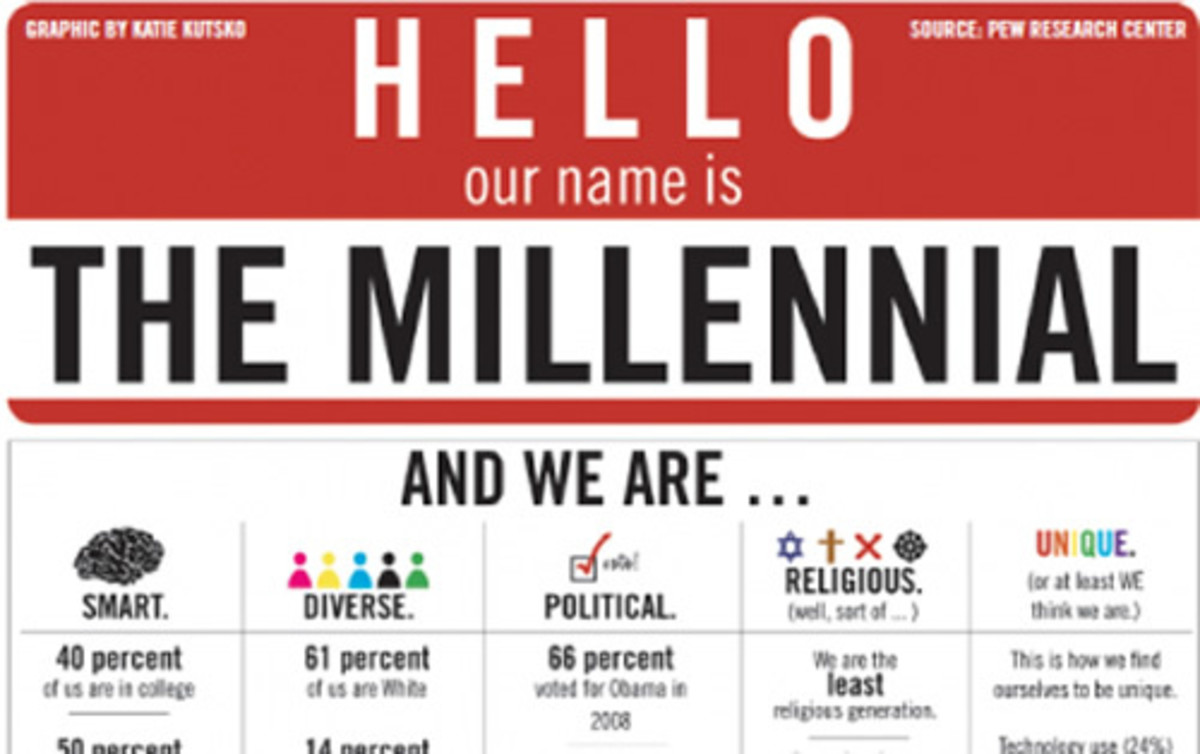

Generation Y Characteristics Include Being Stingy with Gift Giving

In a blow to the underwhelmed retail sector in Australia, surveys have revealed that about 10% of people aged 18 – 24 years of age intend to keep all their money in their purses and pockets at Christmas and to give no presents.

Many people in the so-called 'Me Generation' are saving for their dream holiday backpacking around European or for their first car. They plan to cut back on Christmas presents this year or give none at all. This amounts to almost one million Australians, and the Christmas present boycott is likely to hit retailers very hard.

The Consumer Christmas Spending report commissioned by the Suncorp Bank also showed how the 50-60 years age group was also planning to spend less, apparently because people of superannuation or self-funded retirees have been hit hard by the decline in interest rates that has devastated their incomes.

Social analysts have attributed the lack of spending by the 18 to 24-year-olds to what has been referred to as ‘adultescence'.

These young people are adults but behave like adolescents and expect to get present from their parents without giving return gifts, even to their friends. In Australia about half of them are still living with mum and dad, at home. They are still acting the role of child, despite being adults.

Children receive gifts and don't give them and they are still following these rules. Many of them are studying and so they have limited income, but they can still afford to save up for holidays and things like cars.

The consumer surveys showed that the big spenders are those in Middle-age (45 to 54 years) many with children. It has been estimated that almost half of this group expect to spend more than $500 on gifts this year.

Only about one third of the Gen Y group expect to spend this amount. About 40 % of Gen X (35 to 44) expected to spend at least $500 on gifts.

The remaining people were frugal shoppers (about 50%) were expected to spend between zero and a modest $200 on all gift this Christmas.

Effect of Global Financial Crisis on Generational Groups

Research has shown that Australians under the age of 32 years altered their spending patterns much more than any other age group, in recent years, during a time of financial uncertainty.

This has partially been driven by a fear of the impact of rising unemployment.

More than 50% of Gen Y's surveyed during 2012 for the Bankwest Financial Fitness Index stated that they had become more frugal, despite the number of them being classified as "financially fit'' doubling over the last 12 months.

Generation Y is generally the group least burdened with mortgages and other long-term debt, so that have more room to move than most other generation groups.

They also have the largest potential disposable income. They have also been shown to have reduced dependence on credit cards.

The nationwide survey of 1000 people conducted by the bank produced some other interesting results about the financial state of Australians in 2012.

The survey classified people according to their financial status.

- Financially ‘fit’ individuals were those with regular savings, good insurance cover, low housing costs and low levels of debt.

- The middle group were referred to as ‘borderline” with moderate debt, moderate savings, some insurance cover and average housing costs.

- The worst case were deemed are financially "unfit'', paying more than they can afford on housing, over-burdened by debt, and having few savings.

The survey found that:

- 50% of Australians were financially ‘borderline’

- 25% were financially ‘unfit’

- Only 25% were financially ‘fit’

- Despite this the financial status of Australians in 2012 is better than the trough that occurred during the global financial crisis of 2008.

- Consumers are responding to the economic crisis by being more conservative with their finances, including spending at Christmas.

- Retirees, who have become the financially fittest group in the past year, overtaking the baby boomers who held the prize in previous surveys

- Men are on average, financially healthier than women,

- Generation X (aged 33-46) are generally the worst group for managing money.

- The three biggest items in household budget across Australia in 1012 were energy, food and transport.

© 2012 Dr. John Anderson