Making An Investment Case For Toyota Motor Corporation (TM)

Toyota the World Leader In Automotive Industry

Toyota Motor Company (TM) is fast becoming the dominant player in the world car market. Their products are manufactured with a high degree of quality, and consumers are convinced that they are the best products for their money. Toyota did not always produced such high quality products. It took the Japanese auto manufacturer a number of decade to improve its manufacturing process, and ensure a high degree of quality to all of its products. Its constant investing in research and development as well as design of products finally began to appeal to global consumers, and eventually put it atop the industry. The Company now firmly owns about 20 to 25% of the world car market, and each year beats the other auto manufacturers in sales. According to Yuri Kageyama, business writer, AP News, "Toyota Motor Corporation stayed at the top global vehicle sales in 2014, taking that auto industry crown for the third year straight... The Japanese automaker sold 10.23 million vehicles, beating out Volkswagen and General Motors. But it expects to sell; fewer trucks and cars this year, forecasting sales will fall 1 percent year-on-year to 10.15 million vehicles, according to numbers released Wednesday."

They Make Better Cars of A Higher Quality

The Japanese automaker has given a lot of time and effort to design and develop its products. Because of the amount of due diligence invested, consumers are Constantly buying the products. It also does not hurt when trusted publications like U.S. based Consumer Reports Magazine will come out and say that Toyota's products are characterized by a high quality, and have less complaints filed about them than any other of the other big two automakers (General Motors and Ford). According to William Lowry, CFA in an article written on June 13, 2014: "Here's where market share matters: operating leverage. In the fiscal year ending March 31, 2014, Toyota spent $8.3 billion on capital expenditures. Toyota maintain 62 manufacturing facilities globally. If you go from one to two shifts at a plant, you double volume but only have to pay labor and parts, in turn improving manufacturing profitability. The same concept applies to research and development (or R & D). Toyota spent $7.9 billion on R&D in the fiscal year ending 2014, developing technologies for future products. If Toyota develops a differentiating technology, it can use the technology on over 9 million vehicles,leveraging its technology investments. This should provide Toyota higher margins."

The Toyota Brands

Toyota competes in every facet of the auto industry. Its luxury brand is Lexus which is designed to compete with the high quality German luxury sedans and Sports Utility Vehicles (SUV's). The Company also challenges Ford and General Motors in the truck division as well. They have not become the dominant player in this division, but have consistently challenge the American automakers year after year. The Tundra holds its own against the Ford and GM established brand full size trucks, while the Tacoma competes with Ford and GM's mid-size models.

Toyota A Stock On the Move

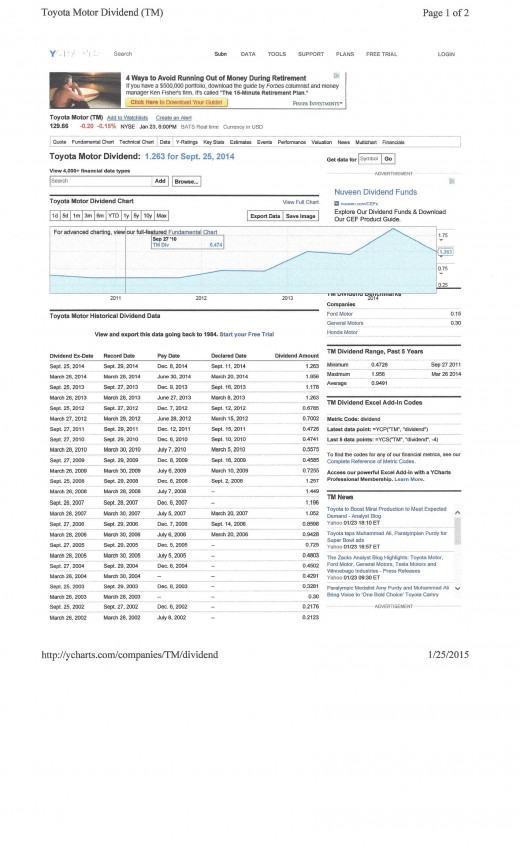

Toyota Motor Corporation (TM) stock is on the move. The stock has not dropped below $80.00 since 2011. Remember that the Company's operations was impacted by that famous earthquake in February 2011. However, since then the stock has soaked with a few pullbacks here and there. At present the stock is trading around $128 to 129.00 per share. It has steady held its own, and investors, especially the big institutional buyers (i.e., banks and insurance companies) have taken note of the stock performance. The current stock price is $129.66 with a net book value between 88.65 and 90.77 as of September 2014. The stock has an R/S rating of 79, a ACC/DIS rating of "B". This is an indication that the big institutional buyers are continuing to accumulate or buy the stock despite the fact that it is not a value stock (current market price exceeds net book value). The stock is also very low in risk compared to the other automakers. It has a Beta (risk factor) of 0.73X (times), which is one of the lowest in the industry. For those investors who chase dividends, TM's yield is very respectable at 2.2%, which is somewhat lower than Ford, General Motors and a few others. The Company has a greater return on equity (13.35%) and profit margin (9.5%) than most of the automakers. Of course, this is to be expected, given the popularity of its products as well as the high quality consumers associate with its products. Consumers tend to vote with their dollars, and TM seems to have benefited from their election of Toyota as the auto manufacturer global leader.

Toyota Will Pay Greater Dividends For Years To Come

An investment in Toyota's stock is generally a sound investment, given the facts associated with this blue chip giant. An investor will continuously realize greater dividends throughout the years because as market share expands, the company will become more profitable. Given its dividend history, as it becomes more profitable, its Board of directors will pay out more of its profits to the Company's shareholders. Of course, past history is no indication of future action, but history tends to foretell future action.

Auto Industry At A Glance

Stock Symbol

| Price

| R/S Rating

| ACC/DIS Rating

| BETA

| Dividend Yield

|

|---|---|---|---|---|---|

GM

| 33.75

| 58

| D-

| 1.11X

| 3.6%

|

F

| 14.91

| 44

| B

| 1.1X

| 4.0

|

TM

| 129.66

| 79

| B

| 0.73X

| 2.2

|

TTM

| 50.72

| 93

| A-

| 1.31X

| 0.3

|

HMC

| 31.17

| 33

| B

| 0.77X

| 2.3

|

NSANY

| 17.55

| 44

| C+

| 0.68X

| 2.8

|

VLKAY

| 44.74

| 42

| A+

| 1.0X

| 1.8

|

Numbers Speak For Themselves

The above table lays off the critical numbers used to evaluate whether an investor should commit their money to each of the company's stocks. Toyota again seems to be the best choice in auto industry. They seem to do better by the numbers. Their stock has less risk associated with it, the stock is being bought by the big institutional buyers, and it dividend competes with the other automaker. Toyota has very competitive profit margin and return on equity, a leader in the industry. However, having better numbers is expected when consumers place a high value on the leader's products and tend to buy them more than the competitors'.

General Motors and Ford Cannot Compete With Toyota

The American automakers seem to be incapable of effectively competing with Toyota. They cannot seem to manufacture products that the US and global consumers want. They also seem to be reluctant to commit the huge sums of money to capital expenditures as well as R & D that Toyota continuously spends. Thus, they are fast becoming followers of the Japanese automaker, and in some cases duplicating its products just to compete.