What's the Real Cost of Fossil Fuels?

1. Market Costs of Fossil Fuels

At this writing, crude oil is selling in the U.S. for about $120 a barrel and natural gas for about $9 per million BTU, according to Bloomberg, and low sulfur coal from the Powder River Basin in Wyoming, the largest coal deposit in the U.S., has been selling for $12.50 a ton.

These are market prices - what it costs to buy a barrel of oil or a million British Thermal Units of energy in the form of natural gas or a ton of coal.

Market prices can be affected by governmental taxes. European governments have long imposed comparatively high taxes on gasoline to reduce demand, and these taxes may be assumed to have lessened the world demand for oil and thereby reduced market prices.

Market prices can also be affected by governmental subsidies. In many countries the price that consumers pay for gasoline is less than the market price, and the subsidies are assumed to stimulate the demand for gasoline in these countries and thus keep world oil prices higher than what they would be in the absence of the subsidies and artificially stimulated demand.

Oil prices may also be affected by the granting -- or removal -- of billions of dollars of government subsidies to U.S. oil companies.

But subject to the distortions caused by governmental taxes and subsidies, the trading prices of fossil fuels on an active open market are generally considered to represent the real costs of those commodities.

Fossil fuels, however, are dirty fuels. Burning them to generate electricity or drive the engines in cars, trucks, tractors and planes pollutes the air we breathe and the water we drink with carbon and other chemicals, creating health problems. Burning also changes the climate of our planet by emitting carbon dioxide and other greenhouse gases that warm it.

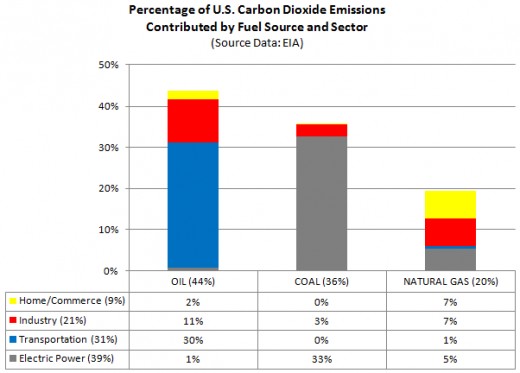

Coal is the dirtiest fuel, as shown in the graph to the right, but in the U.S. we use more oil. As a result, oil accounts for 44% of U.S. emissions of carbon dioxide, the chief culprit in climate change, and coal 36%. Natural gas, the cleanest and also least used fossil fuel, accounts for the remaining 20%.

Fossil fuel pollution entails real costs. Health care costs can be very significant, but they may ultimately be dwarfed by the costs of climate change.

None of these costs are reflected in the market prices of fossil fuels.

2. Externality Costs of Fossil Fuels

Anthony Owen of The University of New South Wales in Australia believes that externalities - the social costs of a transaction like pollution that are not reflected in the price - are "a form of market failure."

A market, of course, is nothing more than a trading environment defined by those who establish or regulate it and make its rules. You really can't blame it for anything.

You can't even blame the buyers and sellers, who are focused on their immediate transactions. Pollution is not their concern.

Pollution is society's concern. And society has a device to internalize an externality - force the parties to a transaction to include the social cost in the transaction price.

The device is called a Pigouvian tax after Arthur Cecil Pigou, Professor of Political Economy at Cambridge University in the early part of the 20th century. His predecessor, Alfred Marshall, developed the concept of externalities, and Pigou then developed the concept of a tax that would internalize them. Pigou's particular target was the perennial London fog that today would be called smog. His tax was to be imposed on those who caused the smog, presumably by burning coal, to compensate the public for the damage it caused.

In 2003, while working for the International Energy Agency, Professor Owen analyzed the data on pollution externalities in European Union electrical power generation and published his conclusions in The Energy Journal of the International Association for Energy Economics the next year, when he was the association's president. A table drawn from Owen's analysis is shown below.

Of the 7 technologies listed in the table for generating electricity, coal is second only to natural gas as the cheapest technology in market price. But when externalities are factored into the price, coal drops to a tie for last and wind power becomes cheaper than natural gas.

Owens concludes that "the removal of subsidies to fossil fuel based technologies and the appropriate pricing of these fuels to reflect the environmental damage ... created by their combustion are essential policy strategies for stimulating the development of renewable energy technologies."

In other words, externalities matter. But only if they are internalized - made part of transaction prices. And internalization requires government action. If the price of carbon fuels included the costs of the pollution they emit, we would buy less carbon fuel and more carbon-free fuel and we would produce less pollution.

3. What Should Externality Costs of Fossil Fuels Measure?

When economists estimate the cost of an externality, they typically measure the social damage caused by the externality rather than what it would take to prevent the damage. Pigou's tax was based on the harm caused by London smog, not the cost of replacing coal with some other fuel that didn't cause smog.

Measuring present damage, like the health costs people incur when they've been subjected to smog, is hard enough. But measuring future damage, like that from increasingly volatile weather conditions as the surface of the planet warms, is very much harder.

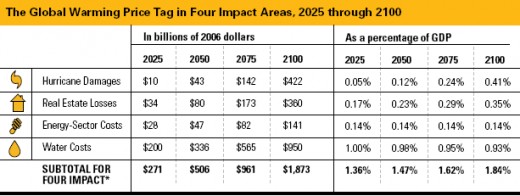

Take the May 2008 report by Frank Ackerman and Elizabeth Stanton of the Global Development and Environment Institute at Tufts University on the incremental costs to the U.S. of climate change if no action is taken to control greenhouse gases. The report analyzes four impact areas and estimates that, in these areas alone, the additional annual cost in 2006 dollars of unchecked global warming will reach $271 billion by 2025. By 2100 the cost will have increased to $1.87 trillion in 2006 dollars, representing 1.84% of the U.S. economy in 2100 as measured by gross domestic product.

The future damage in these four areas is shown by this table from the report:

But what will be the cost for the entire U.S. economy? At this point the authors describe in some detail the new and improved economic model they are using and how they are thinking of incorporating some revised assumptions for future runs of the model. Finally, in small print, on page 19, they say that according to their model, "total U.S. damages will amount to as much as 3.6% of GDP in 2100" - roughly $3.7 trillion in 2006 dollars - but that "a further revision ... would imply climate damages even greater than 3.6%."

3.6% of GDP in 2100 is roughly double the 1.84% for the four impact areas. So, basically, we can just double the subtotals for the four impact areas in the table:

I'm no expert on economic models, but this report (which follows an earlier one on the U.K.) seems very solid. Yet the authors didn't study all impact areas (how could they?), only four, and then concluded, without much explanation, that the damage in the areas not studied (how many?) would be about the same as the damage in the studied areas.

I'm impressed with their effort and studies and the work done on their model but not persuaded by their conclusion. But, really, how could anyone, no matter how sophisticated their model, predict the nature and cost of what will occur decades into the future in an environment that may be, in the words of NASA's James Hansen, "a different planet than the one we know"?

Surely an easier task is to estimate the costs of preventing some or all of the damages of unchecked global warming by reducing the pollution that causes it. When the damage is long term and decades away but the action needed to prevent the damage is present and near term, we should measure prevention instead of damage.

And then we should internalize the externality of climate change prevention so that the market prices of fossil fuels reflect the costs of preventing the damage that the burning of fossil fuels would otherwise have caused.

4. Internalizing Climate Change: The Real Costs of Fossil Fuels

The attainment of Al Gore's proposal for carbon-free generation of electricity in 10 years is said to cost between $1.5 to $3.0 trillion over 30 years - an average of $50 to $100 billion a year.

I think his proposal is just the sort of catalyst we need to face what will be a catastrophe to future generations if we don't do something soon - but there are other worthy plans that have been developed. What I want to do is use the Gore plan, or rather its $100 billion a year upper cost estimate (which I'm sure will go up as the details are worked out), as an example of how a prevention externality for climate change could be internalized into the market prices of fossil fuels.

According to EIA, the U.S. Energy Information Agency, fossil fuels represent 85% of the primary energy the U.S. consumes and 98% of the carbon dioxide it emits. The graph below breaks down the carbon dioxide emissions by fuel source and economic sector.

In 2005, the latest year for which this data is available, the U.S. spent $833 billion on the fossil fuels it consumed and an additional $200 billion on electricity, of which $142 billion was generated by fossil fuels. After including this $142 billion, the amount spent on fossil fuels in 2005 was $975 billion.

As shown in the table below, if the projected cost of prevention of the externality of global warming is, say, $100 billion a year, the U.S. Government could charge the $100 billion to the fossil fuel industry according to the potential carbon dioxide content of their emissions. Based on 2005 data, the $100 billion, assuming it had been passed on to fossil fuel buyers and consumers, would have increased overall energy prices by about 10%, with oil prices increasing by 7%, natural gas prices increasing by 8%, and coal prices (which means electricity prices) increasing by 26%.

Because fossil fuel prices have increased since 2005, the percentage increase might be less - or more if the cost of prevention goes up more than the fuel prices. In any event, the plan to incorporate the prevention costs into fuel prices doesn't mean that the ultimate consumer has to bear the burden. The Government could take what it charges the industry and give it to the consumers. It could also remove the subsidies it gives to the industry and give those to the consumers.

But market prices reflecting prevention costs would make alternative non-carbon sources of energy more attractive to consumers and fossil fuels less attractive. Since any plan to prevent the more serious consequences of the climate crisis has to shift energy consumption to non-carbon sources, it's important to get the market working towards that shift.

Fossil fuels have other social costs beside climate change. Their emissions cause smog and acid rain and other health hazards, and then there are the costs of protecting the supply of oil imported from abroad, sustaining the Strategic Petroleum Reserve and cleaning up the oil spills.

But the critical cost is that of preventing the climate crisis from getting any worse. Adding that cost to the market prices of fossil fuels makes these prices more closely reflect the real cost of fossil fuels.

Comments

I will appreciate your comments.

Thanks from riversedge