Home Loans and Dealing with Your Lender

What is required by the Lender in a Home Loan

When you getting a loan to purchase a home, most all lenders will require that you give a comprehensive financial statement. This usually is covered when you complete a mortgage application. When you fill out the application, there is information there that helps them to determine whether or not you qualify for a loan. It also helps to determine how much you can borrow.

There are some key things they will be looking for. They are going to look at your income, debt and expense ratio, and the value of what you own. The application is pretty standard.

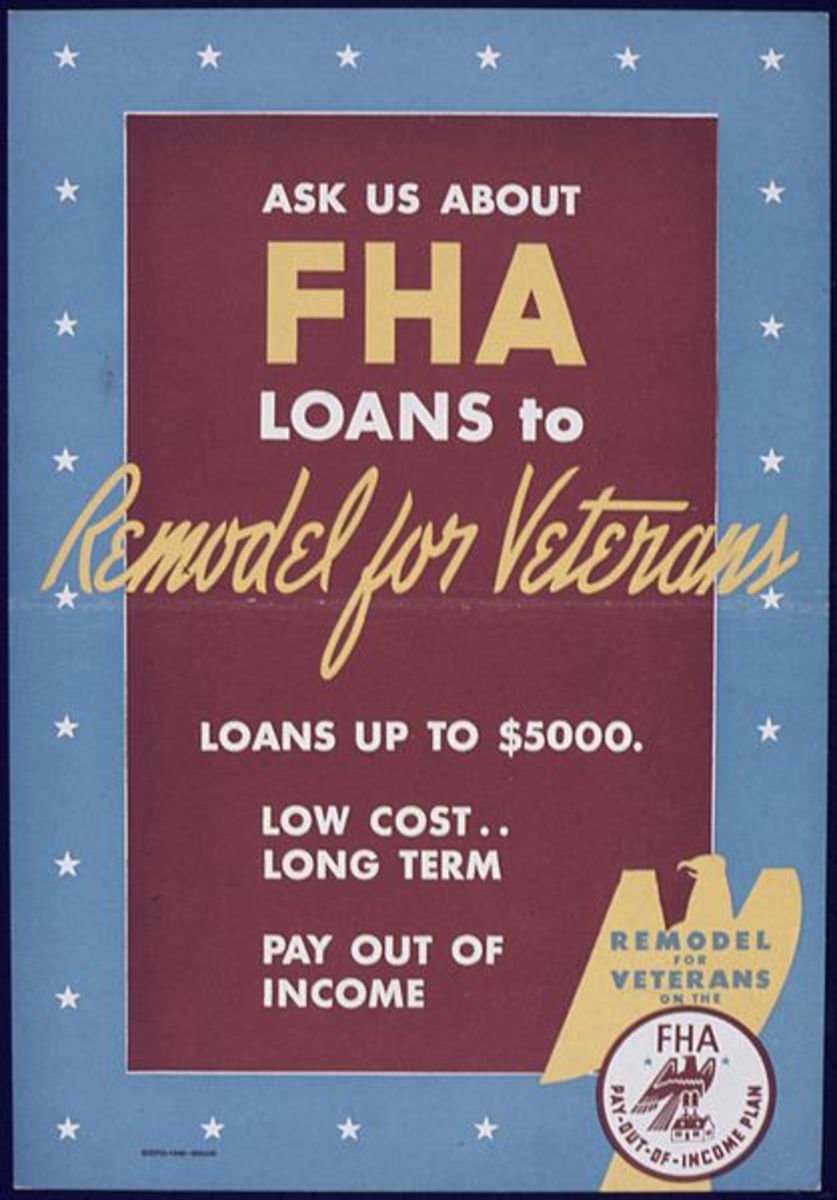

The other things required by a lender will be a survey, application fee, origination fee, and private mortgage insurance. You can give them a survey, or an official surveyor's drawing. The property and all the buildings on it will be on the survey.

The application fee, as well as the origination fee are to cover the costs of processing your loan application. The lender wants to know if the appraisal of the house is worth the mortgage loan. So these fees usually include the appraisal of the house. Its good to plan on the application fee to be about two hundred and fifty dollars, plus a percentage of the amount of the mortgage, like one percent of the mortgage.

Private Mortgage insurance, or PMI, is usually required if your down payment is less than twenty percent of the price. This is a guarantee to the lender if you should default on your loan.

Committment Letter

When your mortgage is approved, you will get a commitment letter. This letter will spell out how much you are able to borrow. It also states how long the offer of that amount is good for.

Sometimes the lender will turn an application down, and hopefully that will never happen to you. Even if that does happen, however, you can always try a different lender. While a lot of lenders use the same basic information, they may approach things differently. They might evaluate the information differently or help you to find mortgage sources. You can always approach the seller as well, and ask them to lower the price or maybe even loan you the money if they are really wanting to sell. It never hurts to ask, and it might help the transaction to be completed.