Be Ware of Credit Card Deals

Credit Card Deals?

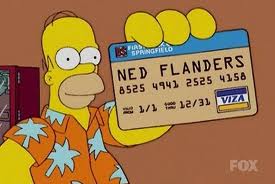

- Some credit cards offer you a payment protection plan that will suspend your minimum monthly payment for a set period of time if you lose your job, become hospitalized, or have a major life event like marriage or divorce. The cost seems like a small amount, perhaps 1% of your ending billing cycle. Credit card deals like this, are not deals at all. Banks like to promote these type of insurance coverage because it is very profitable for them, and you end up paying hundreds of dollars a year to protect yourself, or so you think. The bank will charge your credit cards monthly, and yet, you might not even qualify if you need the protection, and you may not even need this kind of credit card deal. They used to be called credit insurance. Now they are called credit protection. The newest buzz words are called debt cancellation. These are renamed to sidestep federal regulations that are on the look out for these consumer incentives that do not qualify as true insurance coverage. Check your credit card statements carefully. Sometimes you could have inadvertantly signed up for it. Call your credit card company immediately if you want to opt out of it. The bigger your balance, the more you pay, so usually the people who buy these credit protection agreements are the ones who can least afford it. If you pay interest on your credit cards, you will also be paying interest on this kind of protection. Buyer beware!

- Credit cards help us buy things. It is important to avoid buying unnecessary things. It is very easy to overbuy or buy things because they are on sale or because we convince ourselves we need it, or believe we deserve it. Credit cards make buying on the internet easier. Buying things on impulse is a matter of self control and posing some logical questions before you make the purchase. The urge to buy is easier when we are using our credit cards. Buying with your credit cards means paying later, and makes purchasing much easier. If you don’t pay your credit card in full, what you are buying will cost you much more money in interest, and you may not finish paying for that item for years. If you really don’t need the item, you will be wasting your money and compromising your future opportunity for saving and spending on other more necessary things.

- Credit cards can give you the luxury of buying a big ticket item without worryin about carrying a lot of cash around, or having to use your checkbook. Research before you make a major purchase. Know what you are buying, what your options are, what the item has to offer, and how it compares to its competitors, among many other things to research. Of course you also want to know where the best place to buy it is, and how you pay for it. Paying with credit cards when you make a major purchase is actually a good idea. Credit cards offer additional protection should you encounter an issue with the item.

Understanding Your Credit Cards

- Sometimes store credit cards will offer incentives for purchases that give no interest for a year (as an example). It is important to understand what the terms are for this incentive. Know when the interest charges kick in, and what terms you have to meet in order to avoid interest on these credit cards.

- Interest charges add up quickly, so if you are paying the minimum amount each month on your credit cards, the amount of interest you pay over the years, may end up being greater than what the purchase originally cost you. It could also take you 20 years to pay off what you buy. Using your credit cards and not paying off the balance will keep you in debt.

- It is wise to see the signs when you may be getting into a major debt situation. If you find yourself borrowing more money to pay loans that are outstanding, if you are paying your bills late, if you are putting off taking care of yourself and not going to the doctor and dentist, this probably means you don’t have enough money. Stop using your credit cards and commit to paying down those credit cards so you can get a better handle on your monthly expenses

- Credit cards and how you pay your bills impact your credit score. Pay your bills on time., keep your credit cards to a minimum and check your credit score. Review your credit reports for accuracy. You are entitled to get 3 free credit reports (one from Equifax, TransUnion, and Experian.

Credit Cards Have Lots of Offers to Be Aware Of

- Credit cards charge steep interest rates. Pay off your credit card balances each month. It is never a good idea to not owe money on your credit cards. The interest is high and the payback rate is designed to be long term, so you end up paying more in interest than the original purchase.

- The immediate gratification of buying something comes with the inevitable monthly credit cards payments. Look over your bills and statements carefully to make sure there are no unathorized charges. Try to pay more than the minimum amount. Every little bit will help you pay less interest.

- Some credit cards offer a low introductory rate. B e aware of when the offer expires. Read the fine print in your agreement from the credit cards. There is a saying that the “devil is in the details”. Banks are in the business to make money. Credit cards make banks a lot of money, and they intend to make it from unaware consumers. Arm yourself with information and knowledge so you can protect your own money. Read and understand the agreements from the credit cards. Ask the bank to explain, if there is something you do not understand.

Credit Cards and Credit Wise

Credit cards can be a convenience when managed with common sense and education about the nature of credit cards. Good credit habits will serve you well for a lifetime. Little by little you can work at reducing the amount you owe on your credit cards. A little discipline now will give you more freedom later on. It is hard to do, but anything worthwhile is difficult. The more of a habit you make to pay your credit cards on time, and pay as much as you can, the easier it will be in the long run. Spending may be fun now, but debt never is. Stretch yourself to make changes for the better. Be diligent and determined and you will have the financial freedom you desire. Good Luck, and Good Savings!

Learn More About Your Credit Score

- Creditophobia - Whats My Credit Score? Getting a Free Credit Report

Many people want to know whats my credit score? You can find out your credit score through your credit report that is done by one of three consumer credit reporting agencies. What is my credit score is...