How to Understand Your Credit Score

It's important to understand your credit score when you want to apply for new credit and to maintain an overall healthy credit report. First of all, there is a different between your credit score and your credit report and lenders may take more into consideration that just your credit score, depending on the type of credit you are applying for.

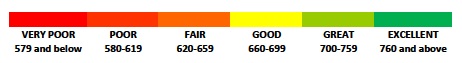

You credit score, also known as your FICO score, ranges from 300-850, with 300 being the worst and 850 being the best. Be aware that some creditors, such as GE Capital Retail Bank, have their own variation of a credit score. So, if you apply for a new line of credit and they say your credit score is 490, before you freak out, check the credit score range and you might find that their range is 200-620.

Your credit score is calculated using a complex algorithm that takes into account hundreds of factors and values. Here, you will discover the key factors that are involved in computing your score, how your spending habits affect each factor, information that is included and not included in your score, resources for monitoring your score and tips for maintaining a healthy credit score. By the end of this article, you should have a better understanding of your credit score and it's different components.

What are the credit score ranges?

Your Credit Score Break Down

Credit Score Influencer

| Weight on Credit Score

| What It Means

|

|---|---|---|

Payment History

| High

| Having and on-time payment will positively impact your credit score while late payments and derogatory marks will negatively impact your score.

|

Amount of Debt Owed

| High

| Credit card utilization of 20% or less will positively impact your score. The closer you get to maxing out your credit cards, the more it will negatively impact your score.

|

Length of Credit History

| Medium

| The longer your credit history the better for your score.

|

New Credit

| Low

| A high number of new accounts and credit inquiries will negatively impact your score.

|

Types of Credit Used

| Low

| A healthy mix of credit types will positively impact your score.

|

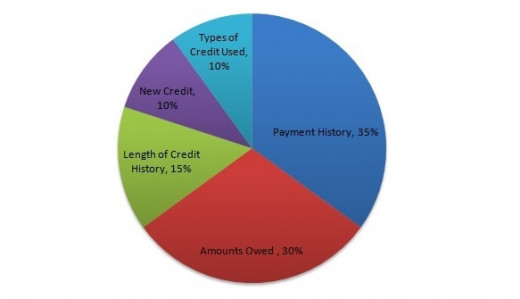

Key Factors Involved in Calculating a Credit Score

Percentages of importance shown in the pie chart below are for the general population. Exact percentages may be different for different credit profiles.

Payment History:

Approximate weight on credit score: 35% or HIGH

Your payment history is probably the most important factor taken into consideration when calculating your credit score. Making payments on time, taking care to not miss payments and keeping your accounts in good standing is the best way to maintain a good credit score.

Say that you've made 100 payments on-time and your score is 706. If you miss even one payment, so that you've made 99% of your payments on time, your score could drop to 658, which is a significant difference. Take care to make your payments on time.

Any derogatory marks will have a huge impact on your score. A derogatory mark will be on your credit report if you have any accounts in collections, bankruptcies, civil judgement or liens. It can take 7-15 years for a derogatory mark to be cleared from your credit report. If you have a credit score of 709 and then one of your accounts goes into collections, your score could drop to 631. Ouch! It's always better to call your creditors to work out a different payment schedule if you're having trouble paying your bills on time. You always want to try to work it out with your creditors before letting your accounts default or go into collections. Lenders may be willing to work with you because it is better for them to get some money by working out a payment plan with you rather than getting nothing at all if you default.

Amounts Owed

Approximate weight on credit score: 30% or HIGH

Another important part of understanding your credit score is the amount of debts owed. Though it is important to keep your accounts active, you don't have to carry a balance from month to month. Using your credit card to make everyday purchases and then paying it off in full every month will help keep your credit score healthy without accruing interest.

Generally speaking, you want to keep your credit card utilization to 20-30% or less. What this means is that in order to maintain a healthy credit score, you should not carry a combined balance on your credit cards that is more than 30% of your available credit. For example, if you have $10,000 available credit on all of you credit card accounts, you should keep your account balances to a combined $3,000 or less or it may start to negatively impact your credit score.

Though it is not included when calculating your credit score, some creditors may check your income to determine how much credit you can afford to take on and how much credit they will offer you. They may also take into consideration your debt to income ratio, or the ratio of how much you owe in debt payments to how much income you earn on a monthly basis. This ratio is especially important for larger loans, such as mortgages.

Length of Credit History

Approximate weight on credit score: 15% or MEDIUM

How long your accounts have been open will impact your credit score. Creditors are more willing to give credit to those who have demonstrated that they are responsible with credit over a long period of time. If you have little or no credit history, your options will be limited when applying for credit. Many times, you will be given a low limit on revolving credit accounts or creditors will ask you to apply for a secured credit card to build some credit before you more options will be made available to you.

You want to keep old accounts open and in good standing. The average age of open credit lines will be used when calculating your credit score, so opening a number of new accounts at the same time may negatively impact your credit score.

The Difference between Revolving Credit and Installment Loans

Revolving credit is based on a credit limit that you can continually make charges against as long as you make your monthly payments. Interest rates on revolving accounts tend to be higher than installment loans and may vary greatly from one line of revolving credit to another. Payments on revolving accounts go up and down each month, depending on how much you have charged that month. The most common example of revolving credit accounts are credit cards. Another example would be a home equity line.

Installment loans are given as a lump-sum and are repaid by fixed loan terms with fixed monthly payments. Installment loans are generally reserved for big-ticket items such as homes, cars and student loans.

New Credit

Approximate weight on credit score: 10% or LOW

By opening several credit accounts in a short period of time, you may appear as a risk to creditors, especially if you don't have a long credit history.

Included in this category that is also taken into consideration when calculating your credit score is the number of hard inquiries on your report. Hard inquiries are placed on your report anytime your apply for credit. They are dropped off your report after 2 years. Having a high number of inquiries on your report tells lenders that you are in pursuit of new credit and therefore higher risk. Inquiries that are for promotional purposes or for your personal knowledge are considered soft inquiries and do not impact your score. So, those "pre-approved" credit offers you receive in the mail do not count as hard inquiries on your credit report. However, if you apply for one of those offers, a hard inquiry will be added to your report.

When applying for a car loan, mortgage or student loans, it's normal to shop around for the best rates. However, this causes lenders to request your score which puts hard inquiries on your report. When you rate shop and find a loan within 30 days of rate shopping, the inquiries in a particular shopping period will count as only one inquiry. This is why, when shopping for loans, it is better to do your research and complete your rate shopping within a predetermined short period of time. If you apply for credit with one bank, then wait a week or two for a decision, then apply at a different bank and wait a week or two for a decision, the inquiries will show up as separate inquiries on your report and negatively impact your score.

Types of Credit Used

Approximate weight on credit score: 10% or LOW

For an excellent credit score, you need a mix of different types of credit, which might include: credit cards, retail accounts, installment loans, finance company accounts and mortgage loans.

Also considered in this category when calculating your credit score is the number of accounts you have open. Having more accounts open generally means a better credit score because it shows that more lenders are willing to give you credit. That being said, it's generally not a good idea to open a bunch of new accounts all at once to try to improve your score. That strategy may backfire on you. It's better to build your account portfolio over time.

What Information Is Included in a Credit Report?

Remember that there is a difference between your credit score and your credit report. Here is a summary of the information that is included in your credit report.

Identifying Information: Though not used in credit scoring, your credit report will include identifying information, including: your name, address, employment information and your Social Security number. You might notice when that when you apply for credit that some lenders will ask you for pieces of this information to help identify you and protect you from identity theft. Please be sure whoever you provide your personal information to is trusted and uses a secure system to help protect your identity and finances.

Trade Lines: Trade lines are all of your credit accounts. Creditors report to the credit bureaus the type of account, the date you opened the account, the account limit or loan balance and your payment history; all important pieces used to calculate your credit score.

Credit Inquiries: Anytime you apply for new credit, an inquiry will appear on your report, as discussed above. Anyone who has accessed your credit in the past 2 years will appear on your credit report, including both hard and soft inquiries.

Public Record and Collection Items: Any public records or information from collection agencies are gathered by the credit bureaus. Any bankruptcies, foreclosures, suits, wage attachments, liens and judgments are considered public record.

Information that's NOT Included in Your FICO Score

Though your address, employment history and income is included in your credit report for identification purposes, the following information will not impact your credit score.

- Age

- Race, color, religion, national origin, sex or marital status

- Salary, occupation, title, employer or employment history: Though it's included in your credit report for identifcation purporses, this information does not impact your credit score.

- Where you live

- Interest rates being charged on any accounts

- Child/family support obligations

- Rental Agreements: Unless your rent is overdue and/or in collections.

- Certain types of inquiries: Again, soft inquiries will not affect your credit score. Soft inquiries include credit requests by you for your own personal information or when your report is requested for promotional offers. Hard inquiries will affect your credit score and you receive a hard inquiry anytime you apply for credit.

- Whether or not you are participating in credit counseling

How to Check Your Credit Report

You can check your credit report once a year for free from AnnualCreditReport. It's a good idea to keep track of your score and to review your report carefully to look for mistakes, which happen to be more common than you might think. In fact, in 2004 the U.S. Public Interest Group, or the U.S. PIRG, did a study that revealed that 25% of credit reports had a serious error that would result in credit denial and 79% of reports had an error of some kind! To check your report for free, go to:

Please note that checking your credit report for free won't give you your FICO score. However, you will be able to check all the activity that makes up your score. Be sure to check your credit report from all three of the major credit bureaus, which are: TransUnion, Equifax, and Experian. There might be a mistake in one of the reports but not the others. You might be saving yourself a headache in the future by checking thoroughly.

Please note it's not really free to check your credit score on Freecreditscore.com. It's actually a credit report monitoring agency that will give you your score if you sign up for a "free" trial with them, which requires a credit card. If you want to pay to have your report monitored around the clock and to help prevent identity theft, then it might be a good option for you. However, there are wonderful free resources available where you can check and monitor your credit.

Also, keep mind that most free scores you get are not the exact scores that lenders will see. However, as long as there are no errors in your report, the free scores that you see should be close enough to give you a general idea of where you stand.

Free Resources for Credit Monitoring

Credit Karma: My personal favorite free website for credit monitoring is Credit Karma.

- Credit Karma - Free Credit Score & Credit Report Data. No Credit Card Needed

Instantly receive your free credit score and free credit report data online. Free credit tools to track and optimize your credit score. No credit card needed & no hidden fees.

I personally use Credit Karma and I believe that it's an exceptional free resource. You have the option to turn on credit monitoring so that you receive alerts anytime anything in your credit report changes. It's packed full of resources and ideas to help you improve you credit score. You can compare where you stand to the rest of the population. It gives you are credit report card, where you can see your grades for the important factors that impact your credit score. A feature on Credit Karma that is fun to play around with is their credit simulator. It takes your credit score and then you can simulate how your score might be impacted in different scenarios, for example, if you add a new account, increase your credit limit, or pay off all of your credit cards.

Even if you use Credit Karma, you'll still want to check your three free reports every year to check for errors.

Credit Sesame: Another free resource where you can obtain your credit score is Credit Sesame. Credit Sesame is more geared toward those looking at home loans or refinancing mortgages, but still provides tons of helpful information regarding credit scores.

- Free Credit Score, Home Loans, Refinancing & Mortgage Rates | Credit Sesame

Find the best home loans, refinance and mortgage rates based upon your credit report and financial goals. Get your free credit score report no credit card or trials required!

Got Credit Credit Score Estimator: If you would like a rough estimate of your score, you can use a credit score estimator, like this one from Got Credit.

- Free Instant Credit Score Estimator

Estimate your credit score without pulling your credit report with our free credit score calculator.

Of course, there are many websites where you can sign up for a free trial for their credit monitoring services and you will receive your free credit score. The hiccup with this technique is that if you're only signing up to receive your free credit score, you have to remember to cancel within usually 30 days. Many will require your credit card information before you can sign up for a trial. And it can be a pain to cancel trial accounts, where you have to call customer service and sit through a number of sales pitches before your account will be closed. Personally, I find Credit Karma to have all the information you'll need to monitor your credit and is always free.

Tips for Improving Your Credit Score

Building an excellent credit profile will take time. The best way to maintain a healthy credit is to make sure that you make your payments on time and to not take on too much debt. That being said, here are some tips that will help you improve and maintain a good credit score:

- Pay down debt. If you carry more than 20% of your available credit limit on your revolving credit accounts, paying off some debt will improve your credit score, maybe a lot in some cases. If you have a clean payment history but are maxed on your credit cards, your credit score will drastically improve once you pay off your cards. As mentioned before, your credit utilization is one of the factors that carries the most weight on your credit score.

- Make payments on time. Be diligent in keeping track of your accounts and payment due dates. Your payment history may have the most weight on your credit score, so keeping a clean slate is extremely important to having a good credit score. Remember that late payments, defaults and bankruptcies may take years to come off your credit report. The sooner you start a track record of on-time payments, the better. The longer history you have of on-time payments, the more your score should increase.

- Check your credit report. As mentioned before, errors in credit reports are surprisingly common. Make sure your credit isn't being impacted by a credit bureau error.

- Pay off your credit cards a month or two before you plan on applying for a mortgage or car loan to improve your score and to get better rates.

- Contact your creditors or consider credit counseling if you are having trouble making ends meet.

- Don't open new credit cards just to increase credit limits or to move debt around. It's much better to pay down your debt. Also, it will hurt your score to open accounts for promotions and then to close then soon thereafter. Only open accounts that you will use and plan on keeping open for a long time to come.

- Closing an account won't make it go away. Late payments or accounts in collections won't disappear if you close the account or pay off the debt. These derogatory marks can remain on your report for years, even after the debt is paid or the account is closed.

- Reconsider closing your accounts. For credit cards you no longer use, don't close them yourself but, rather, don't use them and wait for the card issuer to close the inactive account. Cut up the card so you won't be tempted to use it. Or, keep your older accounts and close the newer ones. If you close your older accounts, it may make your credit history seem shorter which will negatively impact your credit score.

- It takes time and consistency to build an excellent credit score, so avoid any advice that claims to improve your score fast. In general, if you follow the guidelines to maintaining healthy credit, you should see improvements in your score in 6 months to a year. Those with the best scores make their payments on time, keep their credit card debt low and have a history or responsible credit use.

Congratulations! Understanding your credit score is the best first step to building, improving and maintaining good credit. Being interested in learning how credit works and informed about your credit score shows that you are taking initiative and your credit will benefit from your knowledge and diligence. I will be happy to answer any questions or comments you might have.