Banking Safely Online With Your Plastic Money, ATM and Smartphone

Introduction

The financial world has experienced jitters in its attempts to embrace digital banking. Safety has been an issue of concern to the effect that many nations have to date, refused to embrace online banking while justifiably citing cyber theft. The banking world prefers to play it safe, adopting a “wait and see” attitude before making the digital leap that will convenience its customers’ in their banking experience.

As more and more nations embrace online banking, safety measures need to be put in place. While online banking remains attractive to clients, the fear of fraud limits the uptake of such services. Banks have secured clients’ accounts to protect themselves against external theft of confidential records, and other modes of cyber crime.

Many people don’t feel secure with virtual banking. It seems like the money in your hands provides better security. We can’t blame you for that especially with the advent of our major strides into digital technology.

Reasons why we use ATMs; Convenience at our disposal

The main reason why we use Automatic Teller Machines (ATM) is the convenience they offer to the user. Better still, an electronic link between your bank account, the ATM and your phone (Simple Banking) makes banking much easier than it has previously been.

The thought of accessing my bank account while lounging on my sofa set brings comfort to my mind. This ensures my ability to access my money any time I need to use it, any time of day or night. This is very convenient.

Safety

The closer my money is to me, the more I am bound to feel secure. The safety aspect of such banking lies in my ability to coin a safe password that is difficult to guess. I’m thereafter able to transact without having to carry large amounts of money around, attracting robbers while trying to do business. I have made it my business to rarely physically visit my bank these days.

Many instant transactions

Balance checks, money transfers, payment of utility bills, bank deposits and money withdrawals from accounts can now be made instantly via the mobile phone to virtual accounts operated through the phone with much ease. I normally pay my water and electricity bills through my phone while lying on my bed at midnight.

No queues or waiting

Long gone are the days when we had to form lengthy queues waiting to transact, deposit or withdraw money at the bank. Electronic accounts operate 24 hours non-stop. I have hated queues since birth. I can could anything to avoid queuing.

Prior to the coming of phone-based banking (Simple Banking), I often opted to visit my ATM on Sunday morning or very early during weekdays, before anybody woke up for the day, just to avoid queues. I have no queues or waiting in my life any more today.

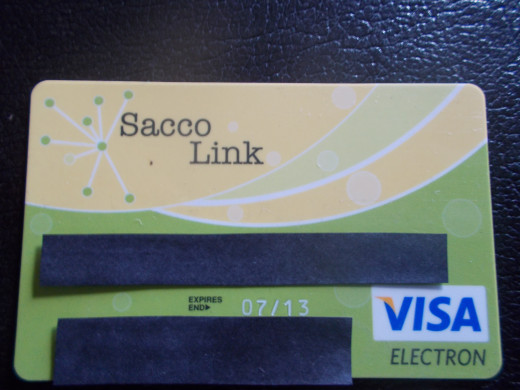

Shopping conveniently with plastic money

Nothing beats the use of plastic money when doing your shopping. Just collect your shopping basket full of goods, walk to the counter and have them swipe your card to make the purchases. That’s all. This saves valuable time and worry about handling physical cash.

While banks play their parts of securing customers’ funds, bank clients too, have a role to play towards ensuring their money remains safe and secure. What can you do to practice safe online banking that ensures successful transactions while avoiding losses?

10 Tips to ensure safe online transactions

- Never leave your banking details on your computer. Cyber snoops are likely to get at it via malware and other cunning virus. Banks are having headaches of sniffing out cyber criminals. Avoid making it easier for them to get at your money.

- Do not leave your debit or credit cards lying everywhere for all to see. Some of your banking details can be found on these cards. Report lost cards or suspicious unauthorized account activities to authorities immediately for faster follow up.

- Passwords or PINs (Personal Identification Numbers) must be kept secure at all times to cut off leakage to third parties. It is safe to keep them between yourself and the bank. Avoid leaving such details in your mobile phone too. Banks do not allow their employees to have any access to your passwords and private details. Use passwords that only you can remember. Do not send anybody to do your banking for you.

- ATM (Automatic Teller Machine) transactions must be conducted in secure environments away from prying eyes lest thieves start getting reasons to strategize on your habits. Beware of cameras or mirrors in ATM booths. Shield your actions carefully.

- Do not leave or discard your ATM receipts near the ATM machine you have just used. This keeps snoops and identity thieves away from your transactions and bank details. Destroy your receipts immediately. You can always get a bank print out on the counter when need arises. I always reject the issuance of a receipt by the ATM for security reasons. Note that print outs increase transaction costs.

- Be cunning enough to operate two accounts. Use only one account for electronic transactions explained above. I always ensure to wipe clean my electronic account leaving only the book balance for safety. Operate your safe account manually and not electronically as a direct affront to cyber-crime.

- Always invest monies you don’t intend to use instead of leaving them hanging in your account for thieves to play around with. Money in circulation multiplies faster than stationary funds. This helps fight cyber-crime.

- Change your passwords or PINs frequently to avoid cracking by skimmers.

- Avoid using ATMS that have strange-looking attachments. They could just be copiers.

- Be vigilant to learn new things about virtual banking to be prepared for any eventuality.

Available Pay-by-cash options

Online banking will always remain a boon in modern society at whatever cost. However, there are many other options one can use to pay for services by electronic cash where ATM or phone options are least convenient. The Pay-By-Cash options available among many others include:

Yandex Money, Western Union QuickPay, WebMoney Transfer, Wallie-card, Ukash, UDPay, UAH iMoney, Travellers Express MoneyGram, Todito Card, Snap, RuPay, Pecunix, paysafecard, PayPoint, PayPal, PaymatePayGNN, myCitadel Wallet, Moneymail, Moneybookers, Cashiers Check by Mail, MOLEPoints, Mobillcash, Mistercash, InstaDebit, INOCard, Home’Pay, ING, iDeal, hyperWallet, Google Checkout, GiroPay, Ficha RAP, EPS, eNets, eCheck, Easecard, Direct Debit, Click2Pay, Certapay, cashU, BPay, Boleto Bancario, Bank Transfer, Ultimate Game Card, etc, etc, etc, etc etc, etc, etc, etc etc, etc, etc, etc, etc.

Turning Your Smartphone into a Wallet

By simply installing these mobile applications onto your phone, you can turn your Smartphone into a wallet:

- Apple Passbook (iOS)

- Google Wallet (Only NFC enabled Android devices like Samsung Galaxy S III-Sprint, Samsung Galaxy Note II-Sprint, Galaxy Nexus-Sprint, and Nexus 4)

- Levelup (Android, iOS)

- Paypal's free mobile wallet (Android, iOS)

- Square (Android, iOS)

You only need to download and install these mobile applications on your phone, the notion of utilizing your Smartphone to access digital cash is very much practical and gaining usage in business transactions in the modern world. However, many people are being left behind in their fondness to use the good old filthy green bucks. Get technologically savvy and embrace the ease of using virtual cash without necessarily handling it physically.

By setting up a PIN-activated account that is linked to your credit card, debit card or loyalty card, you only need to tap your Smartphone near your retail trader's near-field communication (NFC) terminal and viola, your transactions have been conveniently paid for, courtesy of your Smartphone.

America's Techno-Enemy Cities

There are a few geographical locations where most of these activities may not be feasible. Such locations can be branded as Techno-enemy cities. In these cities, you will find only one or less wi-fi hotspots per 100 people, less than one IT job per 100 people, only one or no IT graduate programs on the offing, no mobile application that can ran in the city on necessary digital services, less than 15mbps download speeds, costly internet connectivity averaging $6.5 per mbps, less than 10 mbps download speeds on 4G networks, plus many other inconveniences. The worst performing cities according to PC World magazine are: Elpaso - Texas, Fresno - California, Memphis, Oklahoma City, Mesa - Arizona, Tulsa - Oklahoma, Milwaukee, Arlington - Virginia, Long Beach - California and Omaha.

Residents of these locations will take longer to catch up with modern data transmission speeds, let alone using mobile applications.