Terms & Conditions Of Signing A Loan Or Credit Agreement

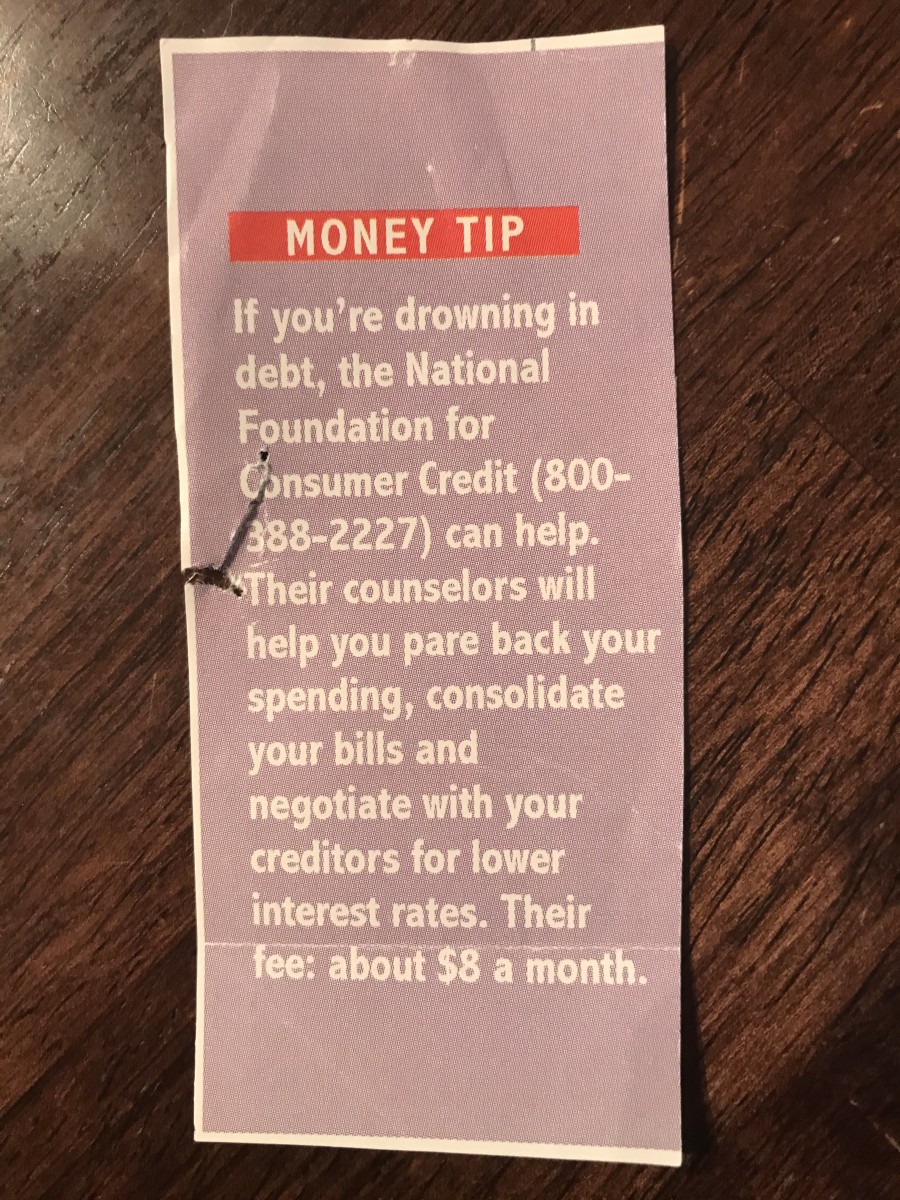

So what do you do when your credit card debt has gotten to be a point where you feel it's all over and there's no way out?

Refinance your debt and pay it off as quickly as you possibly can!

Tips to refinancing your credit card:

- Secure the lowest possible interest rate

- Avoid paying additional annual credit card fees

- Read the terms and conditions

Most people end up falling into the trap of signing up for a credit card for every day purchases without being able to pay the outstanding amount back by the end of their 30, 45 or 60 day interest free term. In the end, they're stuck paying back hundreds of dollars in interest alone.

The first thing to do when you have an outstanding amount on your loan is to pay off your debt as soon as possible. This may mean setting aside a certain percentage of your monthly salary to help pay off your debt and sacrificing the things you enjoy. On most cases, you would be advised to refinance your debt first, to avoid paying a high interest rate.

Refinancing your credit card debt can mean you can reduce your interest rate from 20% to 0.99% for the first 12 months, helping you pay off your debt sooner.This mean that instead of paying an extra 20% on your outstanding balance, you'll only pay an additional 0.99%.

Under most circumstances, I would advise that you don't refinance by adding the outstanding debt to your home loan. This will only make things worse!

Once your credit card loan is paid off - cancel your credit card and close your account!

My advice is that instead of having a credit card for every day purchases, use a debit card. This will allow you to use your own savings funds when making purchases. Be sure to check your online bank statement daily or at least weekly to track your current spending patterns to ensure that you still have sufficient funds in your account instead of overdrafting on your loan (that is, exceeding your balance). Where ever possible, try using cash. This will also assist you in managing your spending whereby you can only spend what money you have in your wallet at the time.