Leasing vs Buying a Car On Loan

Getting into our own dream car for the first time is an experience in itself. The kind of satisfaction you get once you own a car is something really divine. Today there are various options available that can help you get your dream. You can either choose to go for a car loan and buy a car, or opt for leasing one – according to your demands. However, each of these options has its own merits and demerits.

According to a study, a car loan is the most common debt amongst most of the people, after mortgage and student loan. If you are planning to buy a car on loan, it is really important to get a pre-approval for your car loan, before you even choose the car you want to get. Below are certain tips that can help you in ideally choosing and proceeding ahead in your car loan:

1) Check your options properly and figure out what exactly suits you the best in a car. Is it the advanced safety features, or mileage or repair costs?

2) Once your car is decided, check for the prices at various places. You can check various websites to know the prices. Check out various points that can help you decide the best possible option here.

3) Next, apply for a conventional loan at your local bank or credit union.

4) Once you’ve got a pre-approval for your loan, you can easily go ahead with the amount and won’t get confused with all the bargaining as you know the exact price of your car. This is the most efficient way as you don’t have to check the cars in showroom you can’t afford.

Usually a vehicle loan may run between 12 and 60 months, but most of the financial advisors suggest a car loan of maximum 36 months or three years for various reasons.

1) The foremost reason is the higher amount of return payment because of more interest, if you choose to go for longer term in your car loan. For instance, if you buy a car priced at $17000, with a down payment of $2000 on a 36 month loan, you will have monthly payment of $490. Then by the time your loan term ends, your call will cost you $19,640 along with the interest, i.e. around $2640 more than the actual cost of the car.

2) If God forbid, your car gets damaged by some unfortunate incident, your insurance settlement gets done on the actual cost of the car and not on its market value. So, as your car gets older while longer loan term period, you will get quite less amount from insurance agencies for any possible damage.

If you are a first time vehicle purchaser then your best step is to look at the options and calculate whether you’d be able to finish your car loan payments in 36 months or not. If yes, then go ahead get the car, otherwise it is advisable to wisely choose a less expensive car.

Now, let us look at another picture. Imagine yourself standing in the auto showroom and as you are visualizing yourself driving your dream car, feeling excited about it – you hear the salesperson announcing the amazing lease rates on the car, which are even less expensive than the monthly loan payments. What do you think? Should you take the deal or not? Well, not before knowing all the aspects of everything.

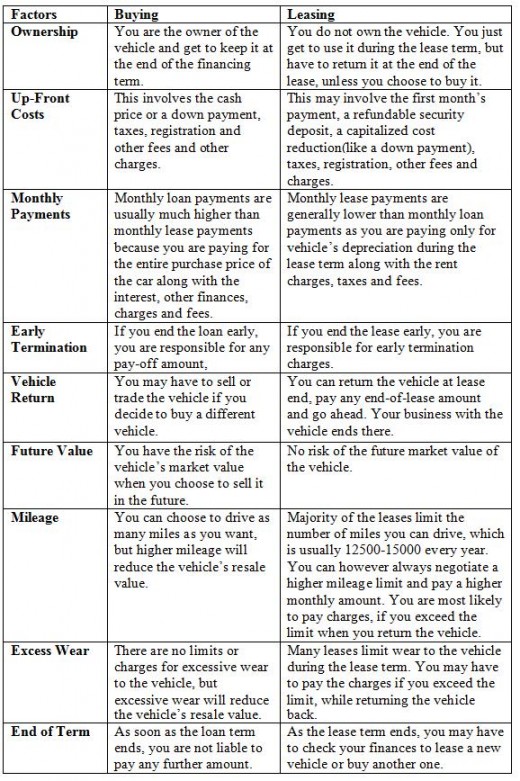

Below are certain pros and cons of owning a car versus getting one on lease:

Apart from above factors, always check the various financial programs your dealer offer you, as such offers may have hidden additional charges.

I suggest you to check both the options properly and see what suits you the best. You can choose to buy a car on loan, if you say yes to following checkpoints:

- Is this your dream car, and are you sure you are not planning to buy another car in future?

- Are you planning to settle in the present country and don't have any plans of settling abroad?

- Do you want this particular car for long term and not for some specific short term purposes?

If your answer is "No" for any of the above options, then it is advisable to opt for a car on lease. It is always advisable to have proper discussions with your financial advisor, before choosing any of the options mentioned above. You don't want to spend your nights worrying about getting out of debt and you also don't want to feel empty handed after spending so much on lease. So, look at all the pros and cons of leasing and buying a car and choose wisely.

- Want to buy a car? - Check out some essentials

I remember, when I was a little girl, I used to pull my dad out to take me for a long drive. We used to live in a small town belonging to the Himalayan Ranges of India and I loved the winding roads there,...