7 Easy Steps towards a Higher Credit Score

There appears to be a “7 Easy Steps” to everything these days. Why not for credit scores—everyone wants a higher credit score, right? The reason: consumers with higher credit scores enjoy savings on everything, including lower finance charges on home mortgages, auto loans and insurance premiums. Most consumers would assume placing the words “easy” and “higher credit score” in the same sentence is a bit far-fetched. Nevertheless, there are things that you can do to make a 750 FICO score a living reality. Here are seven easy steps to consider when enhancing your credit score:

Step #1 Review Your Credit Reports For Negative Marks…

Reviewing you credit report for errors helps burnish the idea that in order to fix your credit report, you have to first know what’s broke. Thus it goes without saying that you should go through your credit reports very carefully. The thing you’ll certainly look for are the typical negative marks such as late payments, collection accounts and charge-offs. Moreover, you’ll want to look of these accounts even if they carry the notation “settled,” “paid derogatory,” or even “paid charge-off.” The reason: a negative account, even if paid, can still adversely affect your credit scores.

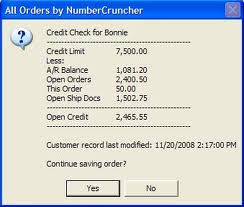

Step #2 Check for Proper Credit Limits on Your Reports…

One of the most overlooked aspects of credit score enhancement is improper posting of credit card limits. Unknown to the novice, this particular feature delves from FICO’s utilization feature, which exist to penalize individuals for too much use of their credit. Thus if a creditor fails to post a proper credit line to your credit reports; naturally, this will adversely affect your credit scores. If you notice an improper posting of your credit limit, you should immediately bring this to their attention. In addition, if you have bankruptcies that should be showing a zero balance, make sure they are indeed showing a zero balance.

Step #3 Negotiate and Remove Negative Marks From your Reports…

If you have negative marks on your credit reports, you only have one course of action—negotiate with your creditors/lender to remove them. In fact, if you are a long time customer and it's something simple like a one-time late payment, a creditor will often wipe it away to keep you as a loyal customer. On the other hand, if you have a more serious negative mark, say a past-due account that has gone to collection, then you’ll have to negotiate a payment in exchange for removal of the negative item. Remember there are two adages when it comes to collection account negotiations: 1) Always put everything in writing; and more importantly 2) Do not pay off a bill that has gone to collections unless the creditor agrees in writing that they will remove the derogatory item from your credit report.

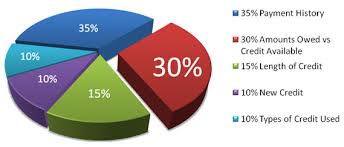

Step #4 Lower Your Utilization Below 30% of Available Credit Line…

What’s utilization? Actually, utilization is a big fancy word, with a very simple meaning—namely, it just simply a ratio of total available credit divided by your total credit balances. The golden rule of utilization is the 30% mark. It goes without saying that if you have a ratio above this mark, then your credit score is indeed being penalize for this. You can fix this problem by simply paying down your debts so that your ratio is below this number. Ideally, you should aim for a utilization of below 7%, as this is the number most consumers with very high FICO scores typically will have.

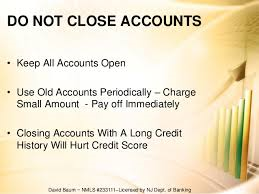

Step #5 Keep Old Charge Accounts Open…

Perhaps you have a favorite credit card that keeps getting you into trouble; therefore, you decide one day that after you pay off the balance, to close the account all together. Before you make such a decision, keep in mind that this act could end up adversely affecting your credit score. How is this so? This is so because very old and established credit accounts have one very important feature: a history. And if this history is good, why get rid of it. It’s the spending habit that’s getting you into trouble not the credit card. A good way to alter your spending habits without lower your FICO scores is consider the “sockdraw” method (i.e, putting them in a sock and tucking it under a bunch of cloth in your draw). Another great idea is to put them in a container of water and freeze them, or you could just cut the card up with a good pair of scissors. But you’ll certainly want to keep accounts open for their score enhancing features.

Step #6 Avoid Applying for too Much Credit…

Did you know that each time you apply for new credit, your credit score gets dinged? A credit inquiry, as it is called is a kind of unique feature of FICO’s scoring system, whereby opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time (as opposed to rate shopping for a single loan, which is handled differently as discussed below), your FICO score can be lower as a result.

Step #7 Maintain at Least Three Revolving Accounts and One Installment Account..

The last and final feature is only significant given its importance’s to the egos of FICO’s creators. Case in point: they want to see how you maintain a variety of credit accounts (three revolving and one installment account, mainly). If you do not have three active credit cards, you might want to open some. What if my credit score isn’t good enough for a credit card? Not to worry, you can start off with a sub-prime credit card—or even better, a secured credit card, meaning you’ll need to deposit a certain amount of money which will then serve as your available credit. These are two excellent ways to build credit if you don’t have any. Also, don’t forget about an installment account, FICO wants to see at least one of them on there. The great news here is that any good furniture, major appliance or auto loan will satisfy this requirement.