Investing in Bonds - Things to Consider

Choosing to Invest in Bonds

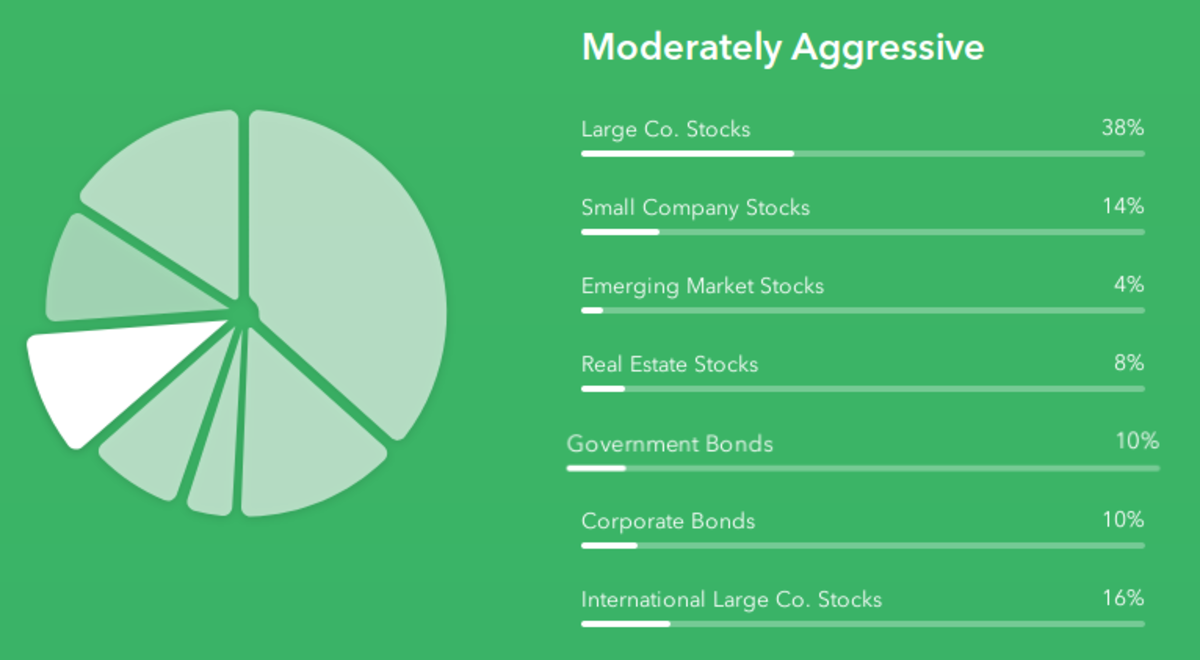

Bonds allow you to be a creditor really, instead of a being part owner as it is with stocks. Bonds tend to attract more investors because of how they regularly pay interest (income) and of course pledge to pay the amount back that you invested in the bond. They are loans to corporations and or governments. While stocks are equity securities, bonds are debt securities. They are fixed income securities as they pay a specific amount of interest on a regular basis.

For the average investor that may not have a lot to invest, bonds may not be as possible an option. So that is one limitation of bonds as investments. Not many bonds sell for less than one thousand dollars. It isn't easy to buy just one either. Because of this, some people invest in bond mutual funds instead. Bond mutual funds tend to not be as safe as bonds themselves are.

Savings Bonds and other types of Bonds

There are many different types of bonds out there. You will find everything from U.S. Treasury Notes and Bonds, Municipal Bonds, and Corporate Bonds, to Agency Bonds, U.S Treasury Bills and of course Savings Bonds. There are Junk Bonds too, but you want to probably avoid those unless you don't mind the risk.

Savings Bonds are a great way to go, and seem to be a tried and true method. One can buy U.S. Savings Bonds, up to 15,000 dollars a year, either through payroll deductions or from banks. They can be inexpensive, as some people invest as little as 25 dollars. Even these ones have a guaranteed rate of interest if you hold on to them until they reach maturity, or five years.

For Savings Bonds, there is no state or local taxing on the interest made, as well as no commissions. When you go to redeem your bonds after they have matured, you may owe some federal tax. One thing to keep in mind is that if you have children or plan to in the future, if you use bonds for your child's education, you may be able to avoid taxes entirely. This is a great way to maximize your money and investment.