Analysing the Stock Market Crash

Analysing The Stock Market Crash

The 1929 stock market crash happened nearly 80 years ago, and a lot has been written since that time to try to understand what went wrong. It seems that there were various contributing factors, and some are more to blame than others. Certainly, there is a good understanding of the particular situation which came about.In the roaring twenties, it seemed that nothing could go wrong. This was a time when, having recovered from the First World War, the U.S. enjoyed low unemployment, high production, stable prices and, perhaps most importantly for this analysis, stocks and shares were consistently soaring in price. In fact, between 1924 and 1929 the New York stock market quadrupled in value.

One of the fundamental problems with this picture was that many people were speculating on the market using borrowed funds. Because investing in shares was considered so secure, individual investors were happy to buy shares “on margin”, which meant that they could pay as little as 10% of the value up front. Similarly, the brokers and banks were happy to lend the money. Margin buying was not controlled by the government, but by the brokers who lent to the extent that they were comfortable with.Prior to the crash, there were some speculators who felt that the market was overvalued, but the masses chose to ignore this advice. The signs of prosperity were all around, so for many it was not believable that the values were not deserved.

All this set the scene for something to trigger the crash. Crashes are driven by panic as much as anything, and the exposure of so many investors to dramatic losses if stock prices should decline a little, because of the margin buying, plainly played into the panic to sell, once the decline was seen to start. Crowd psychology means that there was a positive feedback loop, so that the initial selling by some investors drove an increasing number of shareholders to sell, spiraling out of control.

The economic trigger that set the crash in motion appears to have been involved with public utility regulation. On the weekend before the crash, the Washington post headlined “twenty utility stocks hit new low mark”, and the next day they reiterated “selling again concentrated today on the utilities, which were in general depressed to the lowest levels since early July”. There had also been some declines earlier in October. Inevitably, with the bad news in the utility stocks, margin buyers were forced to sell and this caused further selling in all stocks, creating a snowball effect.

The stock market crash is generally accepted as taking place on “Black Thursday”, October 24th, and the following Tuesday, October 29th. The Dow Jones industrial average had been as high as 380 at the beginning of September. At the close on Black Thursday, it was less than 300, Black Tuesday saw it sink to 260, and it continued falling to 145 in November, and to around 40 by 1932 in the Great Depression.

Another factor which exacerbated the problem and caused further panic was the breakdown in the trading system. The volume of shares traded on that Thursday, at 13 million, was a record, and the amount of selling overwhelmed the ticker tape system which usually recorded the current prices. Telephones and telegraphs were also unable to cope.

As prices fell, some of that trading was imposed on the investors, who were forced to liquidate their stocks because of margin calls, that is, the brokers requiring to be paid for the money lent. This flooded the markets with orders to sell, increasing the chaos.

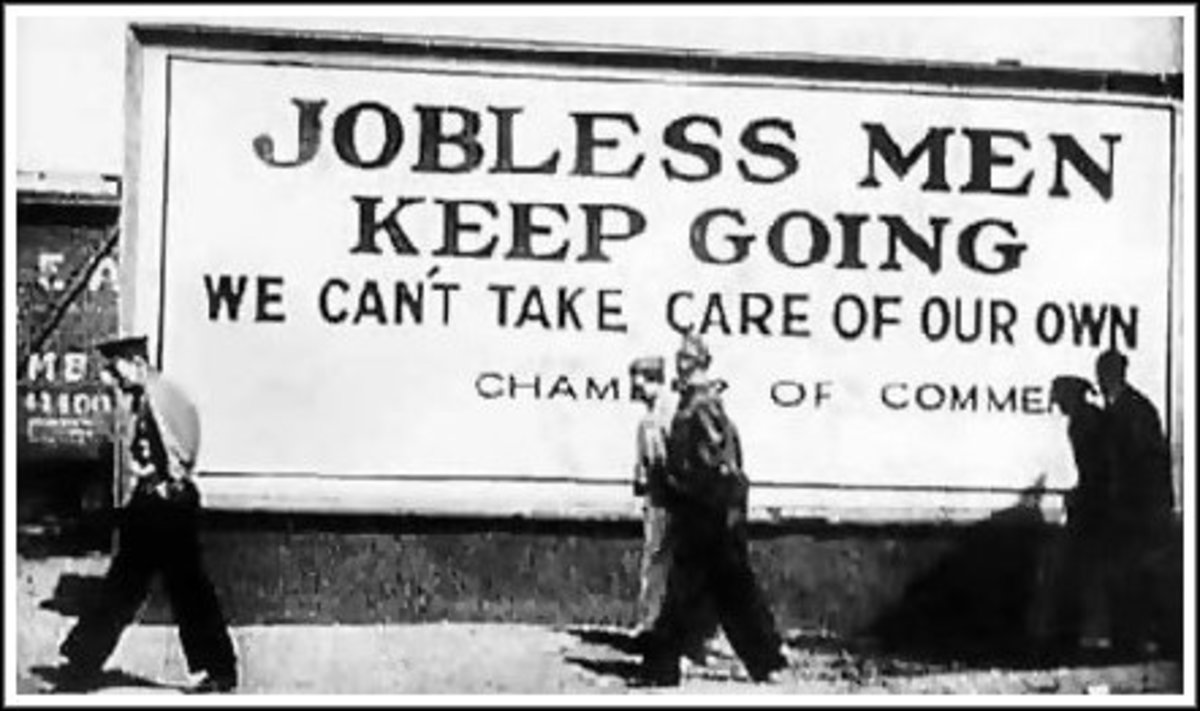

Of further significance to the general collapse of the economy, even for those people who were not investors, many banks had themselves invested depositors money in the market, and were left unable to fulfill their obligations of paying back the accounts. In all, when the market bottomed in 1932 a total of 20,000 companies and 1616 banks had gone bankrupt, leaving 12 million Americans unemployed. The banker JP Morgan is said to have lost $60 million, and the founder of General Motors $40 million. The head of Rochester Gas and Electric decided to gas himself, and 23,000 Americans, the highest number ever, committed suicide in the year following the crash.

The stock market crash was followed by the Great Depression, which aided the rise of the Nazis in Germany, and the U.S. economy was only turned around by production for the Second World War. Stu Whisson of www.insightsupport.com has put together a trading course which you can take for free, that explains some of the movements of share prices and how you can take charge of your own portfolio.