- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

How Donation for Tax Benefit Works

It’s the time of the year when everyone is trying their best to figure out how to avail tax benefits or as a layman would put it, how to save tax. People opt for one of the several tax saving options, like claiming interest and principal components of their home loan, life insurance premiums, medical expenses, etc. What most people don’t realize is that one of the simplest options is to donate to charities, for it doesn’t just entitle you to 100% tax deduction, but also helps you do your bit for a cause.

Donate and Save Tax

In accordance to the Income Tax ACT, charitable institutions are eligible for income tax exemption under Section 11. Similarly, donors are entitled to tax benefits under Section 35AC, Section 80G, Section 80GGA, etc.

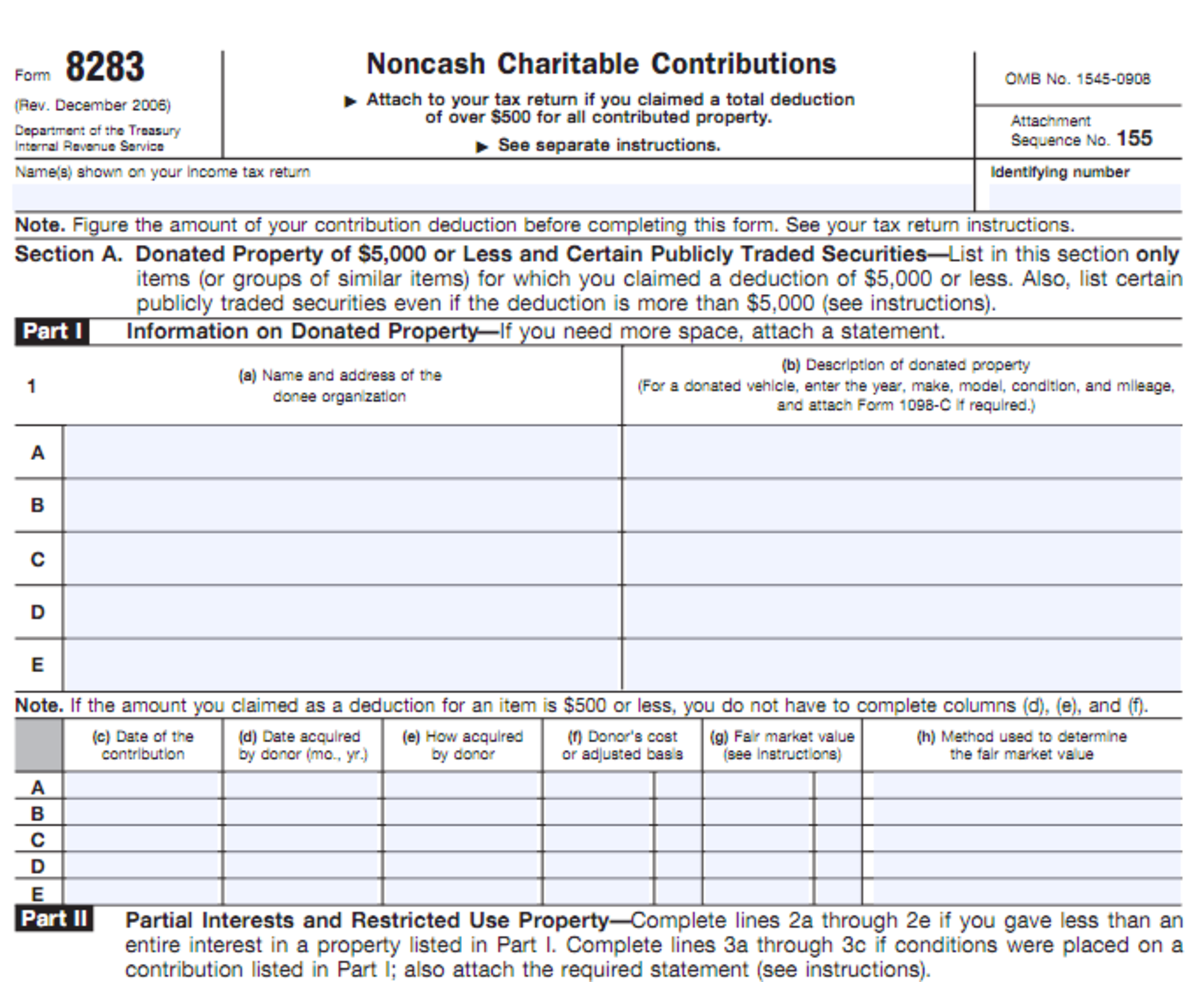

35AC / 80GGA: If your source of income is business or profession and you are donating to institution approved by the National Committee (Finance Ministry) for carrying out any eligible project or scheme, then you are entitled claim 100 % deduction of your donation amount under Section 35AC. The assesses with source of income other than Business can claim deduction for this contribution under section 80GGA. The Mid Day Meal program run by Akshaya Patra is approved as “Eligible project “for section 35 AC deduction, thereby enabling donors to claim 100% tax deduction for the donation amount.

80G: Under Section 80G, 100% or 50% tax deduction can be claimed depending on which purpose and the agency you are helping. If you are donating to the Prime Minister’s National Relief Fund and other funds specifically listed in the IT Act, you are entitled for 100% tax benefit.

The donation to other NGOs who are Registered with Income Tax Dept as eligible to raise donations with section 80G benefit, are eligible for 50% deduction for tax purposes.

Charitable institutions use these provisions in the Income Tax Act to encourage donors.

Which Institutions Are Eligible?

One has to be careful as tax benefits can only be claimed on donation to certain institutions/NGOs. It’s the prerogative of the Central Government to approve the specific program of charitable institutions for benefit under section 35AC / 80GGA. The Akshaya Patra Foundation’s flag ship program of Mid-day meal is approved by Finance Ministry as eligible project under section 35AC. Any donation of Rs. 500 or above to the Foundation’s Mid-day Meal Programme is entitled to 100% tax exemption under Section 35AC of the Income Tax Act of 1961.

How Do Tax Deductible Donations Work?

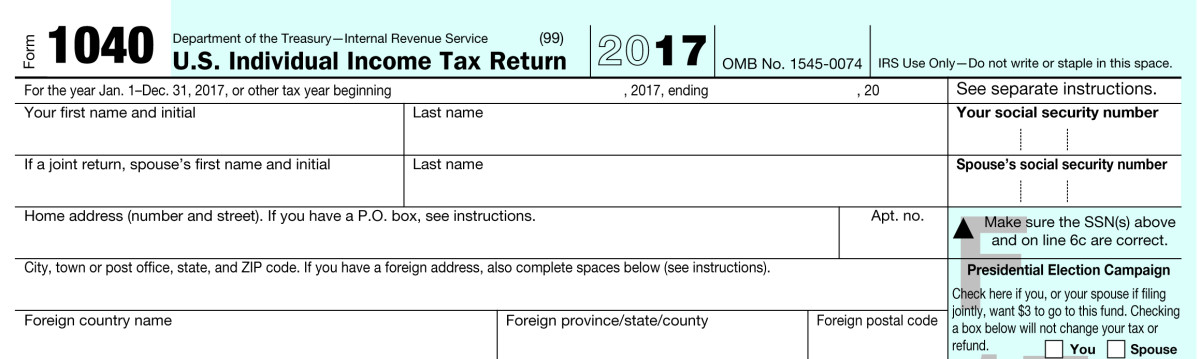

Let's say your taxable income for the said financial year is Rs. 2,00,000 and you make a donation of Rs. 5,000 to a charitable program approved under section 35 AC, then your net taxable income will come down to 1,95,000 and your tax will be calculated on this amount. The institution you have helped will issue a certificate to you for your contribution, which you can then use to claim exemption from taxable income. Simply put, the exemption works by reducing the donated amount from your taxable salary.

In the end, considering that not-for-profit organisations are playing a significant role in bringing about social and economic change in the country, it’s important that they get support from all quarters. This is where you come into the picture. You can come forward and contribute. Your support will help us reach out to more beneficiaries and bring about a much-needed change in the society.