options, futures and hedging-meaning, features, similarities and differences

Businesses by nature are risky. A business makes thousands of decision in the face of challenges and uncertainties. These uncertainties are what constitute risk. Risk is of two types – business risk and financial risk.

A business risk is a risk that a business might be operating below optimal level i.e. not meeting its objectives as a result of a; drop in sales, increase in the cost of inputs etc. financial risk on the other hand involves risk that is associated with; interest rates, exchange rates, stock prices, commodity prices, inflation etc.

OPTIONS, FUTURES, AND HEDGING

Businesses have learnt to accept and live with business risk as it is almost always inherent in business, after all, what is capitalism if not accepting risks for the rewards that follow? Financial risk is what every organization strives to reduce to an acceptable level bearing other factors like appetite of the organization in question in mind. Companies cannot afford to let financial risk go unchecked. The volatility of interest rate for instance can paralyze the whole activity of a company if nothing is done to cushion its effect. Financial risks are managed with financial instruments called derivatives. Derivatives allows companies and individuals to transfer any undesired risk to third parties who are either ready to assume the risk or have a system that can offset the risk in place. This is done for a price. Options and features are examples of derivatives while hedging is an action taken by an investor or a company to protect itself against unacceptable outcome using derivatives. It is worthy to state here that options and futures are not the only types of derivatives out there but, this hub is specifically written to answer a question put forward by a hubber a while back.

- TECHNICAL ANALYSIS

A place where commodity analysis are discussed. - Financial Engineers

Before I go further, I will like to explain what risk is and point out the difference between risk and uncertainty. Risk from the financial perspective is a measure of volatility or uncertainty of a transaction or set of transactions (portfolio). Uncertainty and risk are similar but, are differentiated with the availability of data. While risk describes a situation where we have several outcomes to choose from with the aid of past data, uncertainty describes a situation where we are faced with several outcomes but with no past data to base our decision on.

OPTIONS (MEANING AND FEATURE)

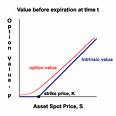

Option is a kind of contract that grants an individual or a company the right to buy or sell an asset, currency or futures at a fixed price for a specific time period. It is a contract between two parties. The buying party pays the seller a sum of money called the price or premium. The selling party is ready to sell or buy according to the terms of the contract entered into with the buyer if he/she so wishes. An option to buy anything is known as a CALL while an option to sell a thing is called a PUT. Options trade in an organized market but, large percentage of it is traded over the counter (i.e. privately). Note that this is just an option. That means it is a right and not an obligation.

FUTURES (MEANING AND FEATURES)

A future is an agreement calling for future delivery of a standard amount of commodity at a fixed time, place and price and is tradable. It is a contract that involves two parties – the buying party and the selling party- to buy or sell something at a future date at a price agreed upon today. You can trade the contract at anytime you want as it trades on a daily basis on a future exchange (futures market). Futures contract as it is also called evolved out of forward contracts and has many of the characteristics of a forward contract.

HEDGING (MEANING AND FEATURES)

Hedging is the process of purchasing any derivative (swap, futures, options etc) with the sole aim of protecting your stand (position) in a business or transaction. An investor (individual or business) actively seek ways to protect a position or anticipated position in the spot market by using an opposite direction in derivatives. It is more or less a calculated gamble.

SIMILARITIES

- Both option and futures are kinds of contract.

- And this implies that they both involve two parties.

- They both have buyers and sellers.

- They are both traded on the exchange.

- They are both derivatives that help manage financial risk

DIFFERENCES

One major difference is that while an option is a right, a future is an obligation. Apart from this, there is no water tight difference between the two.

Note that I made no comparison of hedge as it is not a derivative but an application of derivatives. I hope this hub answers your questions? But if by chance anything is left unattended to, feel free to ask in the form of comment. Thanks for reading thus far!