Saving for Retirement may not be an Option

Storm Clouds are gathering around the world concerning retirement for many.

Pros and Cons of Retirement in the Post Economic Collapse Era.

It seems like we have been sold on saving for retirement forever. It is also apparent that there are endless scandals on lost retirement funds that have "disappeared" through no fault of the ones saving for retirement. There are the union retirement funds, the 401k types, various government sponsored retirement funds, bank centered retirement funds and proprietary funds. We must bear in mind that what a thousand dollars would have bought yesterday, does not do today and certainly won't in the future because of inflation, devaluation, interest and service payments. In a volatile and uncertain economy on the verge of collapse due to other impinging causes like the sub-prime loan catastrophe, it almost seems that saving is counterproductive.

There are some incentives that encourage saving for retirement. These are savings on taxes that come from income tax time and interest accrued on bank retirement savings funds. Although the savings on income tax are a good incentive in the immediate term, the interest that banks pay out on retirement funds are always less than the going inflation rate. Despite what we have been told about the raise of wages fueling inflation, it is actually, credit/debit, fractional reserve banking and interest rates that are the cause. Rated over a few decades, the interest earned will fall well below what one can live on by that time. Consider the fact that in the 1960's one could by a Volkswagen for less than $2,000. Today that same Volkswagen or its equivalent will cost a minimum of $20,000! That means that the dollar per dollar value is only 10 percent of what it was some 45 years ago. The gold standard used to set the dollar at $35 an ounce. Lately, gold was worth more than $1,200 an ounce USD, demonstrating how devalued the dollar is. The question here is can you afford to live on what $100,000 will be actually worth in 30 to 40 years based on the current rate of devaluation, interest payments notwithstanding? By that time, the $100,000 investment will only buy $15,000 in real value; tops! Further more, these savings act as a backing for loans made by the banks in other areas at high interest and at higher risk. One of these loans drawn from retirement funds is on mortgages. Banks will actually encourage you to take a high interest loan to invest in a retirement fund paid out at a lower interest. Then there are the so called “reverse mortgage” loans that are advertized as a hedge income in tough times, although we are encouraged to believe it is for the children's education and so on. A reverse mortgage is simply a devise to worm your home out from under you. Given the current economy, how is anyone going to repay the “reverse mortgage” on less or no retirement income.

Various government pension fund guarantees don't hold much water for the same reasons of inflation and devaluation. In fact the pay outs are much lower that other types of funds. If one does collect pension from the government after being taxes for the same all ones working life, the amounts paid out are not enough to cover living expense like rent, food and medication. In fact, not one of these areas will be covered, forcing one to rely on programs that the government no longer sponsors like food stamps and welfare. Those who rely on government retirement funds alone have to continue to work well into old age, or face the prospect of being hungry and homeless. Given he current mood for austerity, it is likely that there will be no retirement funds from the government as well and an increase of retirement age that will guarantee a turn toward the street for many seniors.

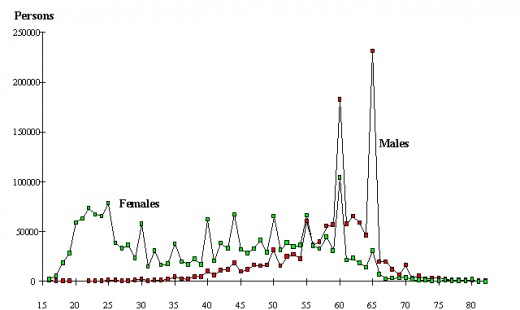

Seniors are concerned abour retirement income

Retirement funds based on tenure at a place of employment have proved to be historically unsound. Almost without exception, clauses within these contracts would guarantee a retirement package if the person stayed right to the retirement age. With the anarchy in the capitalist market, this is seldom fulfilled and early termination of a contract voids any claim to retirement funds. In effect, the deductions made from pay checks to finance the retirement fund are lost for good. The company involved also often forced early retirement for the same end, to not pay retirement on a no longer productive employee. These include all the company based 401k retirement funds that were a real scandal in the 1990s. Many people on the verge of retirement saw all their dreams go up in smoke and were forced to work long after the retirement age on the legal books.

Personal high interest bank accounts, though viable, are subject to higher risk than low interest ones and are often locked in for 5 years, which means no access to funds in an emergency without paying out punitive fines. Just because the money is in the bank, does not guarantee that it will be there when you need it later, especially if the bank fails. Though the government guarantees all deposits up to a certain limit, that limit is usually well below what you would need in the distant future. Then there would be lengthy litigation involved as to who gets what after the bank failure and collapse especially with fraction reserve banking, secured and non-secured loans.

An interesting note in all of this is the fact the governments on all levels are encouraging businesses to consider hiring post retires as employees instead of taking the usual path. This alone tells us something about the whole retirement idea. It is by way of acknowledgment that all the schemes to prepare for retirement have failed in the main and people will just have to keep on working well past legal retirement age, all the way until they collapse from death on the factory floor, the mine, behind the wheel of as a pilot of a commercial jet.

About the only way to make anything for retirement is to become an investor oneself and take the same risk as any other broker would on Wall St. or Bay St. If you conduct a successful career in investment, you may well be able to retire early and retire well, but this road is fraught with real peril as has been demonstrated with various real estate deals and loan manipulations. There are also many scams and shady schemes waiting for the unwary investor ready to take money one empty promises with no result down the road. Not all countries and peoples historically have taken the same route to guaranteeing support to their elders. The Romans, Inca and various socialist states guaranteed a secure retirement for their elders. This of course means a whole reordering of society to guarantee the same for our elders. People by and large are reluctant to change the existing order. Given the current set up, no matter what you do to save for retirement; it will be met with failure, either by being eaten up by inflation and devaluation or legally stolen through various trickery as in the 401k scandals.

Look instead to working to the end of life. If the economy is uncertain, you will have to be flexible. You will have to do whatever it takes to maintain your health in order to work. There are dream jobs, and then there is reality. Your background may be a hindrance to your progress in an entirely new area that requires another set of specialized knowledge. Don't rely on someone else to hire you as competition is extremely stiff with plenty of younger competitors. Unless there is a major change in the reordering of society, THIS IS THE FUTURE!