Making Money with a Slingshot

In today's market you definitely want to be nimble. At the time of this writing the stock market is definitely in an uptrend, but at the same time is definitely overbought. Just last week we had a strong pull back and could be looking at another real soon. So how does one trade?

Personally, I am looking for one base hits instead of home runs right now. The risk of the market turning against you, in my opinion, is very high so I don't want to have a lot of exposure to this. Therefore, I am looking for the best setups then taking my profits early. My other strategy is get into free trades. I explain two of these strategies in the links to my other Hubs:

- Risk Reversal Trade

One of the big problems in investing is having the money to do it right. Let's say you want to buy some shares of Bershire Hathaway, well you are going to need to pony up about $8,000 for every 100 shares... - A High Risk High Reward Stock Strategy

In the title and sub-title of this Hub I warn of the high risk. While I believe that you will see there is a very easy way of managing risk, I want to emphasize that this is a high risk strategy, but the...

The Slingshot Trade

What is the Slingshot trade? It's a trade where we are bullish on a stock, but we don't want to have a lot of money exposed. We are going to get in and out of the market, but still have the opportunity to profit from the stock increasing in value.

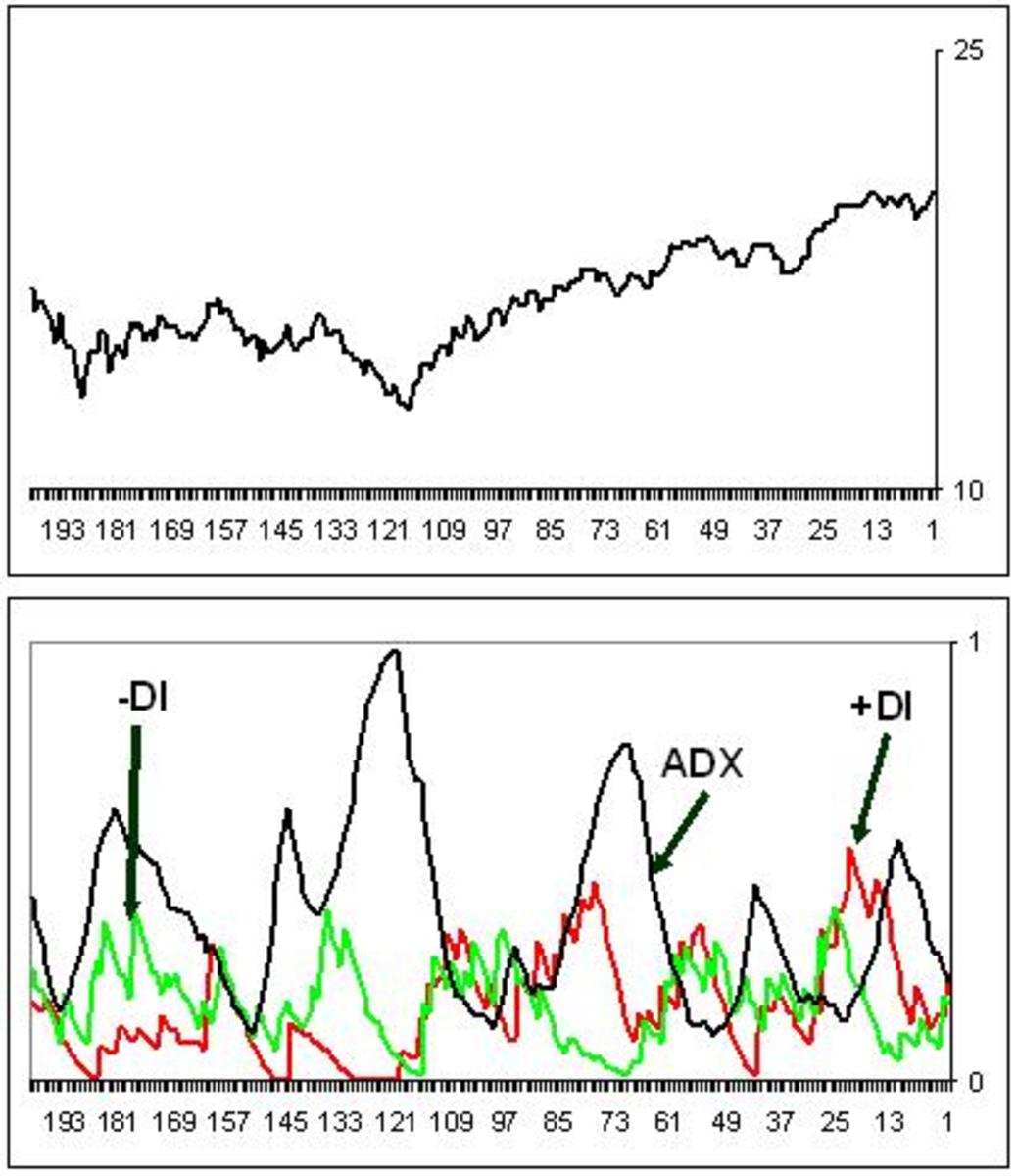

In this trade we want a stock that is in an uptrend and has a larger ATR (Average True Range). The ATR is the average range of the stock in a given day over a specified period of time. This average range is what the stock moves (on average) in a given day.

We will use 3M as our example in this Hub which is definitely in an uptrend at the time of this writing and has an ATR of $1.20. Click on the link below to see a chart of this stock.

Making the Trade Work

The price at today's close is $86.05 and we are going to place an order to purchase 100 share while at the same time place an order to purchase two May 90 Call Options. The Call options can presently be purchased for .63.

Our goal is to collect one ATR of the stock, so we are looking at being in the stock for a very short period of time. Our cost going into the trade will look like this:

Buy 100 Shares MMM @ 86.05 = $8,605.00

Buy 2 May 90 Calls for .63 = $ 126.00

Total cost to enter the trade = $8,731.00

Once the trade is fill we are going to place a limit order to sell our stock for $87.25 which will give us $8,725.00 and we are left with two 90 Call options that won't expire for 4 weeks. Technically speaking we are into this trade for free. However, specifically on this particular trade we have a total risk of $6.00 plus whatever we paid in commissions.

At this point we can enjoy a theoretical unlimited profit should this stock continue in it's strong uptrend. However, time is strongly against us on our long calls since they will expire in about four weeks. Therefore, if we would like to neutralize the negative time affect on us we can simply sell two further out of the money Call Options turning our long calls into a Bull Call Spread. This will also take our theoretically free trade and give us a small profit. Now we can profit two ways. We can make money if the spread expires worthless or we will make money should the stock continue rise.

The bottom line point is that in today's market condition one needs to look for ways to eliminate exposure to risk. One way of doing that is turning your trades into free trades.