Basic Investing - Wealth 101

Save Wealth - Not Money

Collect Wealth - Not Money

When I was about 9 years old my grandpa gave me a savings account with $5.00 in it for my birthday. He also gave me advice about saving a portion of my income and adding it to my savings account. My grandpa also collected coins and would keep any silver coins he found. I remembered what he told me and started saving some of the money I earned as I grew up.

The bank that he selected was about fifty miles away (we lived in a small mountain village with no banks) and I was unable to make deposits, but I did save any silver coins I found and kept them in a can. It was about five years later, I realized something of utmost importance.

One day while looking at my bank statement, I realized something. I often bought candy bars at the local store. They had raised their prices to 25 cents each, from 15 cents each. I could remember them being 10 cents each when I received my saving account passbook from my grandpa. I could also remember buying candy bars for 5 cents each when I was even younger. My savings had gained less than a dollar on the five dollars. My savings were buying less and less candy bars as I got older. My money was losing value very quickly.

The 5% interest earning on my savings did not keep up with the increase in prices. I wouldn't learn the cause of inflation till I was older, but my perception at that time was that prices always went up. It got me to thinking, was putting money in a savings account a good idea? Wouldn't I be better off just buying a bunch of stuff and keeping it?

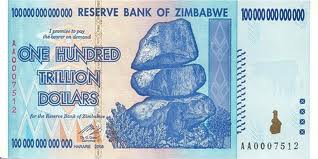

When I turned 14, I found a bunch of books and magazines in the trash. These books explained a lot about economics. I learned that inflation originates from an increase in the money supply. The magazine had an article on how to stay ahead of inflation. I already figured out that if my money grew by 5% per year, but inflation was 10% per year, then I was losing value. I realized that bonds and savings accounts were a fraud. They would never keep up with the depreciation of the dollar. Soon, I would begin thinking in terms of wealth, not money. I began tracking the money supply as a teenager. I would check on it once or twice a year.

Today, I am over 50 years old. I witnessed a burst of inflation around 1980, followed by high interest rates to reign in the money supply. Most of my savings were in silver at the time. So, I was protected from the devaluation of the dollar. Today, I am seeing a flood in the money supply that makes the time around 1980 look like a summer sprinkle. I know we will be hit with a lot more inflation.

This brings me to my point. How are you saving the income you have earned? Are you saving it as money? This includes bonds and anything that pays an interest in more money. Or are you saving your income as wealth that acts as a store of value? I hope it is wealth. If it isn't get out of money and get something of tangible value.

I believe that the economy will soon make a paradigm shift. Money will be what our government uses to retain power and it will print more and more of it. Inflation will continue to accelerate in the future. True wealth will be kept in commodities. Many people suggest silver and gold, but there are many other choices. Platinum, palladium, copper, nickel, oil, or even food will make better investments for saving your wealth. Savings and bonds will be for suckers.

I still believe in the value of many stocks. Stocks give you partial ownership of a company, unlike bonds that give you a promise of depreciating paper currency. You can even buy mining stocks that will continue to rise when metals gain value. The important thing with stocks is not to panic and sell them if their value drops due to investment shifts by wall street. You need to buy stocks with a view to the long run. Leave short term investing to people with excess money to burn or inside connections to high level information. Changes in the money supply can result in irrational changes in the stock market that few can predict.

In conclusion, it is important to remember that money or cash is not a stable reference point for value. It is a constantly declining value. Precious metals may not be a perfectly stable reference point either, but at least it has a central value that is always retained. Gold and silver will never become worthless. A silver dollar would buy me 20 candy bars as a child and that silver dollar is still worth at least 20 candy bars today. A paper dollar that bought me 20 candy bars as child will only buy me about one and a half candy bars today.

Saving your paper money is like saving grain in a rodent infested warehouse. Government vermin eat the value of your money through inflation of the money supply.

So do yourself a favor, store your wealth in precious metals.