10 Practical Advices for Investing in the Stock Market

Investing in the Stock Market is never easy that's why a lot of people do not want to go into this type of investment for fear of getting burned. But experience and a lot of knowledge may help overcome this fear and who knows? You may just be one of those that will be "made" through your stock investments.

Ever since I wrote my hub on earning passive income through investing in the stock market, I've been getting a lot of comments on how risky the stock market is, how there are people who really get affected (and even commit suicide) due to their losses from the stock market and how it is best to avoid this type of investment altogether. Who can blame them? With the rapid decline of stock prices due to the global crisis and the uncertainty facing the stock markets around the world, one will really have to take a deep breath, pray to high heavens for guidance and think a thousand (make that a million) times before putting in his/her hard-earned cash.

This hub is not about making millions in the stock market. It is not about choosing which stocks to invest in. This hub features several practical advices on investing in the stock market that I have read and heard (and generally concur with) throughout these years. I am in no means an authority in investing in the stock market but I have seen several (sensible) people who have earned quite a large amount of money from the stock market and I do believe these advices came in handy for them. I hope they come in handy, too, for those who are thinking of investing in the stock market.

Prepare Yourself

As I wrote in the previous hub, investing in the stock market is not for the faint of heart. You need to prepare yourself well before going into this. Take it seriously, investing in the stock market is not a game and definitely not something that you can take for granted. Unless you really have the money to burn, but even then, this is not an excuse for taking it lightly.

Plan Your Investment

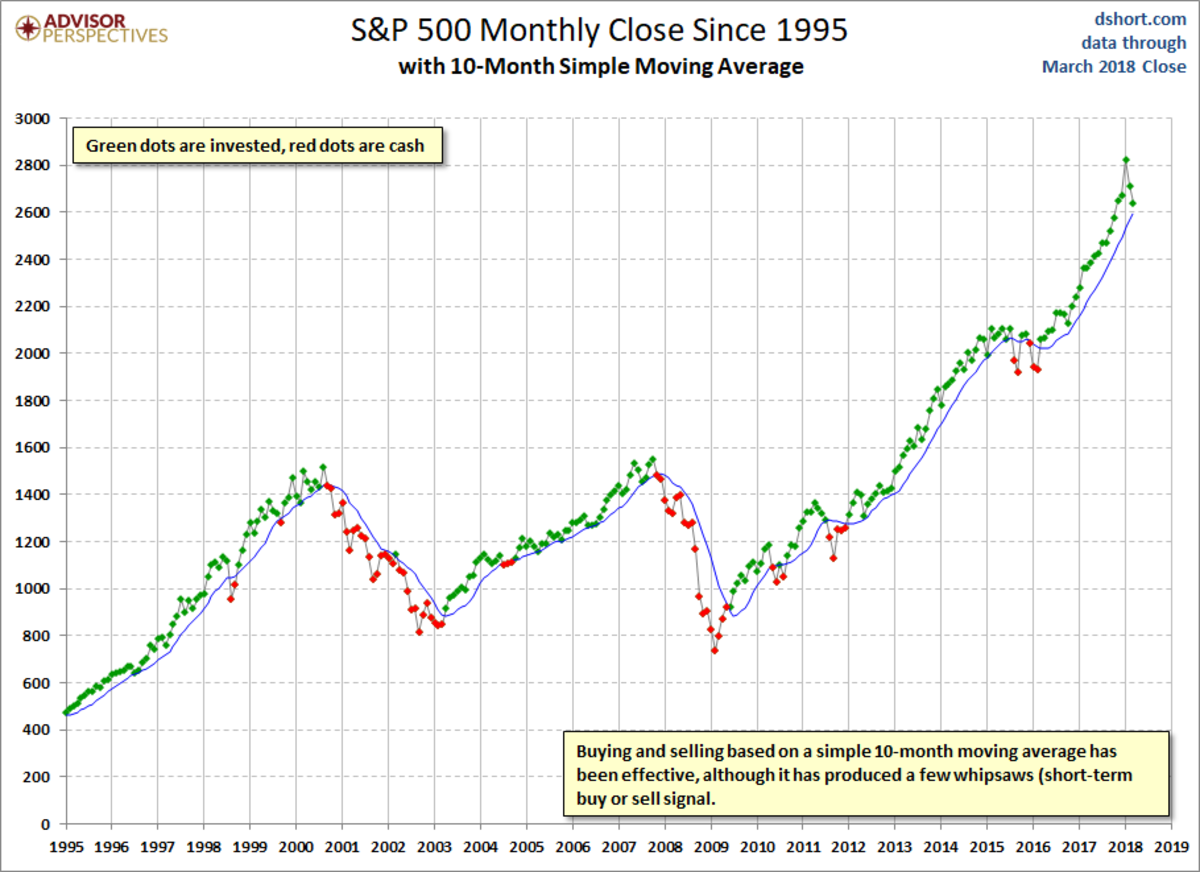

Ask yourself, are you in this for the short-term gains or for the long-term haul? Do you just plan to actively trade stocks or do you want to invest in stocks that are sure winners in the long-term? Your answer to this question is very crucial in knowing your investing style (and what type of investor are you). Some people opt to go for the short-term gains, buying when the stock prices are low and selling when the stock prices are high. Others are in it for the long-term, choosing to buy those stocks of companies that are steady and have good dividend pay-outs. Still others choose a combination of both, investing in some stocks for the short-term gains and investing in others for the long-term goal.

Invest Only Your Excess Cash

When I say excess, I really mean excess. Do not invest your life savings (unless you can still recover them after you lose them); do not invest your savings for emergencies or for your child's education. The stock market (at least for me) is not a means to save for the necessities in life (unless this is your only form of living). Rather it is something that can help build up your wealth over time. If you want to have that excess cash, put aside a certain amount per month until you can build up the minimum required investment by your broker. Putting in only the excess cash means you will not be too worried if the market goes down because you will still have money to fall back on. Using your excess cash will also mean you can roll-over any proceeds back to your investments, thereby increasing your chances of getting more money from your investments.

Diversify

With few exceptions (I think Robert Kiyosaki is one of the exceptions), a lot of investment and finance gurus advise investors to diversify their investment money. You can invest in a combination of bonds or stocks. Or if you choose to invest everything in stocks, buy the stocks of various companies. At least, when one stock losses, some of the other stocks may offset such losses.

Read, Read and Read

Be and stay informed. Do not just depend on your broker. Read and analyze every sources that you can find regarding the stock market and the company you are planning to invest on. Know the business trend of the company and its industry. If you're planning to invest in the stock market of another country, read about that country's economy. Better yet, learn how to read and analyze the annual reports of those public companies you are interested in. An informed investor is (or will become) a wise investor.

Invest Regularly

This is a tip that is said to ensure minimal losses. In periods of decreasing prices, one can invest regularly to have a lower average cost for the stocks. Then when the price starts to go up again, start divesting / selling those stocks with lower cost. Better yet, hold on to all of those stocks until the price is higher than your average cost then sell them all at once.

Don't Go with the Trend

I saw this happen whenever people see a stock price go up, they start buying, thinking that they can ride on the rising trend. Sorry, doesn't work that way all the time. Sooner or later, the stock price will hit the point when the demand for the stocks becomes lower than its supply then the price starts going down. And if you ride the bandwagon too late, you'll end up holding the empty bag.

Think About How Much You Want to Earn

Make your own rule of

thumb. Think about how much you want to earn from the stock market. Is

a 20% price gain okay for you? Or do you want a lower or higher

percentage? Think about this then apply it. If you see the price going up by 20% or more and you've set the threshold at 20%, then it's time to sell the stocks. Okay, what if it keeps on rising? Then the next tip will address that.

Don't Be Too Greedy

Once you decide that you're okay with a 20% price gain, stick to it. Do not look back after you divest the stocks and tell yourself that you should have held on to it longer (because the price is still rising). You will never have peace of mind if you keep on doing this. You will always second-guess everything and think everything through too many times until you just miss out on your chances to get the 20% gain. Be glad (and thankful) that you have the gain and look for other stocks that you can possibly invest in using the proceeds from your latest sale.

Finally, Relax

I did say that this is something that should be taken seriously, did I not? But please, don't take it too seriously that you will lose sleep (and your mind) over the matter. Instead, breathe deeply and relax. Remember that what goes down must come up in the future. Do not watch the stock prices every day (will make you more crazy, believe me). Instead, plan to read the stock prices at least once a week, and stick to this plan. Or if you really can't help it, ask your broker to inform you when the stock has hit a certain price. That way, you know that you can always catch the much-awaited selling price that you want and planned for.

Basically, that's it. There are a lot of practical advices out there. A last piece of advice is - invest in the stock market if you really feel that you are (or you will become) comfortable doing it. Don't force yourself to invest just because you see that you can get huge amounts of money from the stock market. It will just set you up for a big disappointment if things do not go the way you expected them to go. If it's not meant for you, then it's not meant for you and you'll be better off putting your hard-earned money in other types of investments.

Note: These are practical advices I've read through books and magazines and I've heard from those people who regularly invest in the stock market. Although I have 'dabbled' in the stock market, I am in no means a serious investor (read: I don't have the means for it). I've tried some of these advices (especially the excess cash) and I can assure you these work to ensure that you keep your shirt on your back. Other than that, proceed at your own caution. Thank you and good luck!