Inside the Spiders Web: Tax havens and Dirty Money

‘My secretary is still paying higher tax rate than I am.”

Warren Buffet-Billionaire Investor.

Tax havens evoke images of sandy beaches, swaying palm trees, and voluptuous women gamboling in the swimming pools of luxury hotels. There is a less glamorous side to it as well- when one sees burly potbellied drug lords, mafia or tin pot African dictators getting themselves massaged by attractive masseuses near the poolside. There is also the breathtaking view of blue seas dotted with luxury yachts belonging to the uber- wealthy. No wonder the French call these places paradis fiscaux.

The popular stereotype of tax havens got a fresh lease of life in the movie ‘The Firm’- a film based on the novel written by John Grisham- which explores the sinister relationship between a prestigious law firm and mafia money which had to be laundered in one of the island tax havens. As Hollywood movies go there is plenty of excitement with partners of the firm getting murdered by menacing mafia criminals but says very little about the true dimension of Tax havens in today’s world.

Unfortunately, stereotype notions of paradis fiscaux conceal more than they reveal. As the authors of the book ‘Tax Havens- How Globalization Really Works’ point out that Tax havens are not exotic outposts that exist on the fringes of the global economy serving the interests of the criminally delinquent but function as main conduits for tax evasion for the so called squeaky clean multinational enterprises around the globe. Moreover, they exist not in opposition to major economies like US and UK but in accord with them.[i]

Prem Sikka, Professor of Accounting- Essex Business School, UK, in his hard hitting monogram ’The Pinstripe Mafia’ says that tax avoidance is a very lucrative global industry which is operated not by shady banks in island paradises but by largest private banks of the world as well as leading law firms and accounting firms. These players are located not in exotic island resorts but in First World capitals of the world such as London, New York, Geneva, Frankfurt and Singapore.

And there are no mafia enforcers employing kneecapping as a means of control to keep Tax Havens smoothly running. That responsibility is borne by respectable accountants in their business suits from the Big Four Accountancy firms (KPMG, Deloitte, Pricewater houseCoopers,and Ernst&Young) with fees of billion pounds each year who do the job of designing and implementing the tax evasion schemes for their corporate clients.

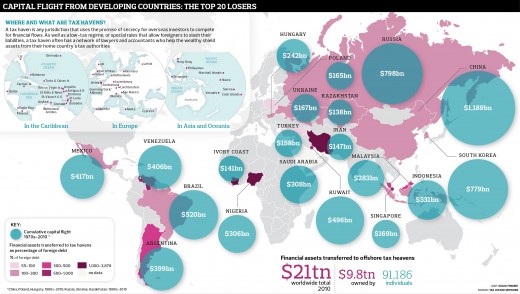

The Tax Justice Network has identified 80 offshore secret tax havens where at least $21 to $32 trillion (tax free) has been invested as on 2010. This is an estimate of financial assets alone. If non financial assets such as real estate, gold bars, luxury yachts owned by offshore entities (concealing the real owners) the figure shoots up considerably. [ii]

But what are Tax havens? What is their attraction for tax dodgers? While academics provide arcane definitions of Ta x havens, it is not necessary to wade through them. A simple rule of the thumb would be adequate to spot tax havens. Firstly, they offer secrecy which help tax dodgers to conceal their identity and source of their untaxed income or wealth. There is also the added attraction of Tax havens which are small sovereign states not cooperating with any tax inquires from other nations or exchange any information about tax evasion. The secrecy protection is fortified by criminal penalties such as imprisonment for employees who leak out secrets. In some Tax havens whistleblowers end up dead with their body stuffed in the boot of an abandoned car. Secondly, Tax havens offer very low or zero taxes for non-residents. This feature is especially attractive for the pinstripe mafia (the big four accountancy firms) to structure tax evasion schemes for their well heeled clients. And lastly, Tax havens have the financial sector disportionately bigger than their local economy. Using this yardstick the IMF fingered the City of London as one of the biggest centers of offshore money laundering.[iii]

The 80 odd secrecy jurisdictions or Tax havens have spheres of influence or control and they fall into 3 groups. The first and the biggest group is the UK based City of London which controls a satellite of tax havens located in Crown Dependencies (Jersey, Guerney and the Isle of Man) overseas territories (Cayman Island), Pacific atolls, Singapore and Hong Kong. The second group is European Tax Havens centered on Switzerland, Geneva, Liechtenstein, Monaco, Luxembourg and Netherlands. The third group is USA which controls Manhattan, Florida, Panama, smaller states of Wyoming, Delaware and Nevada, American Virgin Islands, and Marshall Islands to name a few.[iv]

Perhaps, the most apt metaphor to describe the secrecy jurisdictions that dot the global economy is that of a spider which produces sticky web of silk threads to trap flies for food. The tax havens like the spider’s web catch cross border flows of global dirty money. At the top of the chart is abusive and fraudulent transfer pricing techniques which account for 60-65% of illicit global money transfers which amounts to anywhere between $600 to $1 trillion annually. The illicit proceeds of criminal activity like drug trafficking, human trafficking, counterfeiting, contraband and terrorist funding amounts to 30-35% or $300 to$550 billion annually. The proceeds from bribery and theft by government officials account for a mere 3% of the illicit global flow into Tax Havens.[v]

The sad irony is that corruption of government officials which is peanuts in terms of percentage in global illicit flows has received the greatest media notice while the more significant scam of fraudulent transfer pricing has been pushed under the rug.

In a documentary film ‘We are not broke’ makes the shocking disclosure that giant corporations like GE even after earning $26 billion profit during the years 2005 to 2010 paid zero federal Income tax. Bank of America after posting a profit of $4.4 billion and receiving a bailout of $1 trillion paid zilch taxes. Oil giants EXXON and CHEVRON earning in the year 2009 profits of $19 billion and $10 billion respectively paid zero Federal income tax. One of the biggest banks in America Citigroup after posting a profit of $ 4 billion and receiving a bailout of $2.5 trillion paid nothing to the US treasury.

One of the compelling reasons for giant corporations to declare zero tax or pay low tax in countries where tax rates are more is the presence of offshore Tax Havens. Here shell companies or mailbox companies are established for the purpose of aggressive tax evasion. In an elaborate charade called transfer pricing, corporations with their army of accountants and lawyers create a maze of shell companies (i.e. companies which have no real business activity) in Tax Havens which have secrecy laws concealing the ownership and the source of the funds. The tax strategy is fairly simple: book the profits in shell companies located in tax havens having low or nil rates of tax and show reduced or better still zero earnings in countries which have higher rates of tax. The technique? Misinvoicing the trade transactions. In other words, under invoice the value of exports to the entity located in a tax haven which in turn exports at the full value. The difference is deposited in an offshore account. A variation to the theme would be to over invoice goods sold to the importer. The difference between inflated value of imports and the true value of imports is deposited in an offshore account for the importer. Keeping in mind that approximately 60% of global trade is conducted within multinational corporations (MNCs), between subsidiaries of a parent company, the transfer pricing route is the most popular vehicle for tax evasion for MNC’s.[vi]

Take the case of Google- the giant tech company- which established a subsidiary in Ireland and with which the parent company entered into an agreement in 2003 giving the subsidiary the right to income arising out of search engines. From 2003 to 2009 the Irish subsidiary of Google earned $11 billion and the rate of tax in Ireland is 12.5%. Not content to pay taxes of 12.5% in Ireland, it siphoned off its earnings as royalty payments to another offshore entity in Bermuda at zero rate of tax. Needless to say if Google had booked its profits in USA it would have to pay (after available deductions) tax at 35%. The success of the strategy is borne out by the fact that Google pays around 2% as taxes on its overseas income. If the offshore tax havens were to be knocked off, then Google loses a quarter of its earnings and a cool $100 dollars could be knocked off per share.[vii]

Or take the case of Starbucks –the coffee company -which is in Seattle (US). If the trade mark of- let us say- Frappucinno vests with an entity registered in Netherlands which has 1-2% tax on intellectual property rights, then part of the income on its sales of the coffee drink is booked in Netherlands at low tax while lower earnings are booked in the higher taxed country like the US.

Perhaps, a daring tax heist which shot to prominence was Vodafone (India) which was accused of transfer price tax fraud with respect to issuance of shares to its parent company located in Mauritius for around $138 per share. The Indian tax authorities determined the true value of the share price to be in the region of $876 and made a demand of $617 million on Vodafone. At the moment of writing this article Vodafone obtained a quashing of the order by the Bombay High Court.

A much favored Tax Haven for the Indian Corporate elites is Mauritius. For rich business families and wealthy corporations there is another game to be played called capital round tripping. The mechanics of the tax dodge is simple and elegant. First the untaxed/ illicit capital flows into a shell company established in Mauritius. The money comes back to Indian stock market from the shell company (Mauritius). The capital gain from sale of shares by the shell company (Mauritius) is tax free as per the tax treaty with India. The Indian business elites go laughing to the offshore banks to enjoy their tax free income which is doubly untaxed.

An egregious example of capital round tripping involves a Singapore based company Biometrix ( with paltry assets of $57,000!)which invested close to $1.05 billion in four companies belonging to Mukesh Ambani of Reliance. Mr. Prashant Bhushan, a lawyer and crusader against corporate corruption alleged that these were funds which were siphoned off from Reliance and appeared as FDI investment in four fully owned companies by Mukesh Ambani. There appears to be deafening silence on this issue by the Modi-BJP government which was elected to power on its election promise to root out money laundering.

The under reporting of profits by Multinational enterprises and the transfer of illicit capital to tax havens has a tsunami like effect on the balance sheet of the developing world. One study by Christian Aid estimates that the loss of corporate taxes comes to $160 billion annually on account of tax frauds by mispricing and false invoices by multinational corporations. The other route is 10 year tax holidays given to MNC in Special Economic Zones (SEZ) set up by the local elites of developing nations which end up in loss of natural resources for the developing country without any gain in its public revenue.

Perhaps the more comprehensive picture is laid out by Henry James of the Tax justice Network who in his study of 139 of low middle income countries says that these countries contributed to capital flight of about $7.3 to $9.3 trillion in 2010 which ended up in Tax havens through the top private banks of the first world. These countries were saddled with an external debt of $4.8 trillion. But if one considers the total outflow of foreign exchange which had been invested in first world securities then the picture changes dramatically- these countries become net creditors from debtors to the tune of $10 to $13 trillion dollars as on 2010! [viii]

There are dire implications for even the developed economies of Europe, UK and US as well. In US the loss of taxes is estimated to in the region of $345 billion to $500 billion annually. In Europe it is estimated to be in the region of 1 trillion euro. UK is losing tax revenues to the tune of 35 to 150 billion pounds yearly.

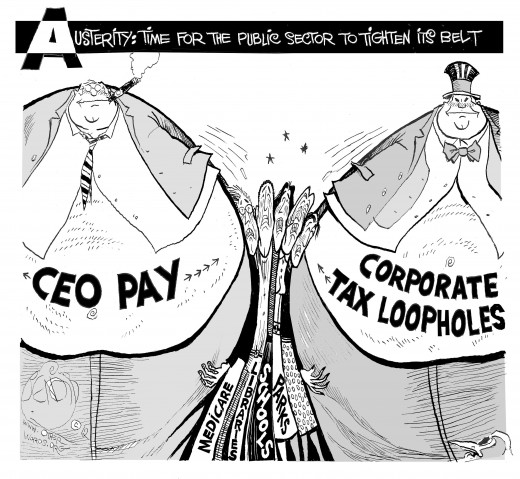

All these countries are caught up with recession and austerity drives. This means the gutting of social spending on schools, health care, fire services and public libraries. In the UK there was a hike in Tuition fee which sparked student riots in the streets of London. There could be more social unrest as public utility services get degraded on account of an eroding tax base.

Leona Helmsley, a billionaire tax dodger, once said “we don’t pay taxes. Only the little people do.” And she is right. In the shadowy world of tax havens only the uber-wealthy and multinational businesses benefit. While the MNC’s and the rich tycoons reduce their tax bill, the little people are saddled with distributional shifts of tax on their shoulders in the form of consumer taxes (VAT) and social security contribution. This is evident by the fact that a New York janitor earning slightly more than $33,000 has an effective tax rate of 25% while GE with billions of dollars in revenue pays zero tax. The big losers are the salaried middle class who pay for the games the rich play in tax havens.

People like you and me.

C R Sridhar

[i] Tax Havens- How Globalization Really Works- Ronen Palan, Richard Murphy, Christian Chavagneux page 4-

[ii] The Price of Offshore Revisited (2012)TJN- James.S.Henry- page 5.

[iii] Treasure Islands- Nicholas Shaxson- page 9.

[iv] Ibid pages 14-21.

[v] Tax Havens- How Globalization Really Works- Ronen Palan, Richard Murphy, Christian Chavagneux page 174.

[vi] The links between Tax evasion and corruption- Global witness –Sept 2009.

[vii] We are not broke- Documentary Film.

[viii] The Price of Offshore Revisited (2012)TJN- James.S.Henry pages 5-6.