That's Where They Get You: The US Government and its endless barrage of taxes

Why do we even have to pay taxes?

Taxes are a necessary part of any country's successful governance. After all, most of us drive around on roads and don't like to get shot by the hoard of meandering hooligans that would result from the seldom proposed anarchistic shitstorm sans government. We need this system to keep us safe and to invest in the costly infrastructure of our once prosperous nation. The problem arises when our funds get misallocated in such an unreasonable fashion that has become the zeitgeist.

OK, so where does all of this money go?

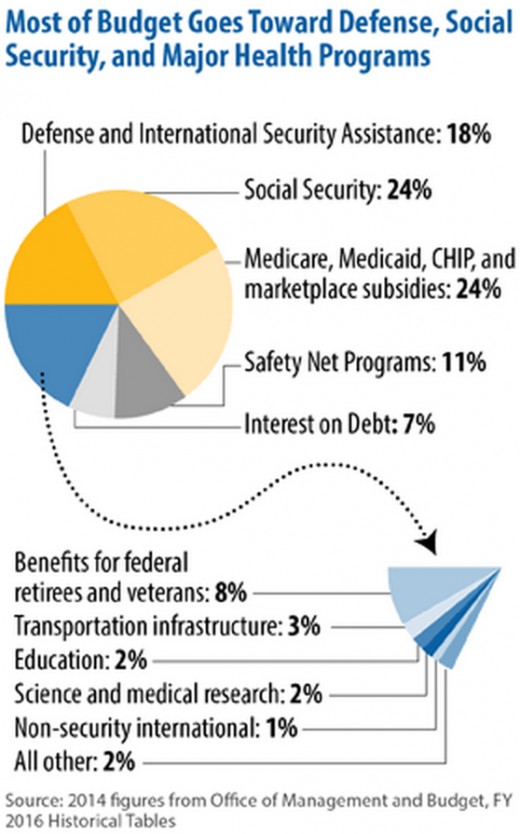

Now, we all want grandma to be safe and secure, living in her crappy little nursing home, but almost a full half of our budget goes toward programs like Social Security and Medicare. This money comes from you, at a tune of about $1.7 trillion per year. That's a lot of Depends. What makes this worse is that us youngsters might not even get to reap the benefits of our contribution to this system.

Another $615 billion goes directly to defense budget. This figure doesn't even account for taking care of the disenfranchised veterans when/if they finally get home. Your money is literally being transformed into Hellfire missiles and "exported" to countries that probably don't really want them.

Throw on the candied sprinkles of, oh, none of this is even really working, and you can start to become reasonably pissed off.

So how many different ways do they take money from us?

There is a literal myriad of tax programs that skim a little bit off of every dollar you earn, spend, invest, hold, and otherwise loosely interact with. Just for the fun of it, I will list some of them here: income tax, capital gains tax, corporate tax, social security tax, payroll tax, property tax, inheritance tax, sales tax, value added tax, import tax, and expatriation tax. Wasn't that exhilarating? Let's go over each of these in more depth, shall we?

Income Tax

Hopefully everyone is familiar with this one. When you make money, some of that money belongs to the government. When you make more money, a larger portion of it belongs to the government, anywhere from 10-40% of your net earnings. They'll spend it wisely, feebly attempting to dominate countries around the world, so don't worry. Maybe we will get some oil out of it, furthering our crushing stranglehold on the natural balance of our fragile environment, we'll see. Oh, and they'll definitely give some of it to the entities that contributed to their political election campaign. This is just a cost of doing business, I don't know why you're so upset.

Capital Gains Tax

After you make your money, you are able to do with it what you please, for the most part. You can hide it under the mattress, put it in a bank, or invest it in some manner. When you sell an investment, such as a stock, the amount of money that you earned on that investment is taxed. This can be in the form of dividends or appreciation. The government doesn't care, but it will make you fill out a separate form for each type of gain. The amount they take is usually 15%, so keep that in mind when you think your portfolio is going gangbusters.

Sales Tax

Not only do you have to pay the government when you earn and invest your money, they are also going to take a chunk when you go and spend it. This tax is exercised by the state government, and can float somewhere upwards of 8%. Some might call this double taxation, I would have no reasonable stance on arguing this. If you're spending gains on an investment, you might even make an attempt to coin the term "triple taxation". I certainly won't stop you.

Social Security Tax

When old people get old, they can't work anymore. The reasonable thing to do would be to systematically hoard cash in foresight of this tragic, apparently unforeseeable, inevitability. Unfortunately, the vast majority of people do not adhere to this practice. This is somehow the fault of young people. Employees and employers together have to pay over 12% of our earnings in direct result of grandpa's gambling problem. The super horrible thing is that social security is failing. All of this money we have put into the system probably won't even exist when we get to the ripe old age of old.

Property Tax

When you buy a house, you have to pay property taxes on the value of that house until you die, or succumb to foreclosure, whichever comes first. Now wait just a g-darn minute, aren't we just paying for something we already own? Yes, this is exactly what is happening, and to the tune of 1.5% in some geographical regions. What this essentially means is that you don't really own your home, you are renting it from the government. If you are unable to pay, they will seize the asset, your home, from you. To the casual observer, this may seem to conflict with our unalienable right to property, but who am I to analyze the constitution?

Inheritance Tax

Your parents worked really hard to leave you some money when they die. Wasn't that nice of them? After all, they had to pay income and capital gains taxes on this wealth their entire lives. They did this all just trying to save a slice for you, but the government is going to hit them in the peaches once more, postmortem. Depending on the deceased's total value, inheritance tax can be upwards of 50%. That means, in the government's eyes, sure your parents worked real hard to ensure your long term well being, but they didn't contribute to this any more than the government did. Oh, and they're going to take their half back, so hand it over.

Corporate Tax

If you don't actually own a corporation, you might not care about corporate income taxes. You might think that they don't affect you at all. Well, you'd be wrong in that assumption. What corporate tax does is make every good that the company makes become more expensive. Since they're ultimately going to have to fork over a portion of their profits to the man, they adjust for this by raising the MSRP of their goods. In short, you actually end up paying for this tax in the form of higher priced groceries and such. So not only are you paying for sales tax when you purchase an item, you are also spending a hidden amount on corporate income tax.

Payroll Tax

This tax effects you in a similar fashion as the corporate income tax. What this tax does is essentially makes our wages less and goods more expensive. Since the company is going to have to pay the government to keep you employed, your wage is going to be subsequently reduced in foresight of this issue. What also happens is that the end product of labor becomes more expensive, since the inputs used to produce the good are more expensive. Essentially, we are getting hit from both ends of this spectrum. I would like to add a snarky little joke to break the tension here, but I cannot for the life of me find comedy in this situation.

Value Added Tax

As if corporate income tax and payroll tax weren't enough, with a Value Added Tax (VAT), the government is also going to take a piece of the pie every time a meaningful contribution is made to a product. This happens all the way down the production chain. Basically, what this means is that when a company buys raw materials and improves upon them, perhaps in the form of another intermediary product, the government forces the company to value the improvement and pay taxes in accordance. Thankfully, the United States doesn't have a VAT. Unfortunately, unless the people in charge are able to get our national debt under control, which has every certainty of not happening, they will be forced to impose a VAT. I don't even want to think about how much this will be, or how it will affect financial reporting standards.

Import/Export Tax

If you're planning on circumventing all of this nonsense by importing goods from an outside country, the government is going to penalize you for doing so. Enter the import tax. The percent you will be taxed depends on the total value of the shipment and which country it is being imported from. If you want to sell these goods, you'll also have to pay sales tax and income tax. Export tax is essentially the same thing, but the other way around. Sure, you won't be directly paying, but you will ultimately absorb this cost by the magic of economics. Simply put, people abroad will buy less things from you because they are going to have to pay import tax on their end.

Expatriation Tax

If you've had enough of all of this, and decide to personally secede from the nation that bore you, wait just one red white and blue minute, that's gonna cost you too. The expatriation tax is mindbogglingly convoluted to calculate, so we will just take the government's word for it. They seem trustworthy enough. The super gnarly messed up thing about this tax is that it doesn't just cover your liquid assets, but all of your assets. This means that everything you own will be taxed as though you sold it all and held the liquid cash. Obviously, this causes some exceptional liquidity issues for most individuals wishing to exercise their right to secede. Yep, this is a real thing.

![TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software - Win [Download] OLD VERSION](https://m.media-amazon.com/images/I/41OkYgFE4TL._SL160_.jpg)