Mortgage Default and Foreclosure: Help and Assistance

Mortgage Default Help

Whether as the result of a lost job, unexpected medical costs, or other unforseen expenses, many Americans find themselves delinquent on their home loan and facing mortgage default and the possibility of losing their home.

The Mortgage Bankers Association reported that in December 2007 the mortgage delinquency rate for residential property was higher than it had been in over 20 years. If you are one of the millions of American affected by this mortgage crunch, the following information and resources can help you avoid defaulting on your mortgage and possibly save your home.

Tips to Help You Avoid Default and Avoid Scams

What is a "Default"?

Technically, a default on your home mortgage occurs anytime you do not strictly abide by the terms and conditions of your loan agreement. Practically, though, the default most borrowers and lenders are concerned about is the default in payment.

Most home loans have a grace period from 10 to 15 days before delinquency charges start accruing. Although delinquency charges are unpleasant, they will not result in a default provided the regular loan payment and the delinquency charges are paid in a timely manner. This usually means that payment must be made within 30 days of the date the payment was orignally due, not 30 days from the end of the grace period. This can vary depending on the contract and the payment frequency, but for most home loans this period is 30 days.

Tips from Freddie Mac on Avoiding Foreclosure Scams

How Can I Avoid Default?

The only sure way to avoid default is to pay the entire amount of the late payment and any late fees that have accrued before the next payment is due and stay current thereafter. In most instances a late payment made within 30 days of the due date will not be reported to credit agencies. Payments made more than 30 days late typically are reported to credit agencies.

If you are unable to pay the entire balance, most lenders are sophisticated enough to realize that it benefits all interested parties for the lender to allow the borrower to catch up on the missed payment or payments, assuming the setback is truly temporary. This is your opportunity to make arrangements with your lender to pay what is overdue. Most reputable lenders will honor these agreements and let you get current.

If lateness becomes chronic or if nonpayment persists longer than 30-60 days, then the lender will begin the process of foreclosure.

Home Loan Default Help

- US Department of Housing and Urban Development

Homes and Communities: Tips for Avoiding Foreclosure from the United States Department of Housing and Urban Development - Lawyers.com: Mortgage Foreclosures

What to do, How to Negotiate with Your Lender, and Alternatives to Foreclosure

Avoiding Foreclosure After a Default

The best advice to avoid foreclosure is to talk to your lender. If necessary, ask your lender for a forbearance. A forbearance is an agreement to allow a short reprieve from payments because of a particular hardship (usually 1-3 months). The payments are most often added to the end of the term of the note. Be advised that your lender is under no obligation to agree to this, but you will never know unless you ask.

Alternatively, ask to make arrangements for repayment. Most lenders are willing to make payment arrangements to avoid incurring legal fees and expenses associated with foreclosure. If you are unable to make arrangements with your lender, your only option is the legal process.

The rights of the lenders and borrowers vary from state to state. However, generally speaking, before a lender is able to foreclose on a home used as a residence by the borrower, the lender must send the borrower a notice of default.

The form of the notice and the length of time between the notice and foreclosure will also vary from state to state. Typically, this notice of default is sent 60-90 days after the default. The notice of default begins the foreclosure process.

The good news is that the borrower can cure the default and keep the property by paying the outstanding balance, late fees and collection fees, if any, before the foreclosure process ends.

In many states there is also a right of redemption where the borrower can cure the default even after the property has been foreclosured and for up to some period of time thereafter.

Tips for Avoiding Foreclosure

- HUD: 10 Tips for Avoiding Foreclosure

The US Department of Housing and Urban Development's 10 Tips for Avoiding Foreclosure.

Housing Services

The US Department of Housing and Urban Development (HUD) provides a wide range of services to home owners and prospective home owners. In addition to providing assistance with first-time home buyers, HUD certifies housing counseling agencies to assist home owners who are having difficulty paying their mortgages. You can obtain housing counseling from HUD approved housing counseling agencies in your state.

The Federal Housing Administration (FHA) also provides assistance to home buyers and home owners. The FHA provides mortgage insurance on loans made by FHA approved lenders. There is a new FHASecure financing option that is available to FHA insured loans where the home owner has a history of timely payments before default or loan reset. You must qualify for FHA Secure financing. However, with FHASecure financing, you can lower your mortgage payment, get out of default, and avoid foreclosure.

There is also a HUD and FHA National Servicing Center to provide help to homeowners with FHA insured home loans. The goal of the servicing center is to help borrowers and lenders find creative ways to resolve default issues and avoid foreclsores. If you have an FHA insured loan, you can call 888-297-8685, the call is toll free. You can also write to: Department of Housing and Urban Development, National Servicing Center, 301 NW 6th Street, Suite 200, Oklahoma City, OK 73102.

Just recently, the Bush Administration announced "Project Lifeline", a program designed to help home owners facing foreclosure. Project Lifeline would allow home owners who are at least 90 days behind in their mortgage payments to halt the foreclosure process for 30 days to assist them in getting caught up on mortgage payments. The plan initially involves six of the largest mortgage lenders, but home owners can only take advantage of this opportunity if they contact their lenders directly.

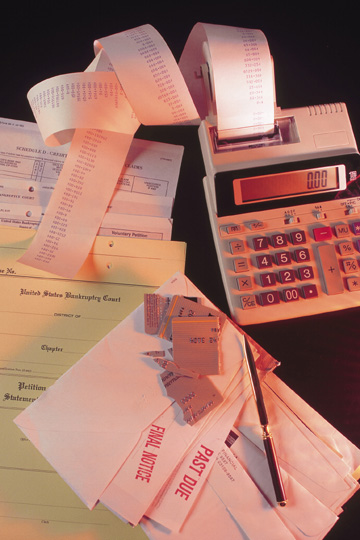

What About Bankruptcy?

Bankruptcy should always be a last resort. However, a bankruptcy attorney may be able to help you avoid bankruptcy. For example, a bankruptcy lawyer may be able to make payment arrangments with your home loan lender. The lender may be more willing to accept repayment terms if a bankruptcy is looming.

Filing bankruptcy will never be pleasant, but if you are severly delinquent and facing an impending foreclosure, filing for protection under the bankruptcy laws may allow you to stop foreclosure and keep your home. Prior to filing, you will be required to participate in credit counseling and pass a means test to determine your eligibility. If you qualify and choose to file bankruptcy, you will make payments as ordered by the court.

Default Help and Alternatives

- United Capital Mortgage Assistance

UCMA has been providing national mortgage assistance since 1997.

Find an Attorney to Help You

- Foreclosure Law Firms

Find an Attorney in Your State to Help You With Foreclosure. - Find Law

Find a Bankruptcy and Debt Attorney to Help With Your Debt Problems. - Bankruptcy Law Firms

Bankruptcy Attorneys Can Help Stop Foreclosure. - Bargain Law

If You Need Legal Advice Now.

What To Do if You are in Danger of Default

- Talk to your lender. Do not ignore the problem. It will not go away. You may be surprised how helpful your lender can be if you just talk to them. One thing is sure, you will never know if you never ask.

- Ask for a forbearance. You might not get one, but if you are in a money crunch, it can give you some much needed breathing room.

- Be realistic. Do not agree to a repayment plan you cannot honor. You will just make things worse. Be honest with your lender and try to work out something everyone can live with.

Budget. Budget for your mortgage payment and share your new budget with your lender. In other words, give your lender a reason why things will be different next time. Did you take a higher paying job but lose a paycheck or two in the mean time? These things matter.

- Pay something. If your payment is $1,000.00 and you can only pay $250.00, pay it. First, your lender is more likely to help if you are making an effort. Second, you save money on interest. Third, $750.00 will be easier to repay than $1,000.00. The list is endless.

- Beg, borrow, but don't steal. Phone a friend, call a cousin, or something. Better to owe a buddy than a bank. Your buddy's terms will probably be friendlier and your buddy probably cannot report you to a credit bureau.

Does Any of This Really Work?

The truest answer is "maybe". But, do not despair. You are not alone. Most importantly, because you are not alone, lenders are more likely to work with you.

It is going to take effort on your part to get things corrected, but it is workable. If you sincerely want to avoid defaulting on your home mortgage and possible foreclosure, remember these key points.

- Be Smart

- Be Honest

- Be Disciplined

- Be Open-Minded

- Be Realistic

If you can realistically afford your home, you can probably keep your home. The most important thing you have going for you is that it is easier for your lender to work with you than any of the alternatives. Use this information wisely, and good luck