Should You Put Your Money in the Stock Market?

If you are asking "Should you put your money in the stock market?", then most likely you have not started or just beginning to put money in the stock market yet. Perhaps you are young person just learning about the market. Hopefully, this article will provide some tips.

But this is not a question that I can answer for you because I am not a financial professional and this is not financial advice. This article is more of a blog post of only my opinion. I have to say this because you might put all your money into the stock market, and yes it is possible to lose all of it.

The short answer is that yes, in some instances, you should put money into the stock market. That is another thing, it totally depends on your individual circumstances and instances. A third thing is that it depends a little bit on timing. If you are putting money into the stock market for the first time, it is probably not a good idea to do it during an economical downturn or recession. Better to do it during the recovery phase or during economical boom.

Suppose you are a young individual who has his/her first or second job and have paid off all your debts and student loans etc. And maybe you have some extra money. What are you going to do with it? Spend it? No, maybe not. There are better things to do with it if you want to have enough money left over during your retirement years. I know that when you are a young person, the last thing you want to think about is retirement. But the earlier you start thinking about it and doing something about it, the better off you'll be. There are many older people close to retirement who would have said, I wished I had started this earlier. Because frankly, now they don't have enough time to save for retirement.

So if you are a young person and reading this now, your advantage is that you have time on your side. In fact, you have so much time that you can even afford to make a few mistakes in the stock market. And most likely, you will. But then, this is how you learn. The sooner you learn, the more expert you become when the time calls for it later when it really matters.

Losing Money in a Savings Account

Okay, so suppose you are a young person without debt and some extra money. Where are you going to put it? How are you going to save for retirement? How about a savings account? Okay, that is better than spending it. And that's nice. But the interest that the saving account pays you is very low, often lower than the inflation rate.

If you put $100 in a savings account for five years, you might get a little bit of interest (some spare change really). $100 dollar now may seem like a lot of money. You might be able to buy a big bag of grocery at Whole Foods for example. But five years later, that $100 is not going to be that much. Five years later, that $100 may only buy you half a bag of grocery. So in fact by putting your money into a saving account you are losing effective money.

Again, for the young folks who may not have heard of this before, you might be thinking... But my grandmother told be to put money into a savings account to save it. How can I be losing money? Just read the Time article How You Slowly Lose Money With Bank Accounts.

Retirement Plans are a good idea

Perhaps you are lucky enough to have a workplace that provides a retirement plan like a 401K or 403B, or some equivalent. Talk to you company HR about the plan. It is generally a good idea to take advantage of these plans, especially if the company "matches" part of it.

Part of your paycheck will get go into these retirement plans. That way you don't see the money when you cash your paycheck, which means that you can't spend it, which is probably a good thing. You can not take the money out of the retirement plan either (unless you reach retirement age or pay a penalty or other specialized circumstances). Because that money is designed to pay for your food during retirement, they don't want you to take the money out until then.

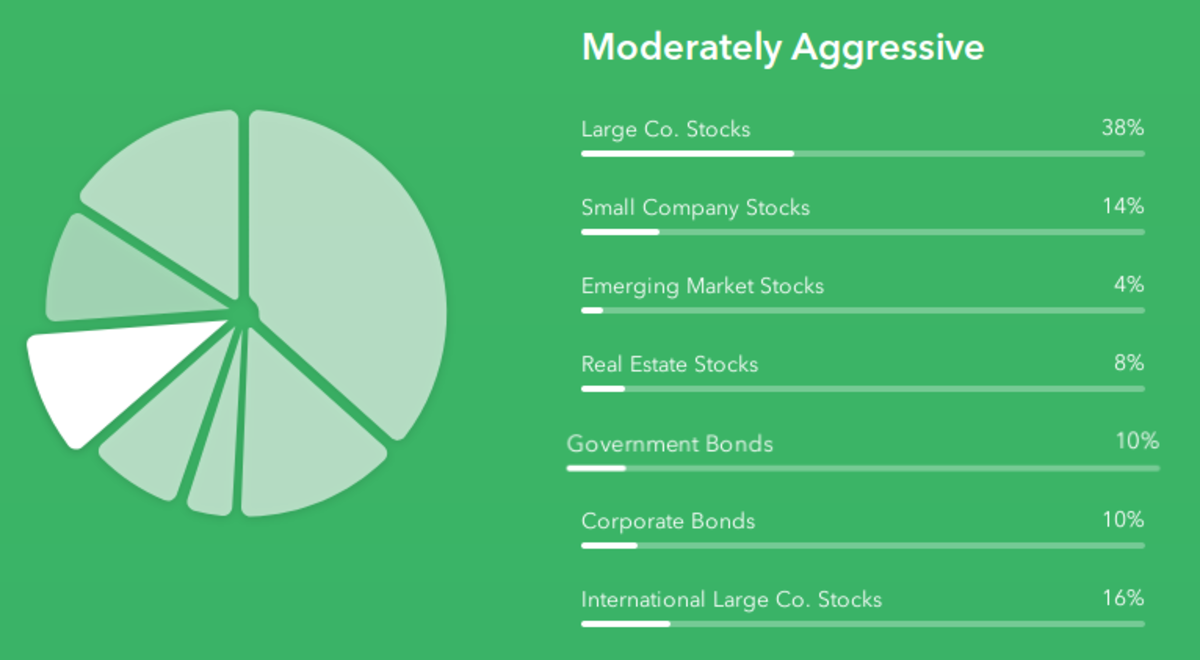

At the very least, the money is not going into "money losing" savings account. But where exactly is that money going. It is actually going into the stock market. When I say stock market, I mean also bonds, mutual funds, ETFs, as well as individual stocks. But when you pick a fund in your company retirement plan, there is a fund manager that worries about all that for you. All you have to worry about is picking a fund based on your expected date of retirement. The longer you have to retire, the more aggressive the fund can be.

Individual Brokerage Account

The reason why money in your company's retirement plan goes into the market is that putting money in the market is one of the best ways to save for retirement over the long term.

But what if your company does not offer a retirement plan?

You may still want to save for retirement by putting your money in the market. You can open your own individual brokerage account. Anyone can open one (well, almost anyone). You don't even need a job. But in an individual brokerage account, you will have to manage your own money, pick your own individual stocks, funds, or bonds, or ETFs. I can not explain all this here. It is too much to write and too much to learn all at one time. There are whole bookshelves about these things at your local bookstore (which you should start reading).

The thing is to learn a little by little. And if you are young, you've got time (maybe 20 to 30 years to learn them all).

What Exactly is the Stock Market?

I can not tell you what "exactly" the stock market it. Not sure if anyone can. It kind of has a life of its own and there are internal mechanisms hidden in it that most people don't even know about -- like mortgage-backed derivatives or other advanced financial instruments.

But I can give you an analogy. Think of some good company or products in your daily life. For example, do you have an iPhone or an iPad? Think about Apple and all the people that buy their products. Do you think Apple makes money as a company?

Are you on the internet now? What search engine do you use? Do you use Google? Did you know Google is more than a search engine? It makes the Android operating system that is in so many smart phones. See all those ads that are on all those web pages? Google makes money on some of those ads, did you know?

Do you think Google makes money as a company?

Do you buy your daily coffee at Starbucks, like so many people? At $3 or $4 a cup? Do you think Starbucks makes money?

What about the long lines and crowds of people shopping at Target or Costco?

Did you know that the 2013 Ford Fusion was ranked best hybrid by USNews. Notice how many taxis are using Ford? Do you think Ford is doing well at this time?

If the answer is yes to any or all of these question, take a look at their stock charts. Their ticker symbols are AAPL, GOOG, SBUX, TGT, COST, and F. But you don't have to memorize their ticker symbols. You can search using the company name.

Look at the Stock Charts

Today, you can get nearly all the public information about any public company on the web. The first thing to look at is its stock chart. You can go to Google Finance or Yahoo Finance.

Don't just look at the chart for the day or the week. Set the chart to display at least three months, or even better one year and two years. You can even set some to show the entire history of the stock.

Once you have mastered that, then you can look into the financials and fundamentals such as the P/E ratios, market capitalizations, and the like. But those are more advanced topics for you to learn as you go.

Buying Stock is Like Becoming Part Owner

Would you like to be the owner or founder of Apple, Google, or Starbucks? They are probably making a lot of money right? Sorry, you can not be the CEO or owner of Apple because you didn't invent the Macintosh. But you can be a small part owner -- a really really small part owner -- depending on how many shares of stock of that company that you buy.

Buying a stock in a public company is like become part owner of the company. As part owner, when the company makes money, you make money. Well, kind-of and not really. But this is only an analogy. The market so complicated that in order to explain to beginners, we kind of have to do some hand-waving.

But you are part owner just like thousands of other part owners who bought that stock. So the profit is spread among the masses who have bought the stock. But if your money is not in the market, you don't take part and you don't get your share if the company or the economy does well.

Can You Lose Money In the Stock Market?

Of course, you can lose money in the stock market? Many people do that all the time. Even if they bought good companies like Apple and Google. Whether the stock of an individual company goes up or down depends a lot on the market itself and the economy (sometimes more so than the company).

Take a look at the stock chart of Apple and Google around year 2008 during the financial recession. The stock dropped. And so did the stock of most companies. Investors of the stock market lost money and many lost a lot.

But look at the stock charts of Apple and Google now around year 2013. The stock had recovered all of its loses and has moved even higher. So for those people who had kept their Apple and Google stock from 2006 to 2013, they would have still made money even though there was a big recession in 2008.

Think Long Term

Let's see from 2006 to 2013, that's 7 years. That's a long time. You have to think in this kind of time frame. You can not look at a stock for a week or a month or even three months. You have to look at them from a point of view of at least 5 years. And for some stocks, you should hold them for that long.

People often ask what is the average rate of return of the stock market. Stock will go up and down in the short term. But in long term, the average rate of return on the stock market is around X% -- probably much better than what you get in a saving account.

I put X%, because it depends. It depends on who you ask and how long you mean by long term. Take a look at this article linked here. It says that according to IFA.com, the total return of large stocks per year over the past 5, 10, 20, 30 are 1.3%, 2.0%, 7.9%, and 10.5% respectively.

That means for an average large stock held 5 years, your annual rate of return is 1.3%. For a average stock held over 30 years, the average annual rate of return is 10.5%. If you want your stock to have a chance of giving you an annual rate of return of 10%, you have to hold it for 30 years. You actually do not have to hold that same individual stock for 30 years (and you should not). Because most company go out of business within 30 years. What we meant is to be "in the stock market" for 30 years.

Diversification is the key

Because company will go out of business (even Google and Apple will eventually go out of business), putting all your money on one or a few individual stock is dangerous. If something bad happens to that company, you can lose all your money overnight.

You have to spread your money across a multitude of companies. That way the chances that all of them going out of business all at the same time is low. This idea of putting money in a lot of various stocks in various industries and segments is called diversification.

The best way to diversity is to buy an index fund and/or mutual funds which are a conglomerate of many different companies in them. For example the S&P 500 (Standard & Poor's 500), is a stock market index based on 500 leading companies publicly traded in the U.S. stock market. The ticker symbol is SPY. Take a look. Buying SPY is like buying all 500 of these companies. Or you can buy the Nasdaq companies or the Dow Jones companies.

Thinking long term and diversification are two key points in doing well in the stock market. The third key point is to buy industry leaders. If you don't remember anything from this article, at least remember these three things.

Disclosure:

I usually don't like to write about finance because I have to put a disclaimer such as that I'm not a financial professional and that this is not financial advice.

And then I have to put a disclosure, such as ...

I have to say that my stock portfolio at the time of writing (which is Aug 2013) have some or all of the stocks mentioned in this article. This is so that you know that if you read the article and buy the stocks mentioned, that you might cause the stocks to do well. And since I have some of that stock, I can profit from it.

Some people may interpret this to be that I am writing this article to drive the stock prices up so that I can profit. This is of course an incorrect interpretation. Because anyone who knows anything about the market will know that the effect of this is slim to non-existent. But it is typical for articles of this type to put such disclosures so that people do not make this exact interpretation.

Of course the effect of this slim. Because what are the chance that people will read this article. And if they do read it, what are the chances they buy these exact stocks I have mentioned or even follow the suggestion of the article. And even if they do buy the stock, what are the chances that they have enough money to buy enough stocks to even affect the stock prices. And even if it did affect the stock prices, how much profit I am going to get if that profit is spread across all the hundreds of other stock holders.

Oh well, that's the stock market for you.