3 Quick Tips on Establishing Consumer Credit for Credit Newbies

Did you just graduate from college? Just got your first job offer; will you be moving to a new community? Perhaps you’ve been out of the country for a while; have you been forced to use only foreign currencies? A “yes” response to any of the three questions could mean that you’re a new player to the game of credit. A credit newbie is simply an individual who hasn’t yet had the luxury of establishing his or her credit history. Thus, without a credit history, there can be no way for FICO to generate you a credit score. In theory, the term “credit newbie” could be considered rather nebulous, especially since America leads the globalized credit world in the area of data collection, storing all kinds of personalized information on hundreds of millions of consumers in huge databases mostly owned by Experian, Equifax and Transunion, the nation’s three main credit bureaus. There are millions of Americans that still hold on to the financial credo of yesteryear, which posit that “Cash Is King.” Sadly, those heroes of the past have slowly dwelled. In today's’ fast pace economy the advantages to consumer credit speaks volumes: Consumer credit enables individuals in a contemporary society to purchase goods and services now—rather than later. Big ticket consumer items, including cars, homes and educational services, can now be purchased by households with even the most limited incomes. Depending on your current financial situation and budget constraints, the following financial activities will help you establish consumer credit for the first time:

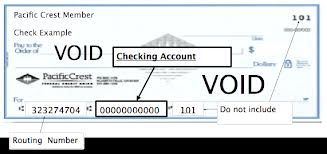

1# Opening up Checking & Saving Account(s)

Checking and saving account(s). If you don’t already have one—get one fast! Opening a checking or savings account is the first step towards establishing a genuine consumer credit profile. Namely, on each credit report, there contains a personal information section, which acts to provide potential creditors with needed background information, such as your name, social security number, date of birth, telephone number, addresses and reported employment data. This may seem trivial to many, but when a bank officer wants to verify information to approve a mortgage loan, the first place he or she will look is the personal information section of your credit reports. In addition, deliberate deposits in any financial institution—be it a commercial bank, savings and loans or local credit union—tend to influence credit reviewers positively, because they reflect conscious actions and indicate a savings-oriented attitude.

#2 Securitizing a Loan or Credit Card

For those select few credit newbies, looking to get ahead of the pack, collateralizing (or securitizing) a loan or credit card is an excellent way to demonstrate your ability and willingness to repay. For example, if you have $500.00 in a savings account, you could request a short-term loan of $500.00, using the full amount as collateral. In historical review, this method was the optimal way to establish a payment pattern with a financial institutional. More recently, the method has largely been replaced with the ubiquitous secured credit card, which is a credit card that’s collateralized by the balance in your savings account or a certificate of deposit. If you accumulate a certain amount of savings, a bank may issue you a credit card with a credit limit equal to your savings—this is why opening a savings account is so important, as indicated above.

#3 Using a Cosigner

For some, building a credit history from scratch can be a daunting task, especially since a high FICO score takes an average of two-four years of on-time payments to obtain. Given the gravity of certain financial and nonfinancial transactions, the allure of using a cosigner to accelerate the credit building process becomes a plausible action. Put simply, building credit takes time. And for those select few credit newbies that desire the privilege of consumer credit sooner rather than later, then the use a credit veteran (i.e., a parent, family member or friend), may be the only mechanism to steer you towards credit nirvana.