What is Non-Judicial Foreclosure?

The Foreclosure Process

The foreclosure process isn't pleasant no matter how you look at it. By the time a house "goes back" to the lender, its owner has depleted most or all of their savings. They can lose equity and find themselves traumatized first by the foreclosure itself and then again by the legal system.

Of course, that's a "worst case" scenario - and one that I've experienced personally. In some cases, the owners are happy to let the bank recover their mortgage and they don't care what it does to their credit ratings.

Today, I'm going to talk about one type of foreclosure - the non-judicial foreclosure - a widely used method for avoiding costly foreclosure litigation.

How Much Do You Already Know?

view quiz statisticsWhat Kinds of Foreclosures Does Your State Allow?

Non-Judicial

| Judicial

| Either

| |

|---|---|---|---|

Alabama

| X

| ||

Alaska

| X

| ||

Arizona

| X

| ||

Arkansas

| X

| ||

California

| X

| ||

Colorado

| X

| ||

Connecticut

| X

| ||

Delaware

| X

| ||

District of Columbia

| X

| ||

Florida

| X

| ||

Georgia

| X

| ||

Hawaii

| X

| ||

Idaho

| X

| ||

Illinois

| X

| ||

Indiana

| X

| ||

Iowa

| X

| ||

Kansas

| X

| ||

Kentucky

| X

| ||

Louisiana

| X

| ||

Maine

| X

| ||

Maryland

| X

| ||

Massachussets

| X

| ||

Michigan

| X

| ||

Minnesota

| X

| ||

Mississippi

| X

| ||

Missouri

| X

| ||

Montana

| X

| ||

Nebraska

| X

| ||

Nevada

| X

| ||

New Hampshire

| X

| ||

New Jersey

| X

| ||

New Mexico

| X

| ||

New York

| X

| ||

North Carolina

| X

| ||

North Dakota

| X

| ||

Ohio

| X

| ||

Oklahoma

| X

| ||

Oregon

| X

| ||

Pennsylvania

| X

| ||

Rhode Island

| X

| ||

South Carolina

| X

| ||

South Dakota

| X

| ||

Tennessee

| X

| ||

Texas

| X

| ||

Utah

| X

| ||

Vermont

| X

| ||

Vermont

| X

| ||

Washington

| X

| ||

West Virginia

| X

| ||

Wisconsin

| X

| ||

Wyoming

| X

|

Judicial and Non-Judicial Foreclosure

A judicial foreclosure requires a lender to go through the court system in order to foreclose. They must win a lawsuit before they can foreclose, which can take extra time and costs more than if they can complete a non-judicial foreclosure.

In a non-judicial foreclosure, the borrower signs a promissory note pledging to pay back the money they've borrowed, plus another document known as the Deed of Trust, which consists of a dozen or more pages that basically say "If you don't pay, you don't stay!" Together, these two documents create what many people call a "mortgage."

There are some basic elements described in the Deed of Trust that become critical when a foreclosure is imminent:

- What is considered a default (not paying is just one possible reason for foreclosure!)

- The acceleration or "due-on-sale" clause

- The trustee or sheriff sale

The actual foreclosure process may or may not be described in a deed of trust, but state laws will specify procedures even if they're not described in the loan packet:

- What kinds of notice the borrower is entitled to receive

- How the lender must serve notice

- How much time the borrower has to cure the default or redeem the property

- Methods for preventing foreclosure

Notice to Cure and Acceleration Notice

As described above, the deed of trust has an acceleration notice or due on sale clause. If the lender determines that the borrower has breached a contract with them (either the promissory note or the terms in the deed of trust that says the borrower won't do things like build a bomb factory in the basement or dispose of toxic wastes), they can say to you, "Hey, you're not doing what you said you would. Either pay everything you owe right now, or we're going to foreclose because we don't want to be in contract with you any more!"

The due-on-sale clause also means that if the house is sold to anyone, for any reason, the borrower's loan must be paid off.

This is where things get ugly!

Many people mistakenly believe that if their property is foreclosed, the bank takes it back, resells it, and then credits their account with the difference between what the new buyer paid and what they owe.

What actually happens is much more sinister. The bank sends the borrower a notice that they've accelerated the loan and want the borrower to pay off the entire loan immediately. If the buyer doesn't do it, they mail a notice that a trustee sale or sheriff sale will take place at a certain date, time, and location. The lender may also be required to advertise the trustee or sheriff sale in a newspaper for a certain amount of time.

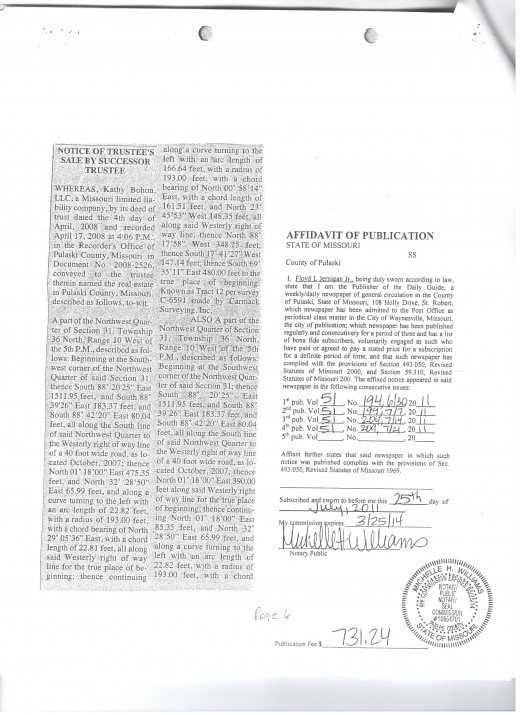

While it would benefit the borrower if these "ads" included photos and an appealing description of the property, the advertisements are long, boring descriptions that most people don't understand. They contain a legal description of the property, the name of the person who owns it, who is conducting the sale, and the details of when and where the sale's to take place. The photo below reveals the way most of these advertisements look. (It's a scan of the publication used when a lender foreclosed on houses I owned - which is currently being contested in court.)

Trustee Sales and Sheriff Sales

The average consumer has no idea what that advertisement is offering. Even as a seasoned real estate professional who can understand the legal descriptions, I would have to go to the courthouse, locate the description on a certain type of map, and ask for a printout of the aerial view of the property and copies of any paperwork filed with the court in order to figure out if it advertised vacant land, a house, or a strip mall!

As a result, the trustee and sheriff sales don't produce many bidders. In a majority of cases, the lender is the only bidder on properties for sale. The lender buys the property back from the borrower at this sale, and the amount paid by the lender is the amount that will get credited back to the borrower's loan. If the lender doesn't pay as much as the borrower owes on the loan, the lender can go to court to get a deficiency judgment.

Let's say a borrower owes $50,000 on a property he has owned for ten years. A Realtor advised the borrower that he could sell the property for $75,000 in a reasonable amount of time, like 90 days. The borrower didn't list the property, and the lender paid $20,000 at the trustee sale. The lender can get a court order forcing the borrower to pay the deficiency of $30,000 - the difference between what the lender gave back to the borrower and what the borrower owed the bank.

When the bank resells the property a few months or a year later, it sells to a new homeowner for $80,000. The lender gave up $20,000 to get the house back, and then recovered $30,000 from the borrower. At this point, the lender has $20,000 of its own money invested. When it resells the property for $80k, the $60,000 profit is the bank's. It does not get credited to the borrower.

The borrower is only entitled to "set off" the amount from the trustee or sheriff sale, not a subsequent resale.

Redemption Period

In some states, a borrower has a legal right to redeem the property. If a borrower pays all of the interest and principal on the loan within the redemption period, they will retain ownership.

Foreclosure redemption periods can be as long as 365 calendar days. Borrowers can use that year to find a loan that lets them pay off their existing loan or to locate a buyer to purchase their house so they can pay off the loan and hopefully recapture any equity they have built up.

Redemption periods can be tricky to navigate. Some states don't offer redemption periods at all. Other states offer a short redemption period for people who haven't been in their homes more than a few years and a much longer amount of time for someone who has owned the property for many years. Some states only offer redemption periods if a judicial foreclosure is taking place.

It wouldn't be practical for me to try to describe every state's redemption period here, but if you are a homeowner facing foreclosure, I would encourage you to check with an attorney to find out your rights. For instance, in Kansas, certain homeowners have a one-year redemption period that allows them to live in the house for a year without making payments on it. However, if they rent it to tenants during that year, the lender can obtain a judgment saying they've abandoned the property and having the redemption period eliminated altogether. I'm not an attorney and cannot give legal advice, so check with a lawyer to evaluate your options if you're in this unfortunate situation!

Fighting Foreclosure

The redemption period is a borrower's friend, but the homeowner must know how to use it. Again, a foreclosure attorney is the best source of information. Some states require homeowners to provide written notice within a certain time frame. Others grant the period automatically. It is not safe to make assumptions.

Other kinds of legal actions can delay or stop foreclosures, too:

- Bankruptcy filings can delay foreclosures.

- Direct legal action can reveal technical details that can delay or stop foreclosures. This is a highly specialized area of law that is best handled by an attorney, although it can be tough to find one when there's not enough money to make the house payments, but has been used successfully on occasion when lenders have been selling and reselling a borrower's loan to other banks.

- Loan modifications can eliminate or postpone the foreclosure period.

- It may be possible to work with the lender to defer or delay a payment if a borrower has only missed one.

- Short sales can be a good way to avoid foreclosure. The lender may be willing to accept less than the borrower owes and give the borrower time to sell in some cases.

- The bank may agree to accept a deed-in-lieu of foreclosure. This may reflect as unpaid debt on the borrower's credit report, but the bank typically agrees not to pursue a deficiency judgment.

Remember, I'm not an attorney! I can't recommend a particular course of action, but I can say that every borrower should consult with an attorney if they want to avoid or delay foreclosure.

Don't Give Up!

Like many Americans, I am angered and frustrated by the legal system in America. Who can afford to pay a few hundred dollars per hour to defend their home when they're not able to keep up with the payments in the first place? What average American can represent themselves in court with all the rules and procedures that are in place? For that matter, how many of us can truly evaluate if an attorney's doing all he or she can to help us, and charging fair prices in the process?

In my case, the lender is seeking a deficiency judgment of $11,000, but the actual details of my case are much more complex. I believe the lender will try to obtain a second judgment later for about $200,000! Worse, I believe they committed fraud multiple times along the way.

I called at least 50 attorneys, talked to about half as many, and eventually found one that promised to attempt to settle my case. I told him I would settle for $4,000, which is what I can afford right now, as long as the bank signed that they would not attempt to pursue any other judgment. I paid $700 for him to have some conversations with the other attorney, and he finally said, "Well, they'll settle for $11,000."

"That's not settling!" I reminded him. I told him I would no longer need his services and started looking for another attorney. Since the bank wanted to be unreasonable, I had no choice but to dig in my heels. (I should mention that the bank has cleared nearly a quarter of a million dollars on reselling my properties! The bank's attorney also asked me if this attorney had let me know that the bank would accept a $6,500 settlement.)

I started searching for a trial attorney. I called at least 50 attorneys, talked to about half as many, and kept getting just a couple of responses that sounded like these:

"Sure, I'll represent you. It'll be $250 an hour, and it'll be a waste of your money. You should just pay the bank what it wants."

and

"You need someone who can do contract law, real estate law, and tort law? Here, let me refer you to someone who might be willing to help you out."

and

"Sorry, I don't practice that kind of law."

and

"I don't work on contingency."

Finally, I located an aggressive trial attorney that is not only less expensive than the others at $175 per hour, he'll let me make monthly payments after my retainer is used. Better yet, he reviewed my documents carefully, takes my viewpoints and knowledge seriously, and provided a written statement of the tasks he would perform on my behalf. Granted, I had to go three hours away to find him, and he's located another two hours from the courtroom where my case will be tried, but when he does his job properly as it appears he's going to, his pay will likely be recovered by the court's judgment.

When looking for an attorney, I encourage anyone to gather all the documents they can, locate people who can testify on their behalf, and make a list of these things so an attorney can easily see what he has to work with. I also conducted a tremendous amount of research so that I could highlight the state laws and cases that have already been tried in court, which I had ready when I consulted with him. He said most people do not have adequate preparation which runs his costs much higher, so by building my case extensively before I met with him, I am able to minimize the hours he has to spend.

I felt like I was looking for a needle in a haystack when I was making all those calls, but whaddya know - I found it. And so can you!