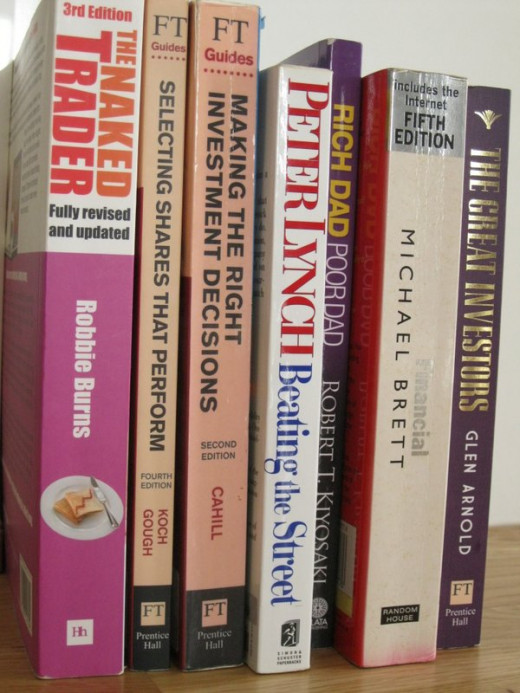

7 Investment Books Worth Investing In?

What books on investing really show a good return on the capital outlay required to purchase them?

Investing is a complicated, unusual, sometimes frustrating, but ultimately fascinating subject, and an area where you can never gain too much knowledge. Ultimately, if you make the decision to invest your own hard earned money, then you, and only you, are responsible for the outcome and you cannot blame anyone else for your mistakes. So it pays to look at as much information as you can before you make your decision. As the Naked Trader would probably say - Don't be lazy, do your research!

The following books open a window into the world of great investors, and by reading them, you can only hope that some of that knowledge rubs off.

1. Share Selection

This section includes books aimed at helping the reader learn how to pick specific stocks and shares in which to invest.

The Naked Trader In His Own Words

"The Naked Trader: How Anyone Can Make Money Trading Shares" 3rd Edition by Robbie Burns

Robbie is a successful investor and writes here in a very clear manner about the lessons he has learned on his route to success. He includes information on practically everything someone considering starting investing in company shares would need to know and consider, and details his own successful strategies for making money from trading and investing. He writes in an everyday language that makes it seem as though you have a friend patiently explaining the realities of investing to you, and he cuts through the jargon to clearly show how he goes about picking stocks and shares, and how he tries to maximise his wins and minimize his losses. He looks at all aspects of the investment game including profit targets, stop losses, timing, trends etc., and always advocates learning as much about a company as possible when considering an investment. The illustrative examples of investing mistakes that both he and his readers have made are real cautionary tales about the dangers of getting it wrong and show how much there is to learn.

"Financial Times Guide to Making the Right Investment Decisions: How to Analyse Companies and Value Shares" (The FT Guides) by Michael Cahill

This is a comprehensive work detailing the many aspects affecting the genuine valuation of a company, and looks at how the investor can seek to assess these complex structures through the information publicly available. There are many illustrative examples throughout the book showing how such things as cash flow, profit warnings, or indebtedness will affect the different financial structures of companies with different business models. Other important aspects such as quality of management and quality and visibility of earnings are covered in depth here, whereas they rarely appear in other investment books. There are very clear and useful explanations of the various different measures of corporate financial health, and their applicability in various different circumstances is discussed. This is a pretty complete guide to company valuation.

"Financial Times Guide to Selecting Shares that Perform: 10 Ways to Beat the Stock Market" (Financial Times Series) by Richard Koch and Leo Gough

The Financial Times has published several excellent investment guides, and this one is no exception. It argues that an investor should manage their own portfolio and share investments, and gives in-depth explanations of 10 completely different investment strategies which have proven successful over the years. Where this book differs from others is that it aims to get the reader to understand what personality-type of investor they are, and then use that knowledge to choose the most relevant and suitable strategies for them. The different strategic styles, and the difficulties associated with them, are each discussed along with their applicability for the various investor personalities.

"The Great Investors" by Glen Arnold

If you are going to learn about investing, then why not learn from the greats? Glen Arnold biographies 9 great investors and examines how they found their own unique style of investing based on their own personalities, insights, and ways of seeing the world. Each chapter focuses on one of the great investors of the last century and what made them tick, and follows up with a description of their investing style and their personal strategic approach. Each investor and philosophy studied is different from the last.

"Beating the Street" by Peter Lynch

Peter Lynch here skips through his years as the Fidelity Magellan fund manager, in which time he increased the funds under management from $18 million to $14 billion. Obviously not all of that was as a result of his share picks increasing, but he took a notional $1000 investment to $28,000 in those 13 years. Here he describes his favourite methods for finding winning companies and undervalued stocks that others are overlooking, and declares that if they are willing to put in the hard work and investigate enough companies, the amateur stock picker can still compete with the investment professionals. Peter gives his golden rules for investing and uses a large portion of the book to describe how exactly he narrowed down the selection of stocks he recommended to the Barrons expert panel in 1992. This book as well as others is also fully reviewed here.

2. General Investing

The books in the following section are not specific to selecting particular stocks, shares or investments, but are very useful for clarifying the mysteries of the financial world and investing for financial security.

"Rich Dad, Poor Dad: What the Rich Teach Their Kids About Money - That the Poor and the Middle Class Do Not!" by Robert T. Kiyosaki

Not specifically about investing, this classic book is a guide to how the average person can learn to make their money work for them, with the attainable aim of becoming financially free. It clearly illustrates the real difference between liabilities and assets, and shows that most people have the wrong ideas about what it takes to become wealthy. Robert emphasises the need to educate yourself financially to understand these differences, and how you should think about money and investing to to set yourself on the right path to financial freedom. For him, financial literacy is a must, and is something that must be continuously increased.

"How To Read The Financial Pages" by Michael Brett

Issued at the start of the internet age when the majority of investment reporting was still taking place through newspapers, this book is a jargon-buster that allows the non-professional into the world of business and investing by demystifying the mass of terms surrounding the subject. It encompasses company valuation, market regulation, corporate governance and the forces at work which cause the prices of various financial instruments or traded goods and commodities to move one way or the other. Purporting to be a book simply explaining financial terms to the layman, it is actually a full discussion of how the various financial systems work, and the specialized language that is used to describe them.

Summary

The above reviewed books have all indeed proved to be a wise investment for the author, as they have helped him immensely in increasing his financial education.

© 2015 ChessLover