Survive Stock Market Volatility

Don't Get Burned by Volatility

Stock Market Volatility

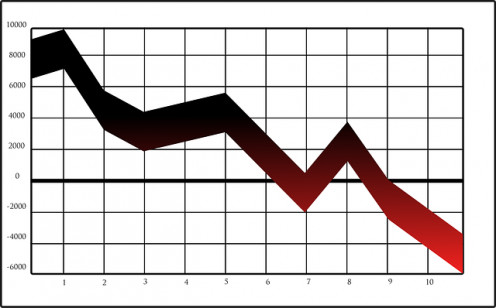

Once again, the stock market seems to crash or soar each day in reaction to global geopolitical events. All it takes to jolt the market is a comment from President Obama or Congressman Boehner about U.S. taxes or spending, or a development involving Greece or Spanish debt, or an update on China's growth rate, or another Middle East bomb attack.

Many investors react to stock market volatility by selling stocks in a panic, thereby locking in losses. Instead of panicking, these investors would be better served by understanding volatility, and using their new-found knowledge to calmly manage their investments even during times of high volatility.

This article defines volatility for the stock market as a whole, and then for individual stocks. It then provides tips to survive a volatile market. By following these tips, investors can be more comfortable in their investment strategy, and avoid the losses that come from panic selling.

Volatility for the Stock Market as a Whole: VIX

Stock market volatility refers to the relative rate at which the market's price moves up and down. Volatility can be measured by calculating the annualized standard deviation of daily price changes in the stock market. Volatility is high when the stock market's price moves up and down rapidly over short time periods. Volatility is low when the stock market's price stays relatively steady over time.

The benchmark for measuring stock market volatility is the Chicago Board Options Exchange Volatility Index, or "VIX". The VIX is based on real-time options prices for the S&P 500 index which reflect the collective view of investors on future stock market volatility. The VIX is often referred to as the "investor fear gauge" because high volatility accompanies instability in the financial marketplace.

The VIX hit a peak above 70 points during the height of the financial crisis at the end of 2008 and start of 2009. Investors will recall this as a very turbulent period when the Dow Jones Industrial Average routinely moved up or down by triple digit amounts. The VIX closed at 15.87 on November 30, 2012, at the low end of its 52-week range of 13.30 to 30.91. Thus, despite recent increased volatility, the VIX indicates the volatility of the market is still fairly low.

Volatility for an Individual Stock: Beta

The volatility of an individual stock relative to its benchmark index is measured by its "beta". Typically, the benchmark index for stocks is the S&P 500 index. Beta measures the amount by which changes in a stock's price are expected to follow changes in the price of the S&P 500 index.

A beta of 1.0 indicates a stock's price is expected to move in line with the overall market. For example, if the S&P 500 index increases by 0.5%, then a stock with a beta of 1.0 is expected to increase by 0.5%. A beta of higher than 1.0 indicates a stock is expected to be more volatile than the market, while a beta of less than 1.0 indicates a stock is expected to be less volatile than the market. A beta of 0 indicates the price of an asset has no correlation with the price of the overall market. A beta of less than 0 indicates the price of an asset moves in the opposite direction from the market.

Thus, a stock's beta makes it easy to determine the expected volatility of that stock. For example, since the beta of GE's stock is 1.37, an investor can easily determine that GE's stock is more volatile than the S&P 500 index. For another example, since the beta of AT&T's stock is 0.44, AT&T's stock is less volatile than the S&P 500 index. Beta values for stocks are easy to find. For example, Yahoo Finance provides the beta for each stock in its summary screen for the stock.

Tips for Surviving a Volatile Stock Market

Now that we've defined the volatility of both the stock market as a whole (measured by the VIX), and the volatility of individual stocks (measured by beta), let's look at tips for surviving a volatile stock market.

Information on Stock Investing

Tip #1: Do Nothing!

That's correct. The first tip for surviving a volatile stock market is to do nothing!

Many investors react to stock market volatility by panicking and immediately selling their stocks. This panic behavior, unfortunately, often causes investors to sell stocks low which they bought high, thereby locking in losses. As we've seen repeatedly over the last few years, plunges in the stock market are often followed by dramatic reversals, and investors who sell after the plunges only miss out on the dramatic rises that often follow.

Investors who understand stock market volatility will realize that volatility is a two-way street since it refers to the relative rates at which markets move up and down. By selling in a panic after the market moves down, these investors fail to benefit from the upward movement that's also a part of volatility.

Thus, the best way to react to stock market volatility is typically to do nothing. Rather, investors are better off sticking to their overall investment strategy, and ignoring the day-to-day market movement.

Tip #2: Implement an Investing Strategy--and Stick to It!

Every investor should have an investing strategy reflecting his long-term financial goals and risk tolerance. For example, many investors follow a well-known strategy that calls for splitting their investments between stocks and bonds, with the percentage of stocks equal to 110 minus their age, with the rest in bonds. A 40-year old investor using this strategy would put 70% of his investments in stocks and 30% in bonds, and then periodically re-balance his portfolio to maintain this balance.

An investor who has implemented a sound investing strategy can survive a volatile stock market by sticking with that strategy even when the market turns volatile. For example, if volatility skews the portfolio of the above 40-year old investor so it becomes 60% stocks and 40% bonds, he should continue to re-balance his portfolio so it returns to his target of 70% stocks and 30% bonds. By taking this action, he will buy his investments low and sell them high, which will serve him well.

Tip #3: Use Beta to Understand the Volatility of Your Stocks

In deciding on their investment strategies, investors need to determine their risk tolerance to avoid getting into positions where they are likely to panic during periods of market volatility.

Investors with low risk tolerances can use beta to build stock portfolios they expect to be relatively stable even in times of high stock market volatility. Such investors can insure their stock portfolios include low beta stocks such as AT&T. To provide diversification, they can also buy assets with zero betas (such as cash) or even assets with negative betas (such as gold).

On the other hand, investors with high risk tolerances can use beta to seek out stocks likely to provide higher average returns over the long run, even though they may be volatile. For example, such investors may want to buy highly-volatile technology stocks in hopes of higher returns.

Tip #4: Build a Well-Diversified Investment Portfolio

Another tip for surviving a volatile stock market is to own a well-diversified investment portfolio. By owning different types of stocks (e.g., large-cap, medium-cap, small-cap, growth, value, international, etc.), by investing in mutual funds rather than individual stocks, and by splitting investments among different asset classes (e.g., stocks, bonds, real-estate investment trusts, CDs, etc.), an investor can decrease the beta of his overall investment portfolios, and thereby decrease its volatility.