Which Better Estimates Rental Property Value, Cap Rate or GRM?

Cap rate (or capitalization rate) and GRM (or gross rent multiplier) are popular real estate investing measures regularly used by real estate investors and analysts who want to determine whether a rental property is priced correctly and might be a good real estate investment opportunity.

Both measures only provide an estimate of rental property value, however, and alone neither provide a true picture of an investment property's profitability.

Nonetheless, they both can provide a quick "first-glance look" at an income property's ability to pay its own way, and because they are easy to compute, both measures are a popular way to determine whether a property is in line with other similar-type rental properties currently listed for sale or sold.

As a result, cap rate and gross rent multiplier are common to real estate investment activity. They are used by sellers to set a selling price for rental properties, and by buyers trying to determine what price to purchase a rental property.

But which is the better method to estimate a rental property's value, measure financial performance, and subsequently will promote smarter real estate investment decisions? In this article we’ll consider both measures and then tell you what the experts think.

Gross Rent Multiplier

The GRM method (expressed as a number) measures the ratio between a rental property's gross scheduled income (GSI) and its value.

Its advantage is that it is very easy to calculate. You don't even need a computer to compute it, and in fact can probably do it in your head.

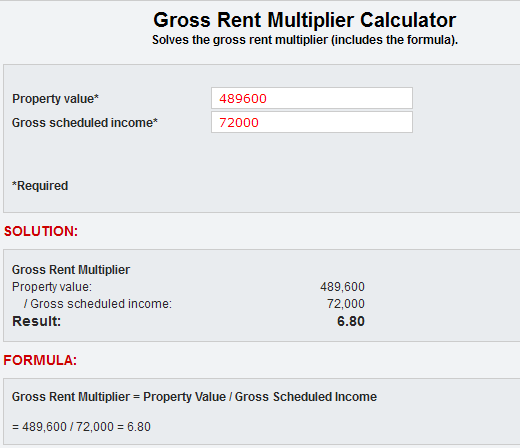

To arrive at a gross rent multiplier you would divide a property's value by its gross scheduled income.

Property Value / Gross Scheduled Income

= Gross Rent Multiplier

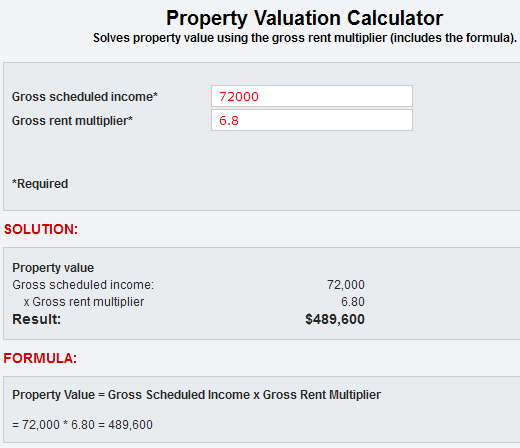

To arrive at an estimate of the property's market value you would multiply the property’s gross scheduled income by whatever gross rent multiplier you deem appropriate.

Gross Scheduled Income x Gross Rent Multiplier

= Property Value

Illustration (GRM)

Illustration (Property value)

The disadvantage of this method is that it ignores occupancy levels and operating expenses, both of which are important indicators regarding the overall performance of a rental property and required for sound real estate investing decision-making.

Is there a universally correct number?

No, because GRM is market-driven and varies accordingly. It would be surprising, however, to see a number lower than 4.0 or higher than 12.0. But if so, you might want dig deeper into the numbers that produced those results.

Cap Rate

Cap rate measures the relationship between a rental property’s net operating income (or NOI) and its price by expressing the percentage rate a property’s net operating income is to its value (or sale price). Why is this important? Because the net operating income generated by a rental property is important.

NOI indicates the amount of money produced by the property that is available to pay the mortgage. This is why lenders look closely at it when making a loan. It also explains why real estate investors rely upon a real estate analysis to reveal it.

So what is NOI? Namely, NOI is the amount of income generated by a rental property after all the operating expenses that keep the property in service are satisfied and deducted.

Gross Operating Income - Operating Expenses

= Net Operating Income

Moreover, at least from the real estate investor’s point of view, once the mortgage payment is satisfied the remainder is cash flow the real estate investor can hope to collect by owning the property.

Net Operating Income - Debt Service

= Cash Flow

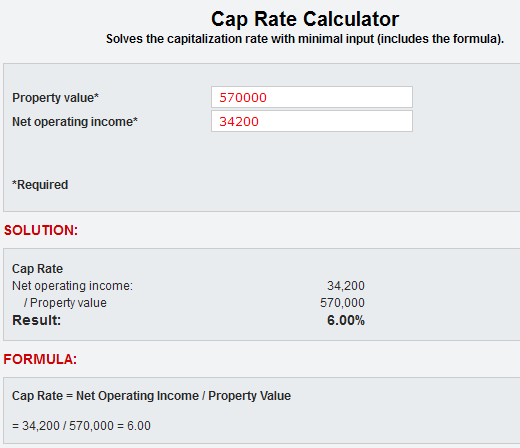

To arrive at a cap rate you would divide the property's net operating income by property value.

Net Operating Income / Property Value

= Cap Rate

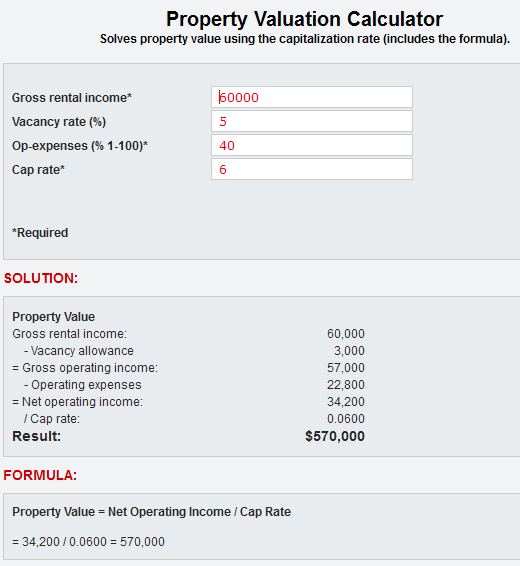

To estimate a rental property’s market value you would divide the property's net operating income by whatever capitalization rate you deem appropriate.

Net Operating Income / Cap Rate

= Property Value

Illustration (Cap rate)

Illustration (Property value)

The disadvantage of this method is that it's sometimes difficult to confirm a sold property's actual operating expenses and therefore difficult to determine the actual (not merely the published) rate it sold for.

Is there a universally correct number?

No, because cap rate depends on individual market areas. What might make one rental income property look like a steal in one city or state at 6%, for instance, might not get a second look in another.

Conclusion

Gross rent multiplier is certainly the easier method to calculate and can serve as a useful precursor to a serious property analysis.

Nonetheless, most real estate analysts would agree that the more reliable way to determine rental property value is with the cap rate method.

Naturally, you should never rely on capitalization rate alone to provide a true picture of a property's profitability or make a real estate investment decision without correctly computing all the numbers, rates of return, and cash flow scenarios for yourself.

Remember, numbers can be manipulated. So when told how great a buy an income property is based upon its cap rate, be sure to reconstruct your own raw data to insure that all is revealed and nothing is concealed before you actively pursue the real estate investment further.

About the Author

ames Kobzeff is a real estate professional and the owner/developer of ProAPOD Real Estate Investment Software. Create rental property cash flow, rates of return and profitability analysis at your fingertips in minutes!

ProAPOD also provides iCalculator - an online suite of real estate calculators that enables you to quickly and easily calculate over 55 real estate calculations. 24/7 online mobile access from your phone, tablet or PC.

Other Articles

- How To Calculate Cash on Cash Return | The Method And Formula!

The method, formula and calculation for cash on cash return with insights in how to use it in your next real estate analysis. - The Proforma Income Statement: How to Project Rental Property Cash Flows And Performance!

Why a proforma income statement is used for rental income property revenue projections. Learn how to construct one. Samples provided. - How To Buy Rental Property To Help Insure You Make a Profit

Four insightful real estate investing tips that will help insure that the next rental property you purchase will result in a profit.