The Importance of Diversification

The Importance of Diversification

There are many old sayings about diversification. I’m not going to bore you with them but essentially what you need to know is that if you have all your coins in one purse, and that purse gets lost or stolen, then you’re busted. The same principle applies to investing. Since the beginning of these articles I’ve been saying that you need to have multiple investments running at once. The reason for this is if one bites it and is liquidated, well you have others to lean on. Times are funny, sometimes they’re good and sometimes they’re bad. When it’s good you may be tempted into investing all into one stock. Times turn bad suddenly and most often without warning. Do yourself and your family a favor and invest wisely.

Get out there and build your portfolio. You do this by diversifying. If you do not do this you will not succeed, sure you may be good for awhile but sooner or later the bottom will drop out and you’ll be on your ass.

Don't Put all Your Eggs in One Basket

How to Diversify

How do you diversify? Easily enough is the correct answer. I have built myself up financially by using one simple little method that you can easily copy with your own money. My employer, the Army has set up a thrift savings plan for me. Your company if you work for someone else has done the same thing but they call it a 401K in the civilian sector. The two funds work in much the same way. You and your employer pay in and during hardships you can cash in some of the earnings to get you by. This is number one and it is done for you and most often without your knowledge.

Next, you settle into a life, make money—pay living expenses and debts and often have money left over. So you start thinking about your future as your own family comes into the picture and you start getting older. Instead of throwing your money away you decide to save some. Eventually you pay off your debts, start using cash to buy stuff, pay down your vehicle to where you aren’t upside down in them anymore, and build up a savings account. You find one that pays three percent on the balance and that pays the dividends each month.

Eventually you decide the apartment is too small for your growing family and buy a house. You find a great little starter home and buy it. At this juncture you don’t really think of it as an investment but as a place to live. Renting an apartment and owning a home are similar in the way that each month you have to make payments so this investment doesn’t really dawn yet. Soon like five years later or even ten you want to sell. The house you bought for fifty thousand can now sell for eighty thousand. That’s thirty thousand dollars, take away realtor fees and closing cost and you walk away with twenty thousand dollars.

While all this is happening you decide you have plenty of money to spread out so you purchase a bond for a thousand or so, a CD for five thousand, you open a money market or mutual fund or both, and you took the advice of your father and started paying into an IRA.

What Now?

Now you have financial worth so you buy a whole life insurance policy that can be tapped if needed and you have an extra five to ten thousand waiting for a place to go to work for you. This is when you invest in the stock market with no worries. Perhaps you buy a stock in an established company and maybe you throw a little to an up and coming company that promises to pay off. Whatever the case on that one is you have no worries because now you’re just playing with the stocks.

Another great way to diversify would be to invest in penny stocks, they often turn a profit in short order. The thing to remember is to be patient with it. Start with one and as time and money become available invest in more and just keep building your portfolio. Stay the course and you will see your money returned and then some.

In conclusion we have discussed how to get started, how much to get started with, and how to diversify. All of the above are necessary to success in the stock market as well as in life. I hope you take the advice and have health, wealth, and happiness.

Stabilize Your Current Situation Before You Invest

Ideally before you start investing in the stock market you need to assess your current financial situation. You should be without debts, you should have at least 20 percent of your net income left over each month after your savings, and you should own a home or have an active mortgage on a home you are buying. You will want to invest in your own future but you need to make sure that current situations are resolved before investing.

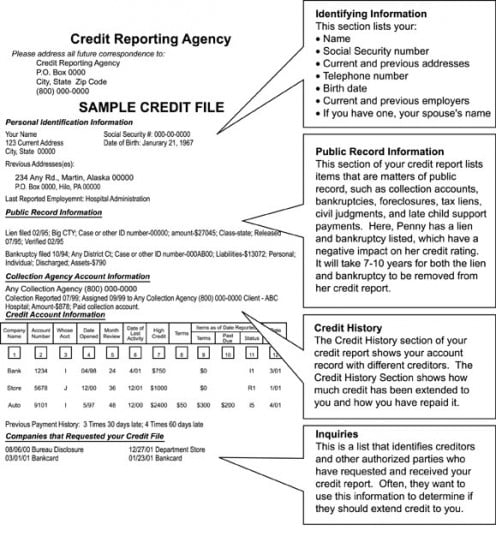

If you haven’t already done so you need to access your credit reports. According to the fair credit reporting act of 2004 you are entitled to view your credit report for free from each of the three credit reporting agencies. You should do this at least once a year but I recommend pulling one report from one agency every four months, or once per quarter. By checking your report often you will be in a far better financial situation as long as you keep your report clear of derogatory items. Challenge the institutions that are reporting the negative things, they will then have 30 days to provide proof of validity.

Credit Report

Clear Your Credit Report

If you have a certain amount of bad credit but you were planning on investing with the money instead of paying off the debts, you would be better served to pay off the negative debts first. Look at what your monthly bills are and how much money is being paid out each month. You’ll want to cut out all your unnecessary expenses and pay off your high interest credit cards. Get rid of those credit cards that are high interest, you’ll be glad you did. Finally pay off all of your loans. This will free up the money you need to reinvest each month.

If you don’t have the funds to completely pay off your higher interest debts, you could pay off the balance on the high interest credit cards and loans with a lower interest card or loan. You may need to tap into your investing funds but it’s a better situation and you’ll recover quicker. Once you get those taken care of you can improve your financial situation by making smart investment decisions. Do this through research or actually talk with an investment banker.

The worst thing you could do is start investing when you are not able to sustain your lifestyle beyond your paychecks. If you live paycheck to paycheck the time is not right to start investing. Investing in the market is a serious financial situation so you must have sound budgeting and financial experience gained through a degree of financial freedom. It is a far cry wiser to spend your money to fix a poor decision you may have made in the past than to tie up your money in an investment.

In the process of cleaning up your credit and financial situation take the time to educate yourself about sound investments. Learn about the safe investments like an interest bearing savings account, mutual funds, plus money market accounts, CD’s, and IRA’s. This way you can be educated about what to do with your money once your finances are clear.

© 2011 by Wesley Cox. All rights reserved. Copying without permission is illegal and will be prosecuted.