The Struggle of Poverty

There are people who live in poverty all over the world and we have come to accept that, though, there are organizations set up to help combat the issues facing third-world countries. But there are also millions, over 40 million people to be exact, living in poverty right here in the United States. And we seem to be more complacent about the issues facing our own nation. Moreover, many people are disgusted by the issue for the wrong reasons, therefore neglecting to help when they can. Take a closer look at what is really going on before deciding that helping those who are struggling is not worth it.

Poverty Poll

Have you ever lived in poverty, according to the federal guidelines?

The 2013 Consumer Expenditure Survey Reports Average Household Income was $63,784 (considered middle class)

Category

| Average Budget Amount

| Percentage of Budget

|

|---|---|---|

Housing

| $10,080

| 16%

|

Transportation

| $9,004

| 14%

|

Taxes

| $7432

| 12%

|

Utilities

| $7068

| 11%

|

Food

| $6602

| 10%

|

Social Security/Pension/Personal Investments

| $5528

| 9%

|

Debt or Savings

| $5252

| 8%

|

Health Care

| $3631

| 6%

|

Entertainment

| $2564

| 4%

|

Cash Contributions

| $1834

| 3%

|

Apparel and Services

| $1604

| 3%

|

Education

| $1138

| 2%

|

Vices

| $775

| 1%

|

Miscellaneous

| $664

| 1%

|

Personal Care

| $608

| 1%

|

$63784

| 100%

|

Poverty Facts and Statistics

- In 2014, 47 million people lived in poverty in the U.S. That's roughly 15% of all Americans.

- In 2014, the poverty threshold for a family of five was $28,960. Any family of five with an annual income lower than that was considered to be living in poverty.

- Poverty is not just an urban problem. There is a 15% poverty rate in metropolitan areas and a 31% poverty rate in areas outside of the metropolitan ones.

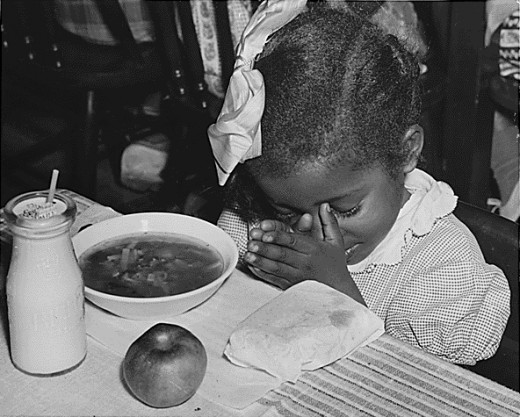

- In 2014, 21% of children lived in poverty. That's 1 in every 5 children.

- In 2014, The National Low Income Housing Coalition released findings that on average, a person working full time needs to earn almost $19 an hour just to afford a two-bedroom apartment without spending more than 30% of his or her total income on rent. Keep in mind that 30% is the amount considered acceptable and anything over that is considered to be financially irresponsible.

Poverty is not equal across demographics:

In 2014, 13% of men lived in poverty

16% of women lived n poverty

6% of married couples lived in poverty

16% of single parent homes with no wife lived in poverty

31% of single parent homes with no husband lived in poverty

29% of disabled individuals lived in poverty

More Things to Consider About Government Assistance

- Even the amount of money a family has on hand or in the bank is considered when deciding if they are eligible to receive government assistance. If there is a savings account, say of a few thousand, it must be spent before assistance is offered. This vastly hinders the family's ability to get their financial situation straightened out.

- Most adults are ineligible for Medicaid health coverage because they make too much money within a month's time. In Texas, that amount is $250 per household. See the doctor with that money or pay a bill? Food maybe?

- In order for a family to receive assistance with childcare expenses, a parent must first have a job. Most jobs expect a person to start right away. A person needing childcare cannot start until childcare has been secured. See the problem? If there is not a friend or family member available to assist with filling in the gap, simply finding work can be problematic, especially since daycares cost almost as much as a person on minimum wage earns.

- You must be receiving food stamps in order to get help on a regular basis from most food banks. People are not selling food stamps just to rely instead on donations from food banks. They utilize what they have until it runs out and then must turn to the banks.

A Breakdown of Expenses in Poverty

We can assume that someone living in poverty is not able to make much more than minimum wage. The federal minimum wage amount is $7.25. And most minimum wage jobs will not keep full-time employees (40 hrs a week), which means that if a person earning minimum wage only averages 30 hours per week, the average monthly income is about $870. If two people in the household are working similar jobs, the average monthly income is more like $1740.`

Now, remember the chart above showcasing a sample middle-class budget? It is so very easy to wonder what people do with their money when they cannot afford to keep their most basic bills paid. But before you judge, consider this: Housing typically costs $500 to $800 or more, depending on the area in which a person in poverty lives and how many bedrooms it has. Also, this housing does not usually come with more than the bare amenities. The homes are often in a poor state of repair, too. Yes, some qualify for government assistance offering substantial discounts on the housing; however, there are strict rules and guidelines besides low income that determine eligibility. Certain individuals, such as the elderly or the disabled might be given preference on the waiting list, which can be years. In the meantime, somehow a person or family must find a place to rent or live with someone else. Again, keep in mind certain factors like rent deposits and utility deposits, all of which require savings that are non-existent.

Let us assume, however, that a family has found housing. After paying $500 a month on rent, that leaves a whopping $1240 for other expenses. Low-income families usually qualify for food stamps. The amount received depends on things like family size and income. Assume this family receives about $600 a month for assistance with food. This means that at least $200 more must be spent on food in order to feed a family of four or five. That lowers the remaining budget to $1040. Do not forget about the utilities. Water, lights, gas, that may not be included in rent (and if it is, the rent is higher). We can estimate about $300 for utility services, depending on the time of year. Remaining income is down to $740. Great! That seems like a decent amount, right? There should be quite a bit of wiggle room in that budget. You cannot possibly imagine why it is so hard for someone living in poverty to get back on their feet once they fall, or heaven forbid, are born into it.

Well, here’s why. First, do not forget about federal, state, city taxes, if any, that have not been accounted for yet. They come out before the check is even issued, but nonetheless, taxes alone can lower a check as much as $100 or more, depending on how many government entities are charging them. If someone has their wages garnished for any reason (taxes, a past debt, child support, etc), that again lowers the gross income. Oh, and what happens if one or more persons working becomes ill? Remember, living payday to payday on minimum wage does not leave much room in the budget for missing work. Just missing one day of work lowers the budget by at least $36.25, assuming it was only a five hour work day. If it is a full eight hour day lost, the pay is lowered by $58.

Say the income brought home is now lowered to about $640 (without accounting for illness or wage garnishment). If any of those scenarios take place, the wiggle room is now down to about $540. Now consider whether or not this family has transportation. It too costs money even without payments. After all, a car that is lien-free still has to have gas to operate. That could be as much as $100 a month, perhaps more if there are no grocery stores within walking distance. Even public transportation costs money, assuming the area in which this family lives has that available. One cannot always rely on the kindness of others for transportation. People do not like to play taxi driver on a regular basis for someone else. So now this family is possibly down to $440 in pocket money.

Something else you failed to consider, all those other unexpected expenses. Someone needs to see the doctor. No insurance means the emergency room must be utilized, which means an even bigger bill to add to the growing pile of debt. Medication, however, cannot be shifted to the debt pile. It must be paid up front. We all know that is not cheap. Or perhaps the car breaks down and needs a couple hundred dollars in repair. Yes, of all things to break, it had to be some expensive part that cannot wait. Okay, now the remaining balance is $240.

Now let’s look at all the other possible expenses everyone else takes for granted. Did you fail to notice no personal hygiene items have been purchased? Neither have things like household cleaning supplies. If there is no washing machine in the home (remember, only bare amenities), clothes must be taken to the laundromat and there goes another $3 per load. A family of five might average at least three loads per week, so there goes another $36 a month. And buying the personal hygiene items like toothbrushes, toothpaste, toilet paper, laundry soap, dish soap, etc.. . .Oh my, another $70, at least, for the family’s personal care needs. Only $134 left. Whew! This family just barely made it!

Oh, but not so fast. Remember, this family is living paycheck to paycheck. This means that sometimes payday comes after a bill is due and that means that late fees are tacked onto the bill. Because the bill is now higher by $25 to $50, the bill cannot be paid in full without sacrificing another bill. And if something is disconnected for non-payment, reconnect fees are added to the bill as well and it must be paid in full in order to have services restored. It is very easy to judge and tell this family that they should just pay their bills on time and not have the late fees. Then, of course, they would not be in this mess. Rest assured, this family is well aware of that fact. But remember those unexpected expenses that crop up every now and then? It only takes one time for that to happen - ONE time - for the bills to fall behind. Once behind, it’s extremely hard to catch back up again. Guess what, the family is lucky to have a dollar or two left in the pocket at the end of the month.

Things Not Included in the Above Scenario

Utilities such as telephone service (cell or landline), cable television, and internet service were left out of that budget. Consider the way those things are used today. Television service is still a luxury, but cell phones are used to help track 911 calls. Thankfully, most of them allow emergency calls even without actual phone service. Internet is considered a luxury most of the time, but schools are relying on it more and more as an integral part of the education of every child. Children use it for everyday homework assignments (such as math games), to take tests, to research, and to communicate with their teachers. It is frowned upon for parents not be in touch with the teachers, too, or the teachers sometimes assume the parent does not care. If there is no internet available at home, where does the parent find the time to take a child to the library? Not during school or work hours when it is open, that’s for sure.

The law requires car insurance. That cost was not included above because the money was not there for it. Or for health insurance. But if a person gets caught driving without insurance, a fine is issued and the car may be towed to impound, where there will be a fine assessed in order to get it back. Also, a person could lose their driver's license. And in addition, some states require vehicle registration, which you guessed it, requires money just to get tested. If the car cannot pass the first time, it needs to have repairs that might require money. Then a person might have to pay again for another inspection. You can imagine the problems that go along with not having health insurance and in states like Texas, adults do not qualify for Medicaid if they make a minimum of $250 per month. That's per household, folks. Two hundred dollars is not even enough to live an entire month on, but it prevents a person from receiving regular medical care. As a result, ailments get put off until an ER visit is necessary, creating more debt and more health problems to create further debt.

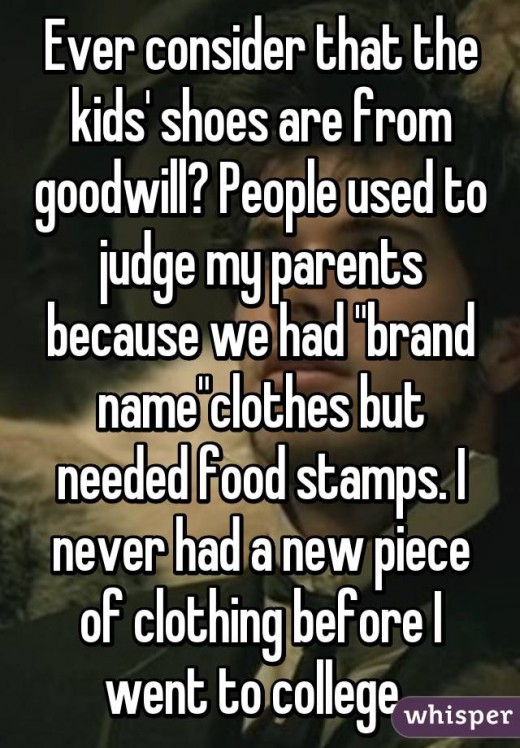

Also not included in the above scenario are the little everyday items that most people take for granted - shoes, clothing, school necessities. Have an infant? Diapers are expensive and cost at least $100 a month. Field trips at school require money. School supplies cost money. There are so many little run-of-the-mill things that most people do not even consider when wondering where someone else’s money goes.

These people often not only live in run-down homes but also have to rely on old and used furniture that is either donated or purchased at garage sales and other places. Sometimes rent-to-own is an option, but again, that is more money out of the budget. Can you imagine only one bed for the entire family? Not even a bed, perhaps, but just a mattress? Let's not forget the pests that sometimes come with these items. Pests like roaches and bedbugs that require money to exterminate.

Can you understand why some of these people sell their food stamps? Of course, it is not necessarily ethical or something that should be done. But there is a reason it is done and those reasons are not always the first conclusion people jump to. Some things just require cash to purchase. To some, that seems like the only way to get the cash. Wrong or right, it is not necessarily going for the purchase of drugs, alcohol, or other sources of recreation.

So next time you see someone struggling to make their bills meet, stop and think about how you do not know their situation. You see only the outside appearances, and everyone knows that appearances can be deceiving. Yes, there are some who will work the system because it is what they choose to do. But there are many more people who would love to escape the system of welfare if they had a chance.

Poverty Poem

Look around you and tell me, what do you see

Can you tell the difference, who among you lives in poverty?

It's not always so easy to tell

Some can hide it so well

And why wouldn't they want to?

When so many judge you

Imagine if you will. . .

It's a constant struggle

A never-ending juggle

Should the water bill be paid

Or pay the power bill before it's too late

What about all the other things you need

Some things are just a necessity

So here you sit in the dark

It's enough to make anyone lose some heart

When it happens way too often

Careful now, it can be a suffocating coffin

Especially when condemning eyes are upon you

What you wouldn't give to be able to retreat from view

How do you save all of that food?

You can't, so what do you do?

You spend more money you don't have to buy

A cooler and some ice

A little cheap, unhealthy food each day

Because other food doesn't last long that way

If the water goes off too

There's no telling what you'll do

It's hard enough to clean without electricity

Oh, my, this is so embarrassing

Some will help simply because they care

Others will help because they've been there

Still others will help in order to fulfill an ulterior motive

You will hear about their good deeds through all that they boasted

But even those with the sincerest of hearts

Eventually grow tired like their counterparts

If only they understood and truly knew

Just how disgusted with it all you are too

There's got to be some other way

But so far the best seems to be surviving payday to payday

And chasing dreams, well - that requires money too, you find

Oh, but hey, what if they lead you to a better life?

Or maybe they ultimately won't

But they still make you feel more alive and whole