure.

Serious e-Commerce Businesses Shouldn't Rely on PayPal

There are many PayPal devotees out there, so I'll briefly explain why I think legitimate e-commerce businesses should steer clear.

- PayPal is more expensive, both in discount rates and fees. If your sales are large, this will be important to you.

- PayPal gives you no flexibility. Your customer pays PayPal, PayPal pays you, and they're done. If the customer calls you to add another item or upgrade to rush shipping, you're powerless. They must return to PayPal and initiate another payment, meaning another fee...

- PayPal pays itself before it pays you. If you sell an item for $50 today, PayPal will deposit about $48 into your checking account in a few days. This makes it nearly impossible to balance your checkbook.

- Relying on PayPal gives you the appearance of an amateur. When a customer finally trusts you enough to provide his credit card number, why re-direct him to someone else's website to enter sensitive information?

Having said this, let me say there are a few, very limited times when PayPal is a good choice for e-commerce. I outlined those special occasions in this article I posted at Bank of America's forum.

If you want to display the image of a serious Internet business, you should invest in your own SSL certificate and route your customers' personal data through your own secure gateway. Others may disagree, but I'll stand by my opinion.

e-Commerce Requires a Website and Shopping Cart? -- Duh.

To accept payments over the Internet, you'll need a website and a shopping cart for starters. This may be obvious, but I don't want to omit anything. The shopping cart, as the name implies, is used by your customers to accumulate their orders and enter their payment information. A good cart can be priced anywhere from free up to thousands of dollars. I suggest you talk to your web developer, and select a cart that he has experience with.

e-Commerce Gateways Keep Out the Riff-Raff

Next, you'll need a payment gateway to securely transmit your customer's payment information from your cart to your credit card processor. Because this data travels across the wide open Internet (think Wild West) instead of a phone line, it must be secured. The industry standard is an encryption process called secure socket layering, or SSL for short. There are several major gateway suppliers and many lesser-known ones. Authorize.net is probably the best known payment gateway, and it works with all popular shopping carts. Be sure to check that the gateway you choose is compatible with both the shopping cart and your credit card processor. After you've entered your gateway and merchant account information into your shopping cart, the gateway will function behind the scenes without your involvement. A benefit of using a large gateway like Authorize.net is that you will have online access to their "virtual terminal." Most e-commerce businesses occasionally have walk-in customers or phone-in orders. The virtual terminal allows you to accept credit card payments for those orders without having a traditional terminal on your countertop.

Don't Forget the SSL Certificate!

The next item you'll need for e-commerce is a valid SSL certificate, issued in your business's name. This is often overlooked because many web hosts will allow clients to piggyback on the host's certificate. Don't accept this option if it's offered. SSL certificates are available for as little as $100, and the peace of mind they give your customers is priceless. The certificate indicates that your site's security has been validated by a third party. Security is evidenced by the letters "https" in the address line and by the small lock displayed in the lower right corner of most browsers. Any page on your site that collects or displays sensitive information must be protected by SSL. Internet shoppers are computer-savvy, and they will check the SSL certificate and the URL address displayed during checkout. If they see a name other than your business's name, they will have reason to be concerned.

In e-Commerce, Don't Settle for Just Any Old Merchant Account!

Lastly, you'll need a merchant account, just like the retail store owner. The primary difference is that your account is based on a MO/TO (mail order, telephone order, Internet) rate structure, which means credit card transactions will cost you a little more. Your merchant account will function just like a retail merchant account. However, 100% of your customers will be paying by credit card, so it's critical that you get a merchant account with the best rates available for your e-commerce business. Using a local bank just because it is convenient or because you feel loyal to them can cost you thousands of dollars annually. On top of that, local banks lack e-commerce expertise, meaning that any free advice they offer will probably be worthless.

We've Only Covered the Basics Here

You should now understand the basic fundamentals of what is required to accept credit cards. I didn't attempt to explain minimizing risks or avoiding rate surcharges. I also skipped information on the steps you should take to avoid fraudulent orders and how to drive traffic to your e-commerce business. If you are ready to start accepting credit cards for the first time, particularly on the Internet, you should find someone with experience who can help make sure you do it right. Your business is too important to make mistakes.

If Your Current Processor Can't Help You, I Can!

Your credit card processor or agent will usually be (or should be) your best source of information, because his income is directly related to your success. In short, by helping you increase your sales, he helps himself. If your current processor is missing the mark on service or expertise, I'd appreciate the opportunity to replace him. You can find my contact information on the Creek Financial website. I enjoy hearing from business owners, and I'd certainly be happy to help you!